Introduction: Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement refers to a legal document that outlines modifications made to the original Registration Rights Agreement between Turn stone Systems, Inc. and a purchaser. This agreement aims to provide the purchaser with certain rights related to registering securities with the Securities and Exchange Commission (SEC). The following is a detailed description of the Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement, including its key components, purpose, and potential types. Key Components: 1. Parties involved: The Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement involves two primary parties — Turnstone Systems, Inc. (the company) and the purchaser (an individual, group, or entity who bought or intends to purchase securities of Turn stone Systems, Inc.). 2. Registration Rights: The amendment defines the registration rights granted to the purchaser. Registration rights allow the purchaser to request the registration of their securities with the SEC, enabling the securities to be publicly traded in compliance with relevant laws and regulations. 3. Securities: The types of securities covered by the registration rights agreement may include common stock, preferred stock, warrants, or any other type of equity or convertible securities issued by Turn stone Systems, Inc. 4. Amendments: The Phoenix, Arizona Amendment No. 1 outlines the specific modifications made to the original Registration Rights Agreement. These amendments may include changes to the terms, conditions, registration process, or any other provision that the parties agree upon. Purpose: The purpose of the Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement is to outline the revised terms and conditions related to the registration rights granted to the purchaser. It ensures that the purchaser can exercise their right to register their securities with the SEC in an effective and timely manner. Types of Amendments: While specific types of amendments may vary based on the negotiations between Turn stone Systems, Inc. and the purchaser, some potential types of Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement could include: 1. Extension of Registration Deadline: The parties may agree to extend the original registration deadline specified in the initial agreement. This extension allows the purchaser more time to fulfill the necessary requirements for registration. 2. Expansion of Securities Coverage: The amendment may expand the types of securities eligible for registration, further empowering the purchaser to offer a broader range of securities for public trading. 3. Adjustment of Registration Expenses: The parties might agree to revise the allocation of registration expenses, such as legal fees, filing charges, and printing costs, between Turn stone Systems, Inc. and the purchaser. 4. Change in Piggyback Rights: The amendment could modify the piggyback rights provision, allowing the purchaser to register their securities in conjunction with certain offerings made by Turn stone Systems, Inc. Conclusion: In summary, the Phoenix, Arizona Amendment No. 1 to Registration Rights Agreement between Turn stone Systems, Inc. and a purchaser denotes modifications made to the original agreement, granting the purchaser specific registration rights for their securities. This legal document ensures both parties are aware of their obligations, rights, and any changes to the initial agreement.

Phoenix Arizona Amendment No. 1 to Registration Rights Agreement between Turnstone Systems, Inc. and purchaser

Description

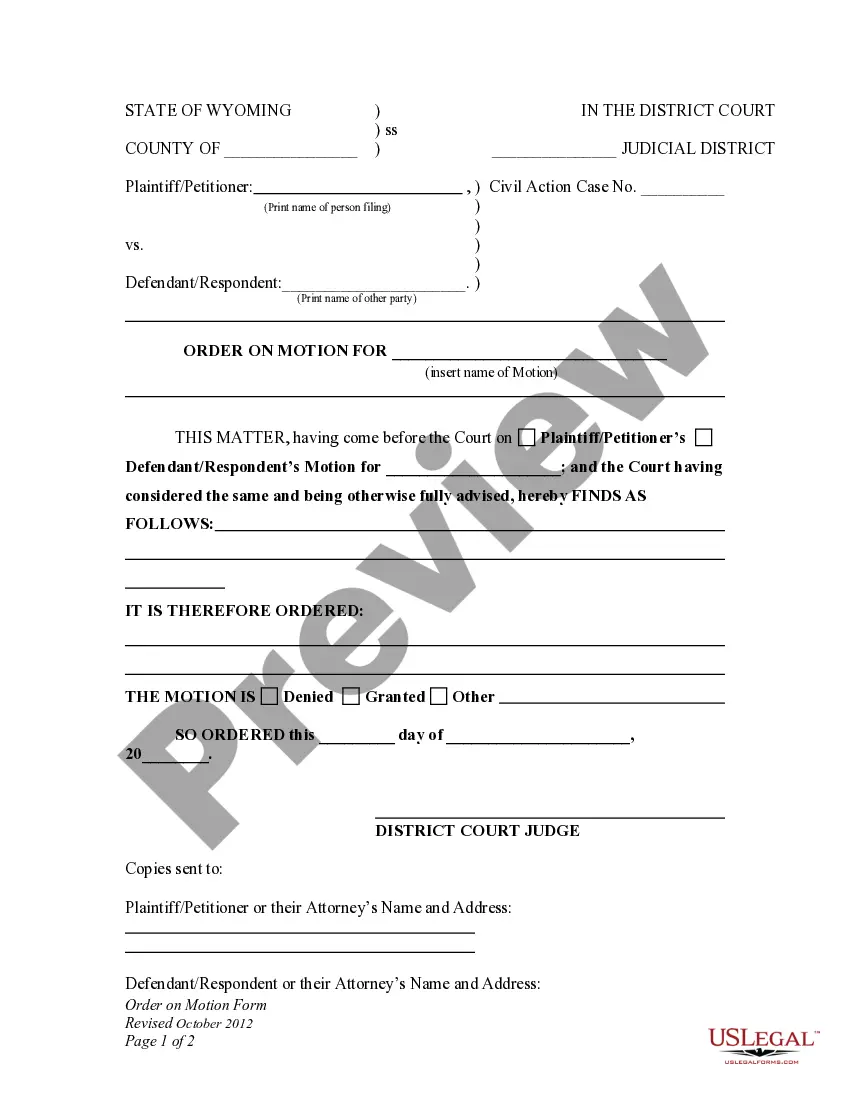

How to fill out Phoenix Arizona Amendment No. 1 To Registration Rights Agreement Between Turnstone Systems, Inc. And Purchaser?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Phoenix Amendment No. 1 to Registration Rights Agreement between Turnstone Systems, Inc. and purchaser without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Phoenix Amendment No. 1 to Registration Rights Agreement between Turnstone Systems, Inc. and purchaser by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Phoenix Amendment No. 1 to Registration Rights Agreement between Turnstone Systems, Inc. and purchaser:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!