The Franklin Ohio Sub-Advisory Agreement between Touchstone Advisors, Inc. and OPCA Advisors is a legal contract that outlines the terms and conditions of the sub-advisory relationship between the two entities. This agreement establishes the roles, responsibilities, and obligations of both parties involved in the investment management process. Keywords: Franklin Ohio, Sub-Advisory Agreement, Touchstone Advisors, Inc., OPCA Advisors, legal contract, sub-advisory relationship, investment management process. This agreement is designed to ensure that Touchstone Advisors, Inc. and OPCA Advisors work together seamlessly to achieve their mutual goals and objectives. Through this partnership, OPCA Advisors acts as a sub-adviser to Touchstone Advisors, Inc., providing their expertise and assistance in managing specific investment portfolios or strategies. There may be different types of Franklin Ohio Sub-Advisory Agreements between Touchstone Advisors, Inc. and OPCA Advisors, each tailored to different investment products or services. These agreements may include: 1. Equity Sub-Advisory Agreement: This type of agreement focuses on the management of equity-based investment portfolios. OPCA Advisors may provide their expertise in analyzing and recommending investment opportunities in the equity market. 2. Fixed Income Sub-Advisory Agreement: This agreement could pertain to the management of fixed income or bond portfolios. OPCA Advisors may assist in researching, evaluating, and selecting suitable fixed income investments to align with Touchstone Advisors, Inc.'s investment objectives. 3. Multi-Asset Sub-Advisory Agreement: This type of agreement involves the management of diversified investment portfolios that may include a mix of equities, fixed income, and other asset classes. OPCA Advisors may provide their insights into asset allocation strategies and monitor the performance of the overall portfolio. These agreements typically outline the scope of services, compensation arrangements, termination clauses, and other legal provisions governing the sub-advisory relationship between the two entities. They may also address compliance requirements, reporting obligations, and any potential conflicts of interest to ensure transparency and adherence to regulatory guidelines. In summary, the Franklin Ohio Sub-Advisory Agreement between Touchstone Advisors, Inc. and OPCA Advisors is a legal contract that defines the relationship and obligations of both parties involved in the management of investment portfolios. Tailored to specific investment needs, these agreements leverage the expertise of OPCA Advisors to support Touchstone Advisors, Inc. in achieving their investment objectives.

Franklin Ohio Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors

Description

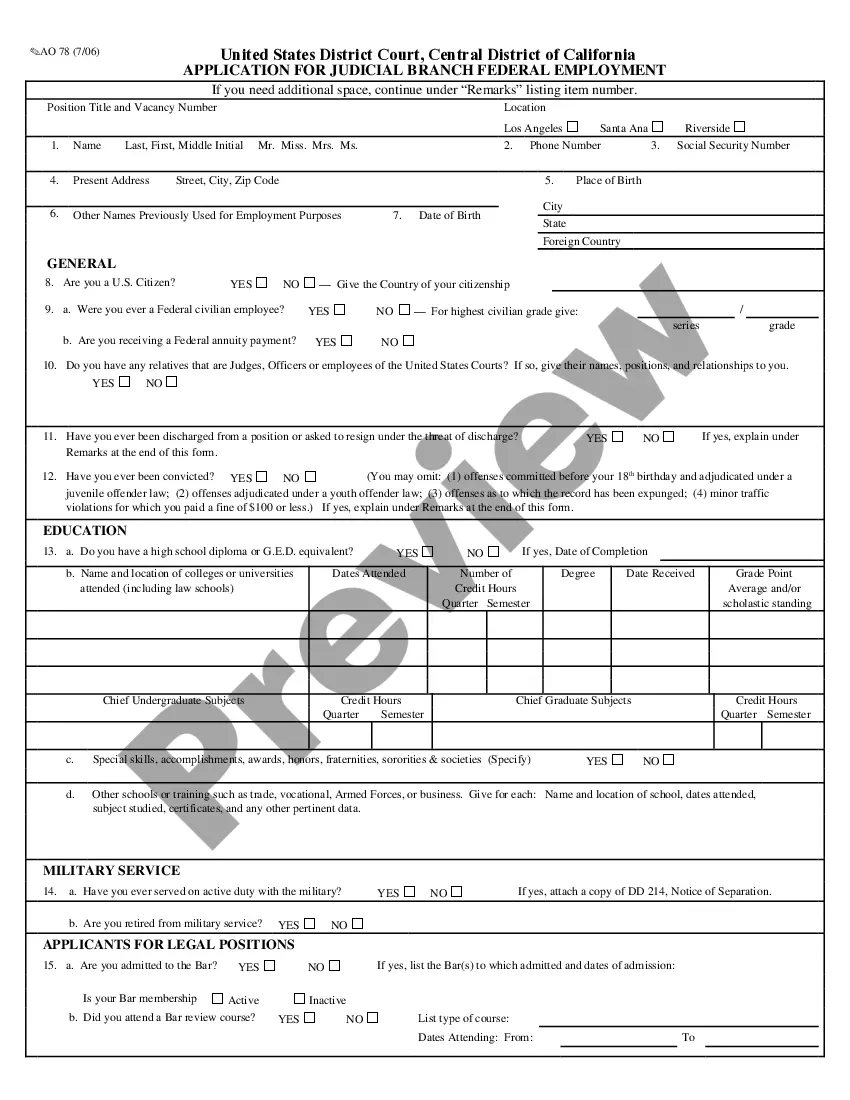

How to fill out Franklin Ohio Sub-Advisory Agreement Between Touchstone Advisors, Inc. And Opcap Advisors?

If you need to get a reliable legal form provider to find the Franklin Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it simple to get and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Franklin Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Franklin Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Franklin Sub-Advisory Agreement between Touchstone Advisors, Inc. and Opcap Advisors - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Subfund (plural subfunds) (finance) A fund making up part of a larger fund.

A subadvisory agreement is a legally binding agreement between a mutual fund and an advisor. These agreements outline the terms and conditions of the relationship between the fund and the advisor and what rights and responsibilities are expected of each party.

Sub-Advised Fund Definition. A sub-advised fund is a fund managed by another management team or firm than where the assets are held. Mutual Funds: Different Types and How They Are Priced.

The difference between an investment manager versus an investment advisor is an investment manager may build and manage your accounts and investment portfolio. An investment advisor may also manage your investments, or provide recommendations on what investment moves to make.

A fund is an accounting entity with a self-balancing set of accounts consisting of assets, liabilities, and fund balances. A sub-fund group is a further classification of fund groups to easily identify the allocation of money.

Subfund (plural subfunds) (finance) A fund making up part of a larger fund.

advised fund is an investment fund that is managed by another management team or firm than where the assets are held. advised fund may consist of specialty or niche investments that the main fund portfolio managers seek outside expertise for.

A subadvisory agreement is a legally binding agreement between a mutual fund and an advisor. These agreements outline the terms and conditions of the relationship between the fund and the advisor and what rights and responsibilities are expected of each party.

advised fund involves a thirdparty money manager that is hired by an investment company or mutual fund to manage an investment portfolio. Subadvised funds are typically sought by investment companies because of their expertise in managing a specific strategy.

A set of share classes is a compartment of an umbrella fund. The terms given for Fund may relate to fund, sub fund or umbrella. Sub Fund is differentiated by the fact that it is part of an umbrella fund, otherwise it is the same as any other fund.