A San Jose California Director Option Agreement is a legally binding contract that outlines the terms and conditions for granting stock options to a director in a company based in San Jose, California. This agreement grants the director the right to purchase a specified number of company shares at a predetermined price, known as the exercise price, within a prescribed period. Here are a few different types of San Jose California Director Option Agreements: 1. Non-Qualified Stock Option Agreement: This type of agreement gives the director the opportunity to purchase company stock at a predetermined price, typically lower than the market value, within a specific timeframe. The exercise price is subject to income tax upon exercising the option. 2. Incentive Stock Option Agreement: This agreement is granted to directors with tax advantages and qualifies under the Internal Revenue Code (IRC) Section 422. It allows directors to purchase shares at a predetermined price without incurring immediate tax liabilities. However, specific conditions must be met, such as holding the shares for a certain period before selling. 3. Restricted Stock Unit (RSU) Option Agreement: Although not a traditional stock option, an RSU Option Agreement grants directors the right to receive company shares at a future date. The number of shares granted depends on the director's performance or the company's achievement of predetermined goals. 4. Performance-Based Stock Option Agreement: This agreement links the exercise of stock options to the company's performance. Directors earn the right to exercise options based on specific performance metrics or milestones established by the company. 5. Director Option Agreement with Vesting Schedule: This type of agreement often incorporates a vesting schedule, which determines when the director can exercise their stock options. The vesting period is typically based on the director's tenure or achievement of certain performance targets. 6. Change in Control (CIC) Director Option Agreement: This agreement comes into effect when there is a change in control of the company, such as a merger or acquisition. It provides directors with certain rights and protections related to their stock options in such a scenario. Overall, a San Jose California Director Option Agreement is a crucial tool in compensating and incentivizing directors. These agreements vary in terms of taxation implications, vesting schedules, and performance requirements, allowing companies to tailor the terms to suit their specific needs and objectives.

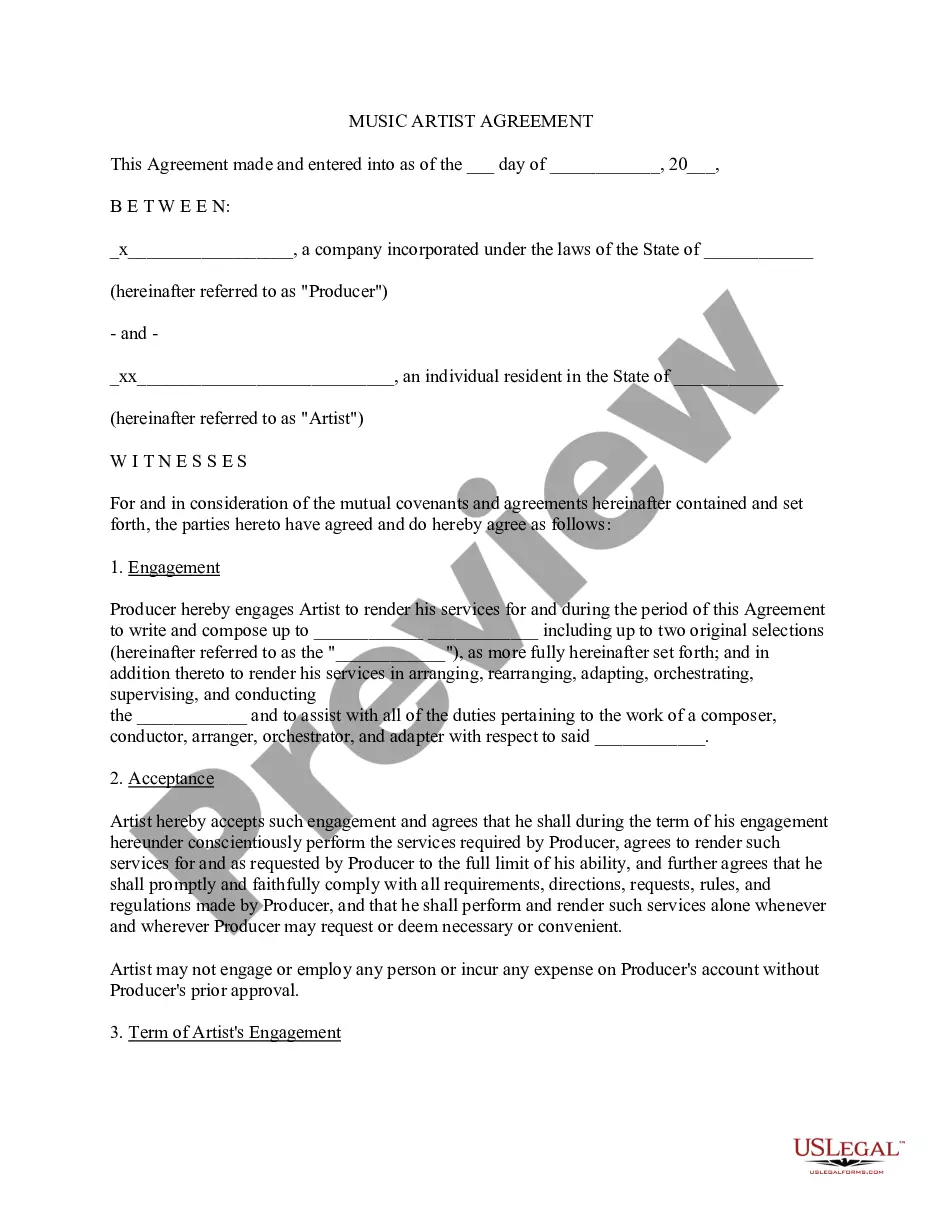

San Jose California Director Option Agreement

Description

How to fill out San Jose California Director Option Agreement?

Draftwing paperwork, like San Jose Director Option Agreement, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for different scenarios and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the San Jose Director Option Agreement template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading San Jose Director Option Agreement:

- Make sure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the San Jose Director Option Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!