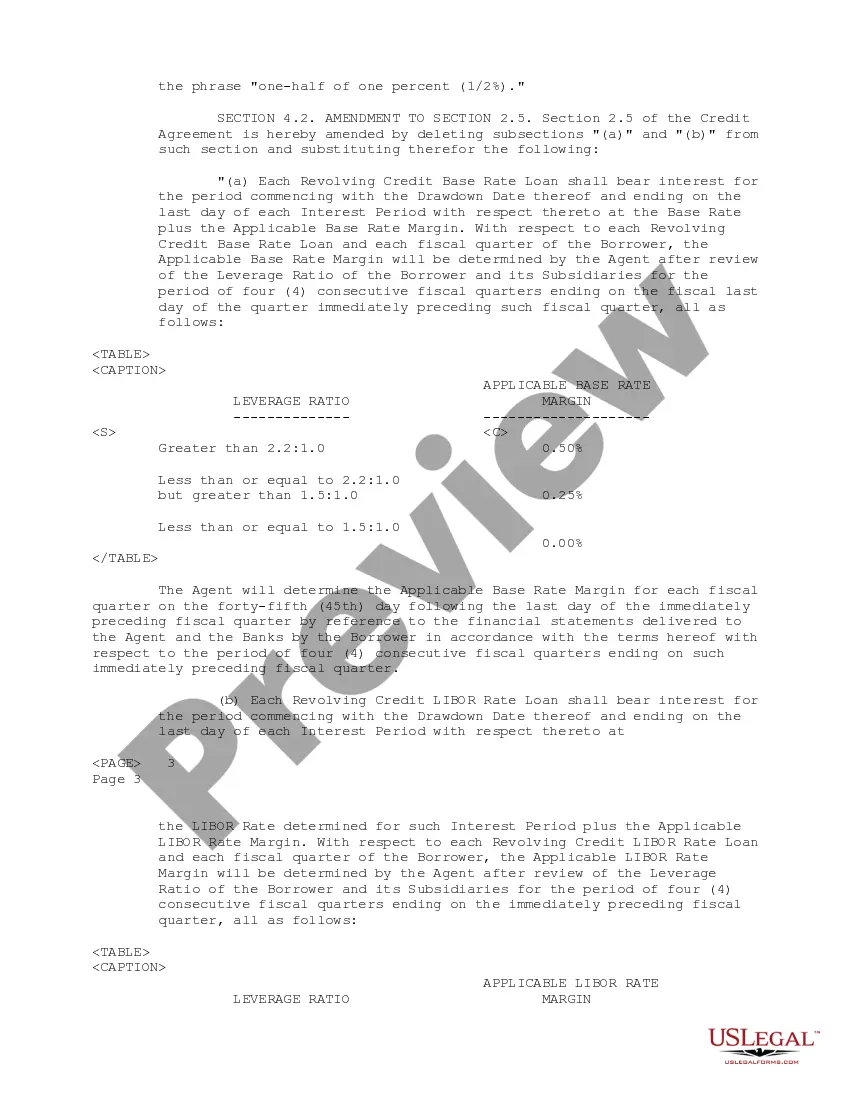

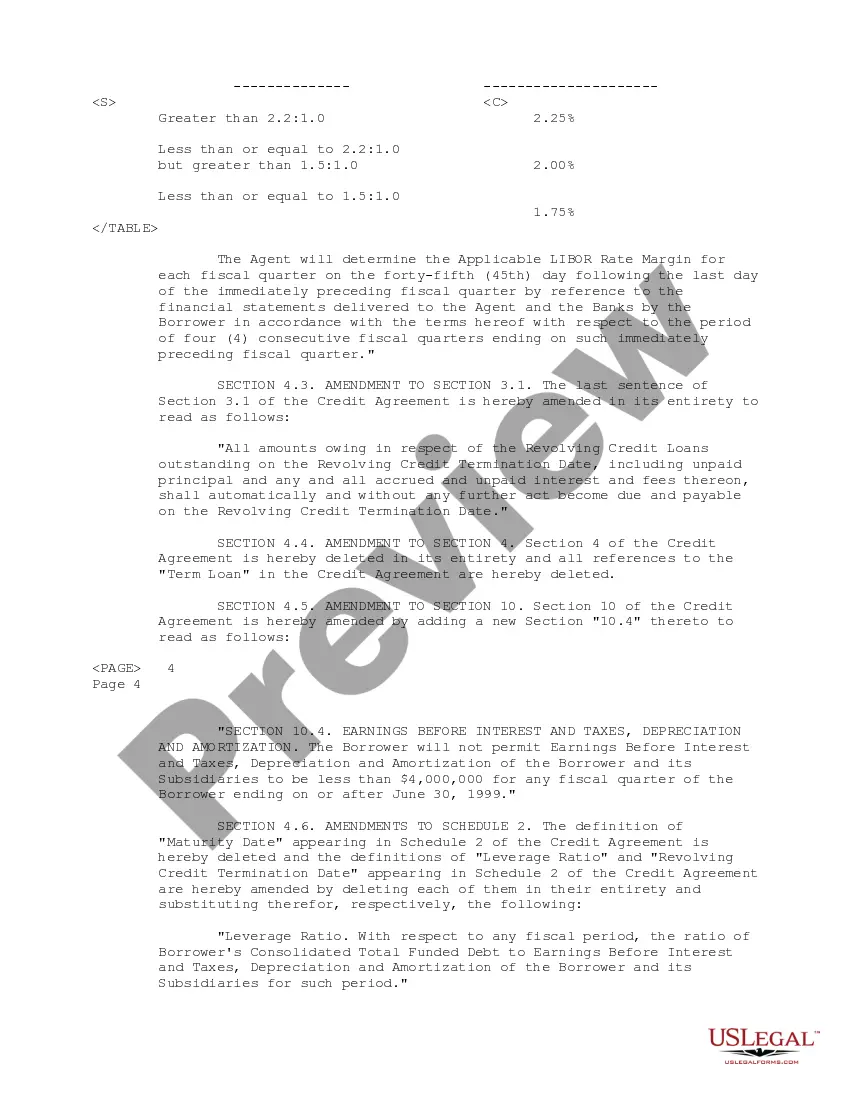

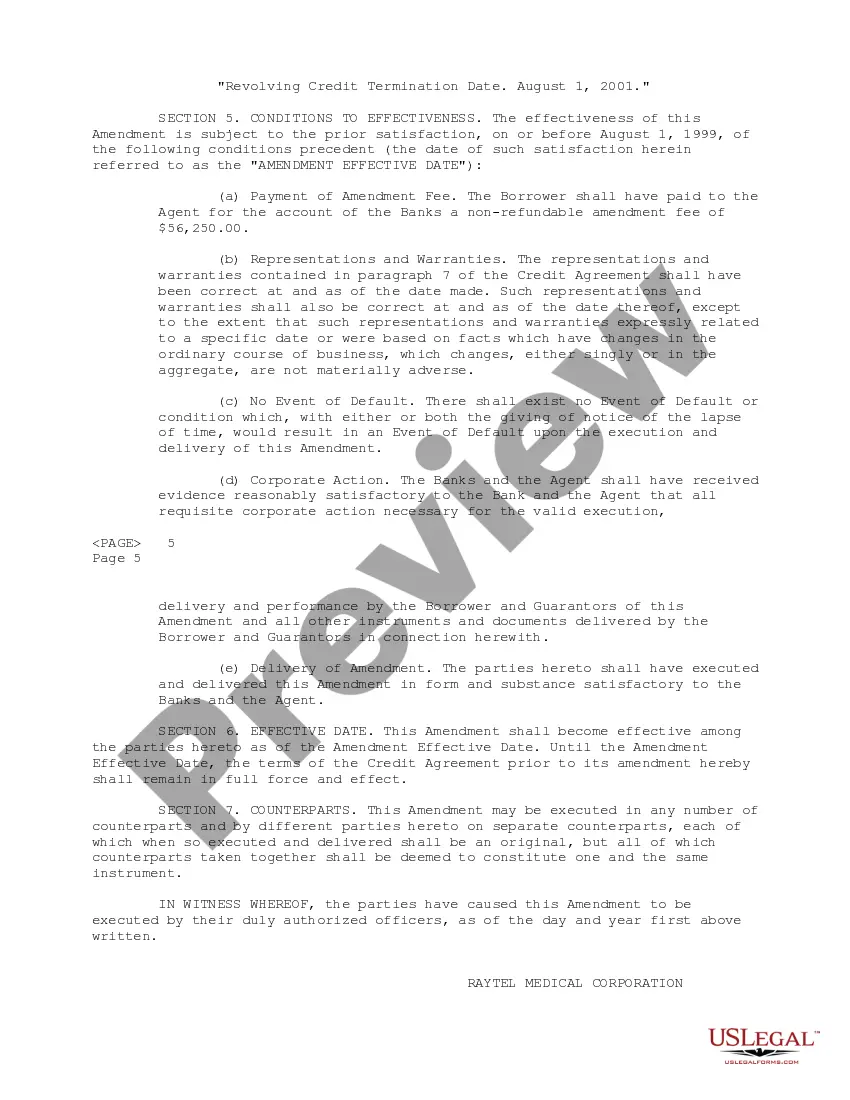

Queens New York Fourth Amendment to Amended Restated Credit Agreement is a legal document that involves Ray tel Medical Corp, Bank Boston N.A., and Banquet Paribus. It is important to note that while the document is mentioned specifically for Queens, New York, it could also have relevance in other jurisdictions or contexts. The Queens New York Fourth Amendment to Amended Restated Credit Agreement outlines the specific modifications and amendments made to the original agreement between Ray tel Medical Corp., Bank Boston N.A., and Banquet Paribus. The purpose of these amendments is to address changes in financial terms, conditions, or obligations that have arisen over time. Keywords: Queens New York, Fourth Amendment, Amended Restated Credit Agreement, Ray tel Medical Corp, Bank Boston N.A., Banquet Paribus The content should be tailored to provide a detailed description of the mentioned agreement. However, without access to the specific details of the agreement, it is challenging to provide a comprehensive and accurate description. The best approach is to outline the common components and