The Bronx is one of the five boroughs of New York City, located in the state of New York. It is known for its vibrant culture, diverse communities, and rich history. The Bronx is home to numerous landmarks, including Yankee Stadium, the Bronx Zoo, and the New York Botanical Garden. Touchstone Advisors, Inc. and OPCA Advisors have entered into a Sub-Advisory Agreement in relation to the Bronx, New York. This agreement is designed to outline the specific terms and conditions by which OPCA Advisors will provide sub-advisory services to Touchstone Advisors, Inc. in the Bronx. The Bronx New York Sub-Advisory Agreement between Touchstone Advisors, Inc. and OPCA Advisors involves the provision of financial and investment management services. OPCA Advisors acts as a sub-advisor to Touchstone Advisors, Inc., assisting them in making informed investment decisions and managing their portfolio within the Bronx, New York. This agreement ensures that OPCA Advisors will adhere to the agreed investment objectives, guidelines, and restrictions set by Touchstone Advisors, Inc. It includes provisions for reporting, performance measurement, compliance, and fee structures applicable to their sub-advisory relationship. It is important to note that there may be different types of Bronx New York Sub-Advisory Agreements between Touchstone Advisors, Inc. and OPCA Advisors, depending on the specific investment goals and strategies involved. These agreements could be differentiated based on factors such as the duration of the engagement, specific asset classes or investment sectors targeted, or the level of discretion granted to the sub-advisor. Some potential variations or types of Bronx New York Sub-Advisory Agreements could include: 1. Equity Sub-Advisory Agreement: Focused primarily on equity investments within the Bronx, New York. OPCA Advisors may be responsible for assisting Touchstone Advisors, Inc. in managing their equity portfolio, conducting research, and providing recommendations on Bronx-based equities. 2. Fixed Income Sub-Advisory Agreement: Centered on fixed income investments within the Bronx, New York. OPCA Advisors may be responsible for assisting Touchstone Advisors, Inc. in managing their fixed income portfolio, analyzing bond markets within the Bronx, and suggesting suitable fixed income investments. 3. Real Estate Sub-Advisory Agreement: Geared towards real estate investment opportunities in the Bronx, New York. OPCA Advisors may assist Touchstone Advisors, Inc. by providing expertise in the evaluation, acquisition, management, and potentially disposition of real estate assets within the Bronx. In conclusion, the Bronx New York Sub-Advisory Agreement between Touchstone Advisors, Inc. and OPCA Advisors involves the provision of sub-advisory services with respect to financial and investment management within the Bronx, New York. It may encompass various types or variations of agreements, each tailored to specific investment objectives, asset classes, or sectors within the Bronx.

Bronx New York Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors

Description

How to fill out Bronx New York Sub-Advisory Agreement Between Touchstone Advisors, Inc. And Opcap Advisors?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Bronx Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Bronx Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Bronx Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors:

- Examine the content of the page you’re on.

