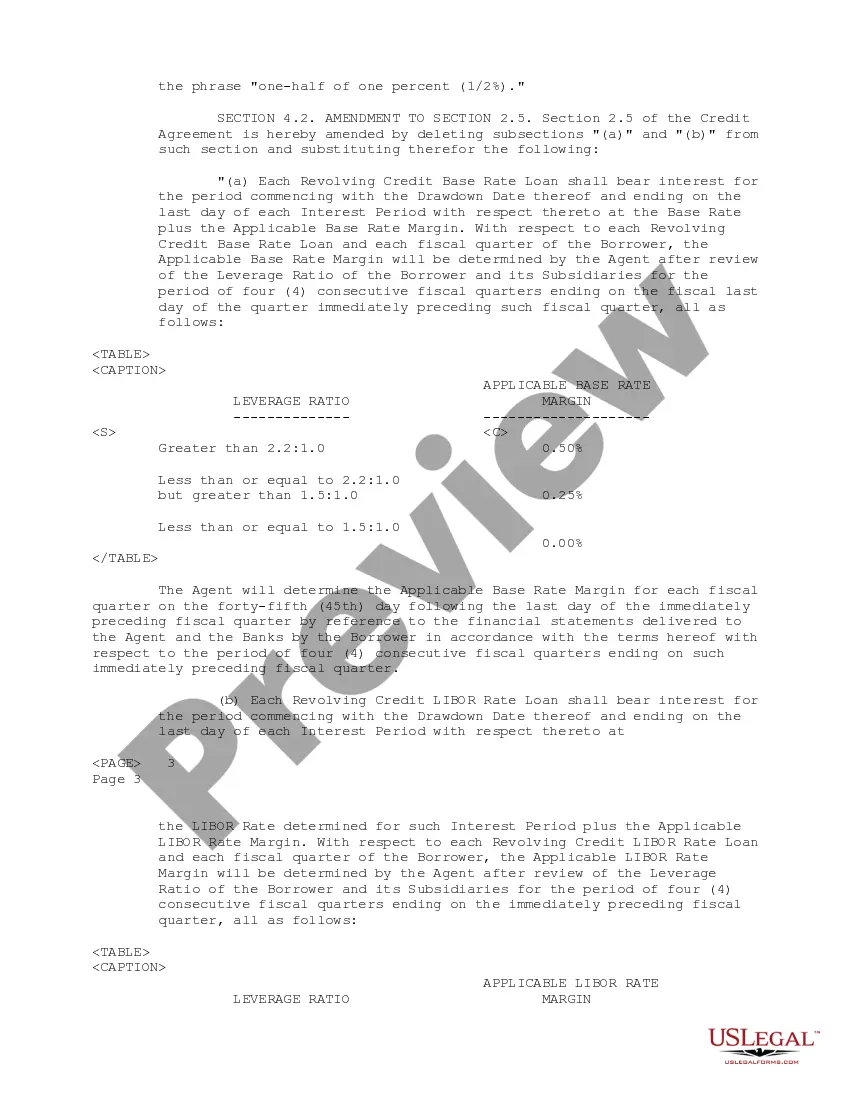

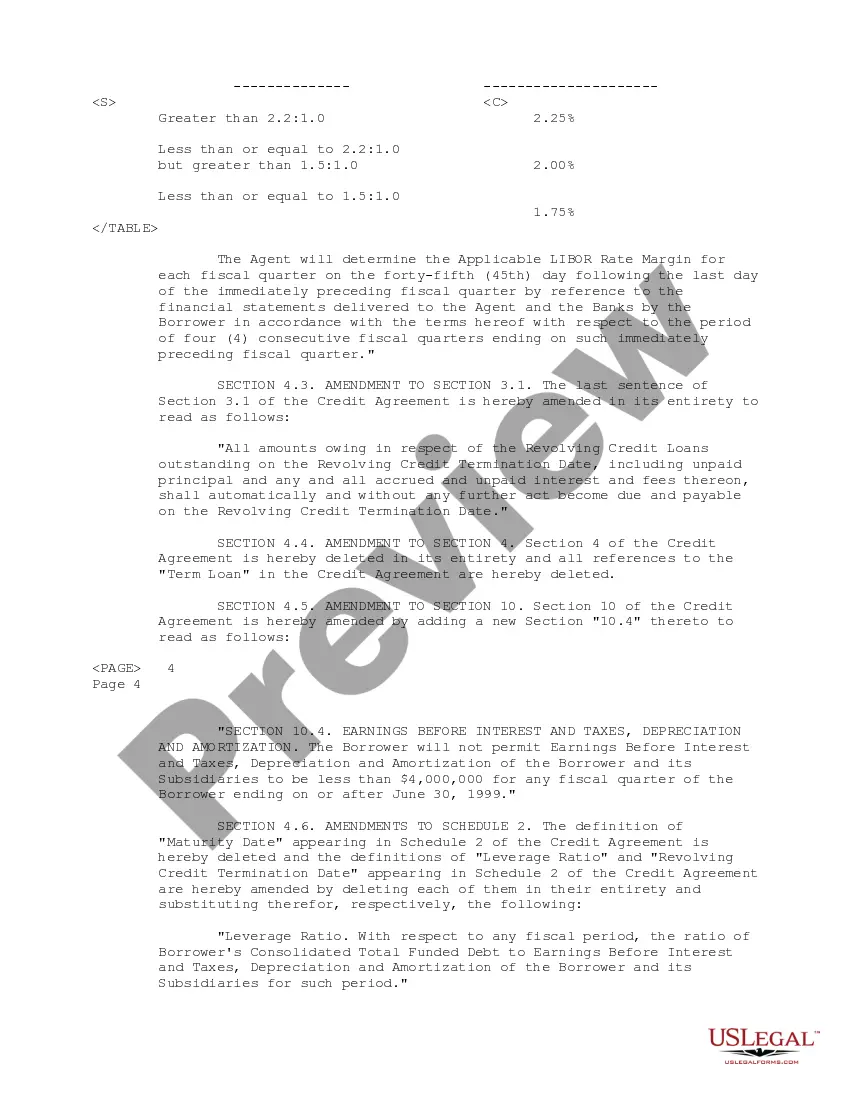

The Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement is a legally binding document that outlines the modifications and revisions made to an existing credit agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. This agreement pertains to financial arrangements and credit facilities provided by the respective financial institutions. The Fourth Amendment to the Credit Agreement includes several important provisions that are vital for all parties involved. It typically covers areas such as interest rates, repayment terms, collateral requirements, and borrower obligations. It is crucial for all parties to understand the terms and conditions outlined in this document to ensure compliance and avoid disputes. Keywords: Chicago, Illinois, Fourth Amendment, Amended Restated Credit Agreement, Ray tel Medical Corp, Bank Boston, N.A., Banquet Paribus, modifications, revisions, credit agreement, financial arrangements, credit facilities, interest rates, repayment terms, collateral requirements, borrower obligations. Different types of Chicago Illinois Fourth Amendment to Amended Restated Credit Agreements may include variations in the terms and conditions based on the specific needs and circumstances of the parties involved. These can include: 1. Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement — Interest Rate Amendment: This type of amendment focuses on modifying the interest rates associated with the credit agreement. It may involve changes in the margin, reference rate, or other interest rate calculations. 2. Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement — Repayment Terms Amendment: This amendment aims to revise the repayment terms of the credit agreement, such as extending the maturity date, modifying the repayment schedule, or adjusting the principal amount. 3. Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement — Collateral Amendment: This type of amendment focuses on altering the collateral requirements tied to the credit agreement. It may involve adding or removing certain assets as collateral or revising the valuation or maintenance requirements. 4. Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement — Financial Covenants Amendment: This amendment pertains to revisions in the financial covenants outlined in the original agreement. It may involve modifying the metrics or ratios used to measure the borrower's financial performance or amending the thresholds for compliance. It is important to note that the specific types of amendments may vary based on the circumstances and the negotiation between the parties involved.

Chicago Illinois Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Chicago Illinois Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Chicago Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the latest version of the Chicago Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Chicago Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Chicago Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!