purpose of credit agreements, acknowledging that specifics may vary in each case. A typical Fourth Amendment to Amended Restated Credit Agreement involves parties such as Ray tel Medical Corp, Bank Boston N.A., and Banquet Paribus. The agreement usually focuses on lenders and borrowers, outlining the revised terms and conditions of a credit facility. It acts as an addendum to the original credit agreement to reflect new stipulations, changes in circumstances, or updated financial arrangements. The Fourth Amendment may cover various aspects, including: 1. Amendments to repayment terms: This could involve changes in the repayment schedule, interest rates, principal amounts, or maturity dates. Adjustments are made to accommodate the borrower's financial situation or to align with changing market conditions. 2. Modifications in financial covenants: The agreement may revise or waive specific financial covenants initially agreed upon by the parties. Financial covenants are measures used to ensure the borrower's compliance with certain financial ratios or requirements. 3. Changes in borrowing limits: In some cases, the Fourth Amendment may address adjustments to the maximum borrowing limit allowed under the credit facility. This change may reflect updated financial needs or the lender's reassessment of the borrower's creditworthiness. 4. Additional terms and conditions: The amendment might introduce new terms, clauses, or conditions related to the credit facility, such as reporting requirements, collateral obligations, or restrictions on dividend payments or acquisitions. By utilizing the relevant keywords within the content, it helps emphasize the connectivity with Queens, New York, and distinguish the specific agreement mentioned amidst other potential versions.

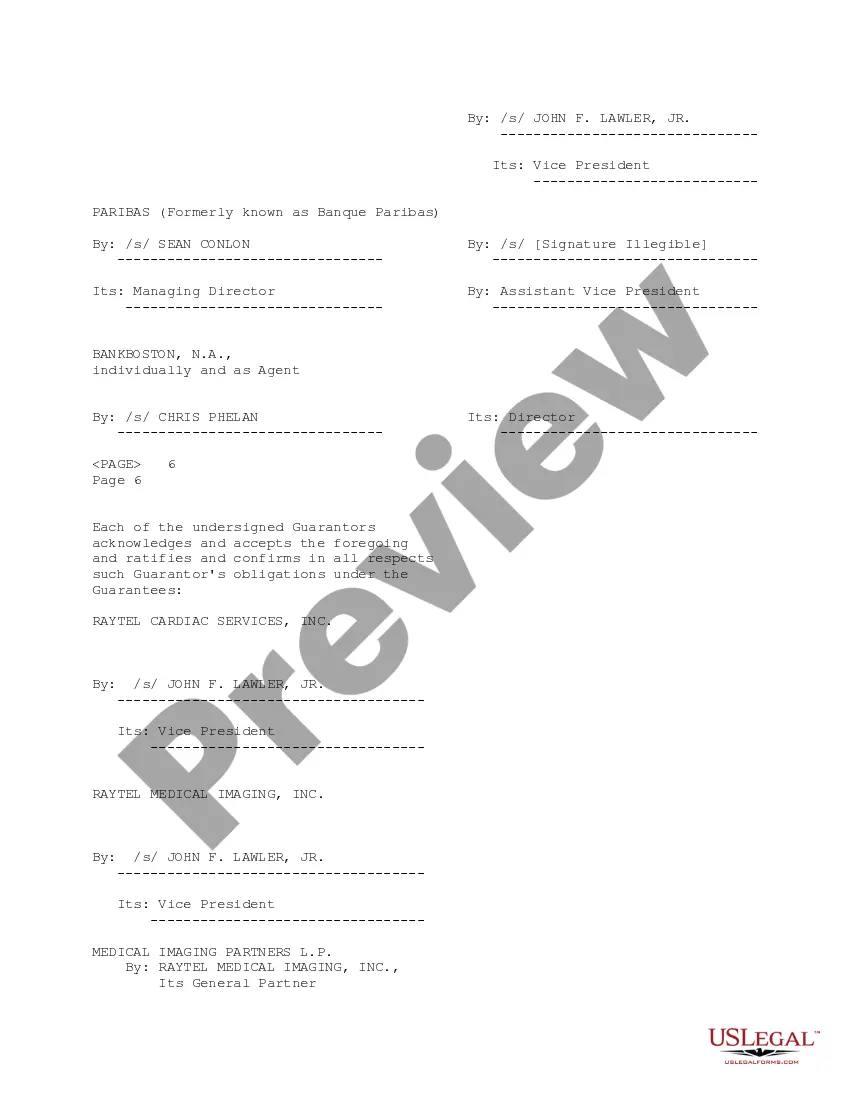

Queens New York Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Queens New York Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

Do you need to quickly create a legally-binding Queens Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas or probably any other form to manage your personal or corporate affairs? You can go with two options: hire a legal advisor to draft a valid document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Queens Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Queens Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Queens Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!