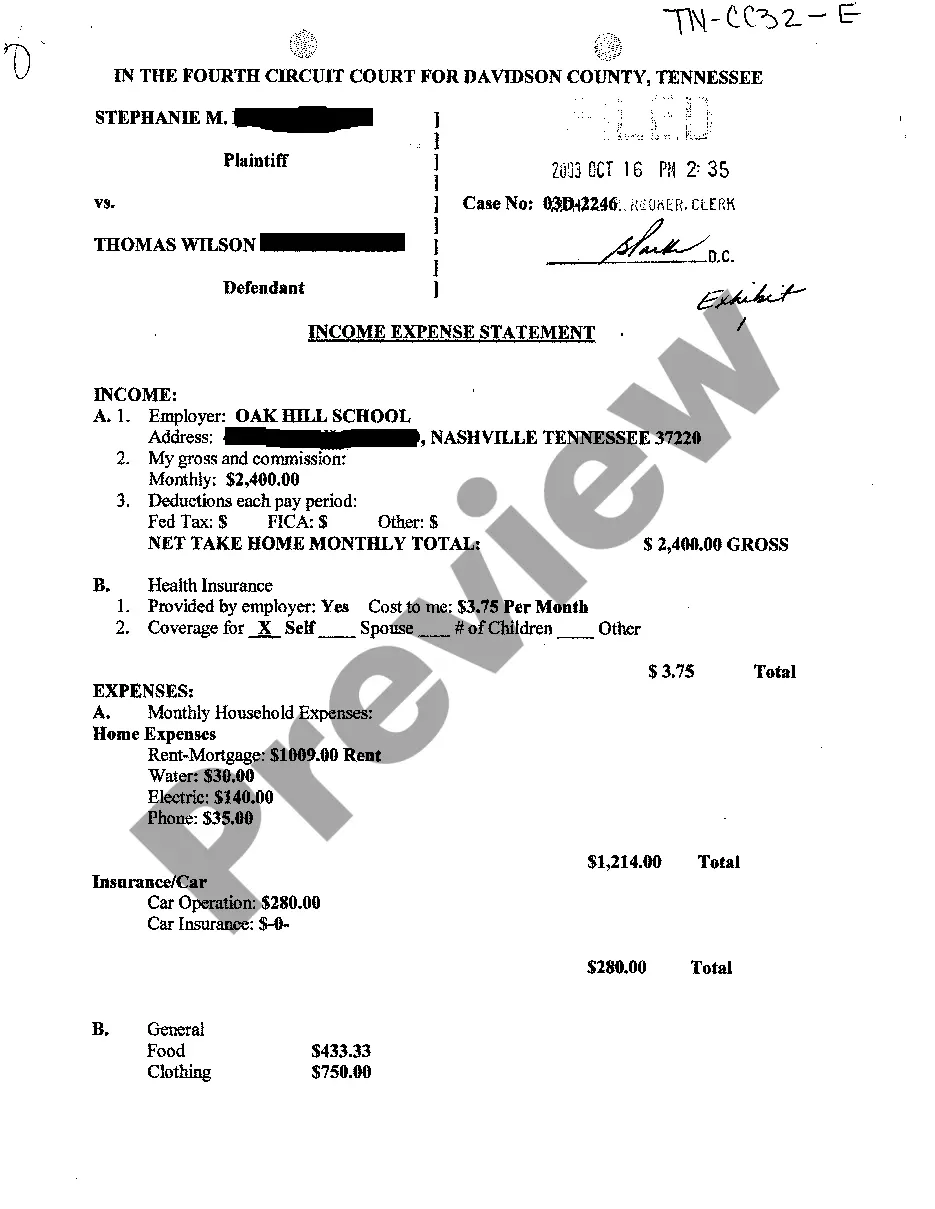

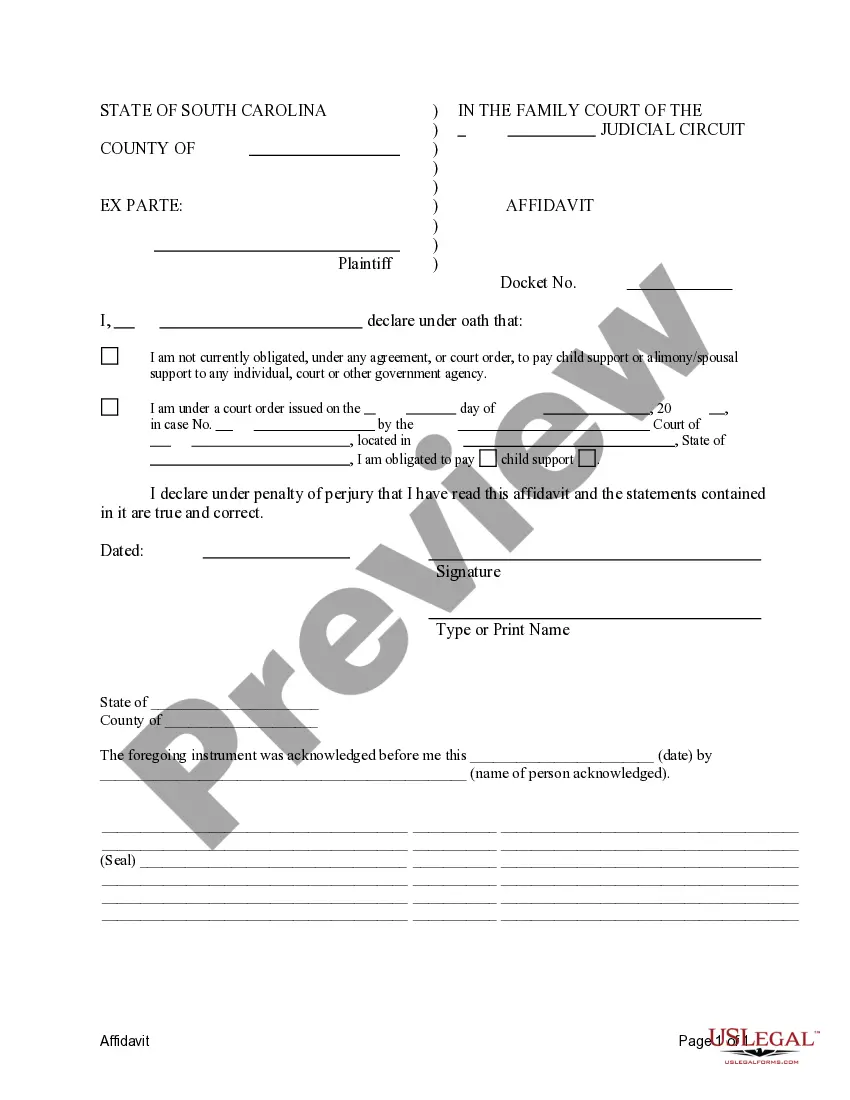

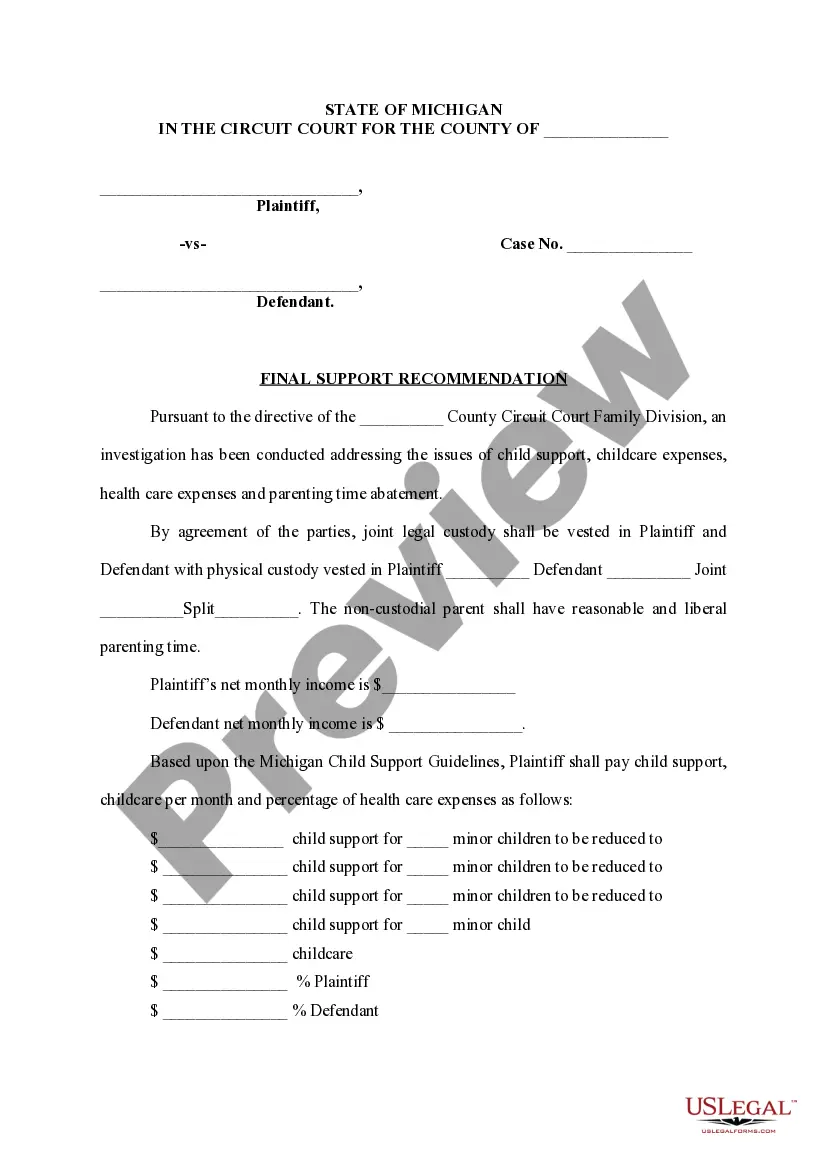

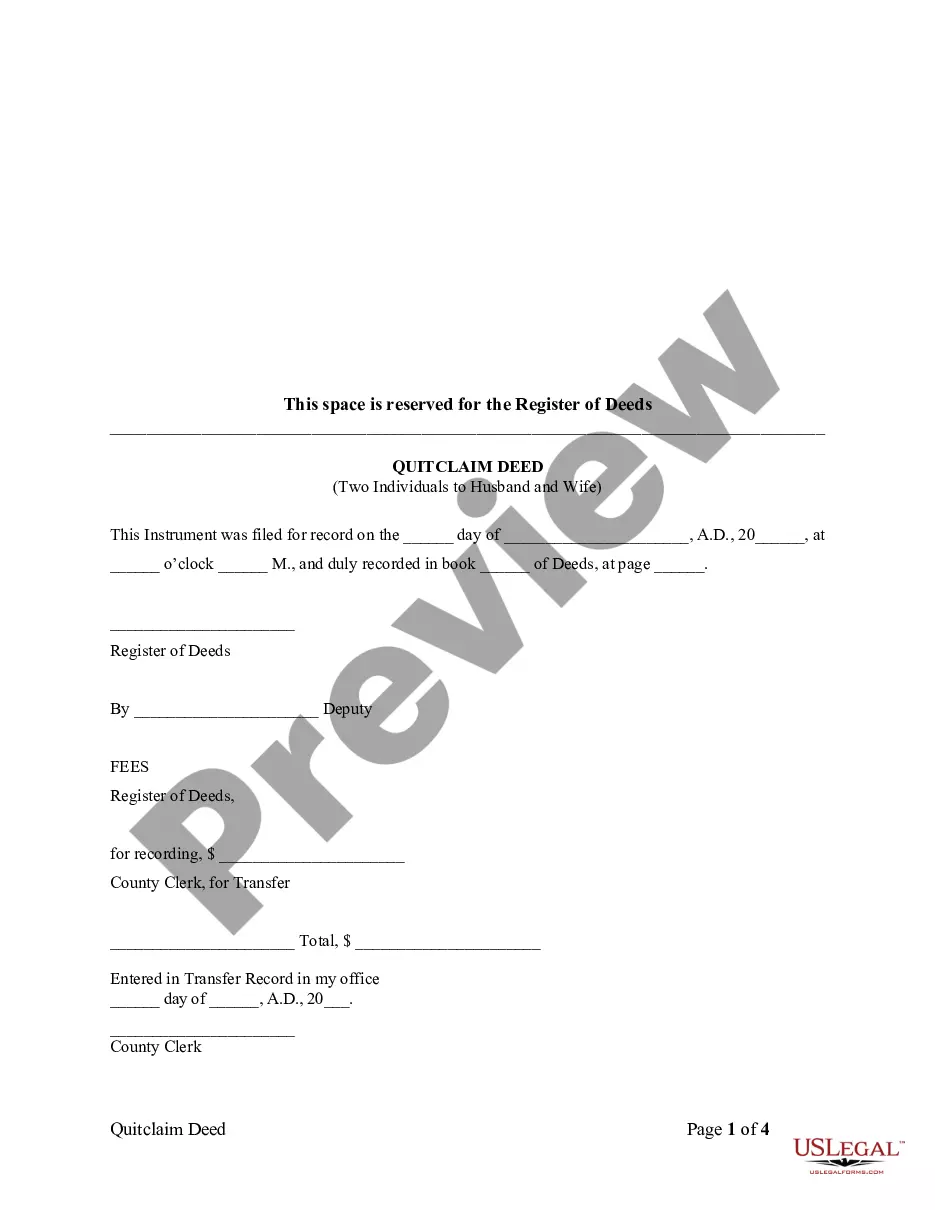

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Bronx Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

They are the product of relationships formed across the investment management business. They allow an investment manager to contract with other investment managers to offer funds with specific investment objectives. Sub-advisory relationships allow for one alternative in launching new funds for investors.

An advisor agreement is a legal document used between a company and an advisor they have hired. The legal agreements outlines the expectations and obligation between the two parties, including the role and responsibilities of the advisor, their compensation, confidentiality, and assignment of work.

