Orange California Stock Option Agreement of Maddox Networks, Inc. is a legally binding agreement that outlines the terms and conditions under which stock options are granted to employees, directors, or consultants of the company. This agreement is designed to provide individuals with the opportunity to purchase a specific number of company stocks at a predetermined price, known as the exercise price, within a specified period. The Orange California Stock Option Agreement of Maddox Networks, Inc. ensures that employees or other individuals are incentivized through ownership of the company's stocks. It serves as a tool for attracting and retaining talented individuals, aligning their interests with the success of the company, and fostering a sense of ownership and dedication. Some keywords relevant to this topic include: Maddox Networks, Inc., Orange California, stock option agreement, employees, directors, consultants, stock options, exercise price, ownership, talent retention, dedication, and incentivization. Different types of Orange California Stock Option Agreement of Maddox Networks, Inc. include: 1. Employee Stock Option Agreement: This agreement is specifically tailored for employees of Maddox Networks, Inc. It outlines the terms and conditions of stock options granted to employees, including vesting schedules, exercise periods, and any specific restrictions or conditions. 2. Director Stock Option Agreement: This type of agreement focuses on directors of the company and sets forth the terms under which they can exercise their stock options. It may have slightly different provisions compared to the employee agreement to align with the responsibilities and roles of directors. 3. Consultant Stock Option Agreement: Consultants or advisors who provide specialized services to Maddox Networks, Inc. may be granted stock options as part of their compensation. The consultant stock option agreement outlines the specific terms and conditions for consultants to exercise their options. In conclusion, the Orange California Stock Option Agreement of Maddox Networks, Inc. is a crucial document that grants stock options to employees, directors, or consultants. It ensures individuals have the opportunity to purchase company stocks at a predetermined price while fostering dedication, talent retention, and alignment of interests. Different types of agreements cater to employees, directors, and consultants, each with their specific provisions.

Orange California Stock Option Agreement of Gadzoox Networks, Inc.

Description

How to fill out Orange California Stock Option Agreement Of Gadzoox Networks, Inc.?

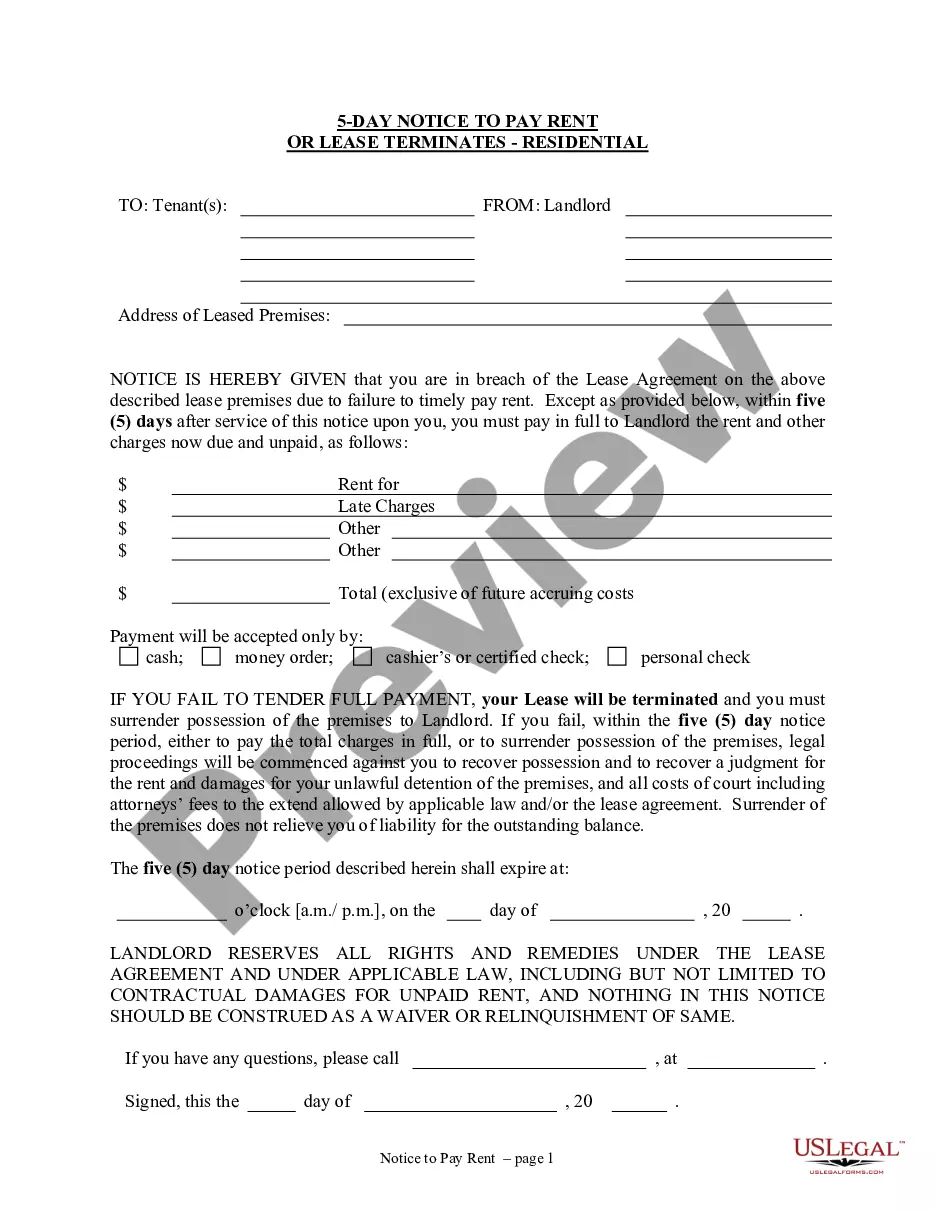

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Stock Option Agreement of Gadzoox Networks, Inc., it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the current version of the Orange Stock Option Agreement of Gadzoox Networks, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Orange Stock Option Agreement of Gadzoox Networks, Inc.:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Orange Stock Option Agreement of Gadzoox Networks, Inc. and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

NQSOs can be transferred during your lifetime to family members, trusts for your benefit, or charities, provided the employer's plan allows for such transfers. A gift of NQSOs is complete only when the employee stock option is vested.

When you leave, your stock options will often expire within 90 days of leaving the company. If you don't exercise your options, you could lose them. Here's what you need to know about stock options and what you should do with them when leaving a job.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Stock options are contracts that give employees the right to buy or exercise shares of company stock at the grant price, which is a pre-set price. The grant price may also be called the strike price or the exercise price. Purchasing stock options is a time-limited benefit that has a deadline stated in the contract.

There is value in employee stock options when the market price is higher than the grant or strike price, but while you might make a lot of money off of them, you also might not. Options must be vested before you can exercise your right to buy them, meaning that a predetermined waiting period has passed.

The share units are offered over a period of time, through vesting and are kept in a brokerage account that the employee can control. When all are vested, the employee can sell the shares or keep them as an investment.

If you're accepting a market level salary for your position, and are offered employee stock options, you should certainly accept them. After all, you have nothing to lose.

You're free to do as you please with the shares after they're transferred into your name. You can sell, trade, exchange, transfer, or donate them. But disposing of ESPP shares triggers tax consequences that depend on three factors: how long you've owned the stock, the selling price, and how many shares are sold.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to

In a simple option transfer to a family member, you transfer a vested option to a child, grandchild, or other heir. The transfer of the vested option is treated as a completed gift for gift-tax purposes. In 2022, you can generally give annual gifts of up to $16,000 (married couples $32,000) to each donee.