Key Takeaways. A sub-advised fund involves a third-party money manager that is hired by an investment company or mutual fund to manage an investment portfolio. Sub-advised funds are typically sought by investment companies because of their expertise in managing a specific strategy.

They are the product of relationships formed across the investment management business. They allow an investment manager to contract with other investment managers to offer funds with specific investment objectives. Sub-advisory relationships allow for one alternative in launching new funds for investors.

adviser is an asset management firm hired by an investment adviser to help identify, evaluate and manage investments within a portfolio. Subadvisers are typically selected based on their investment style, expertise and track record in a specific investment strategy.

In a sub-advisory relationship, the adviser can hire or fire external managers as they see fit in relation to how investments perform. The adviser can negotiate all terms, fees, and services to be provided on the client's behalf something that some clients may prefer, as they don't need to be heavily involved.

In a sub-advisory arrangement, you are responsible for contracting directly with the sub-adviser. You are also responsible for ensuring that all disclosure documents (both yours and the sub-adviser's) and contracts are properly delivered to the client.

A subadvisory agreement is a legally binding agreement between a mutual fund and an advisor. These agreements outline the terms and conditions of the relationship between the fund and the advisor and what rights and responsibilities are expected of each party.

adviser is an asset management firm hired by an investment adviser to help identify, evaluate and manage investments within a portfolio. Subadvisers are typically selected based on their investment style, expertise and track record in a specific investment strategy.

Subfund (plural subfunds) (finance) A fund making up part of a larger fund.