Maricopa Arizona Trust Agreement is a legal document that outlines the arrangements and responsibilities between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York. This agreement serves as a foundation for their business relationship and guides the management and protection of assets held in trust. The Maricopa Arizona Trust Agreement ensures that all parties involved comply with the applicable laws and regulations pertaining to trust agreements. It establishes the terms and conditions for the administration, investment, and distribution of assets held in trust. The agreement also outlines the roles and responsibilities of each party, ensuring transparency and accountability. The agreement may include provisions for various types of trust, such as revocable or irrevocable trust, depending on the specific needs or goals of the involved parties. These different types of trusts provide flexibility and allow for specific asset protection strategies. Key components of the Maricopa Arizona Trust Agreement may include: 1. Parties Involved: The agreement clarifies the roles and responsibilities of Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York, ensuring a clear understanding of their duties. 2. Assets: The agreement specifies the assets held in trust, such as financial investments, real estate properties, or intellectual property rights. 3. Trust Objectives: The agreement outlines the purposes and objectives of the trust, which may include long-term wealth accumulation, asset preservation, or charitable donations. 4. Trustees and Beneficiaries: It identifies the individuals or entities designated as trustees who will manage the trust assets and act in the best interests of the beneficiaries. The beneficiaries, who may be individuals, organizations, or both, are also named. 5. Powers and Limitations: The agreement defines the powers and limitations of the trustees and outlines any restrictions or guidelines they must adhere to when managing the trust assets. 6. Investment and Distribution Guidelines: It sets guidelines for how funds should be invested and distributed, considering factors such as risk tolerance, income needs, and growth objectives. This ensures proper management and alignment with the overall trust objectives. 7. Termination or Amendment: The agreement may include provisions for terminating or amending the trust, allowing for flexibility if circumstances change or the parties' goals evolve over time. 8. Dispute Resolution: It establishes procedures for resolving disputes that may arise during the administration of the trust, ensuring a fair and efficient resolution process. Overall, the Maricopa Arizona Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York is a comprehensive and legally binding document that safeguards the interests of all parties involved. It provides a framework for trust administration, asset management, and distribution, allowing for effective collaboration and protection of trust assets.

Maricopa Arizona Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

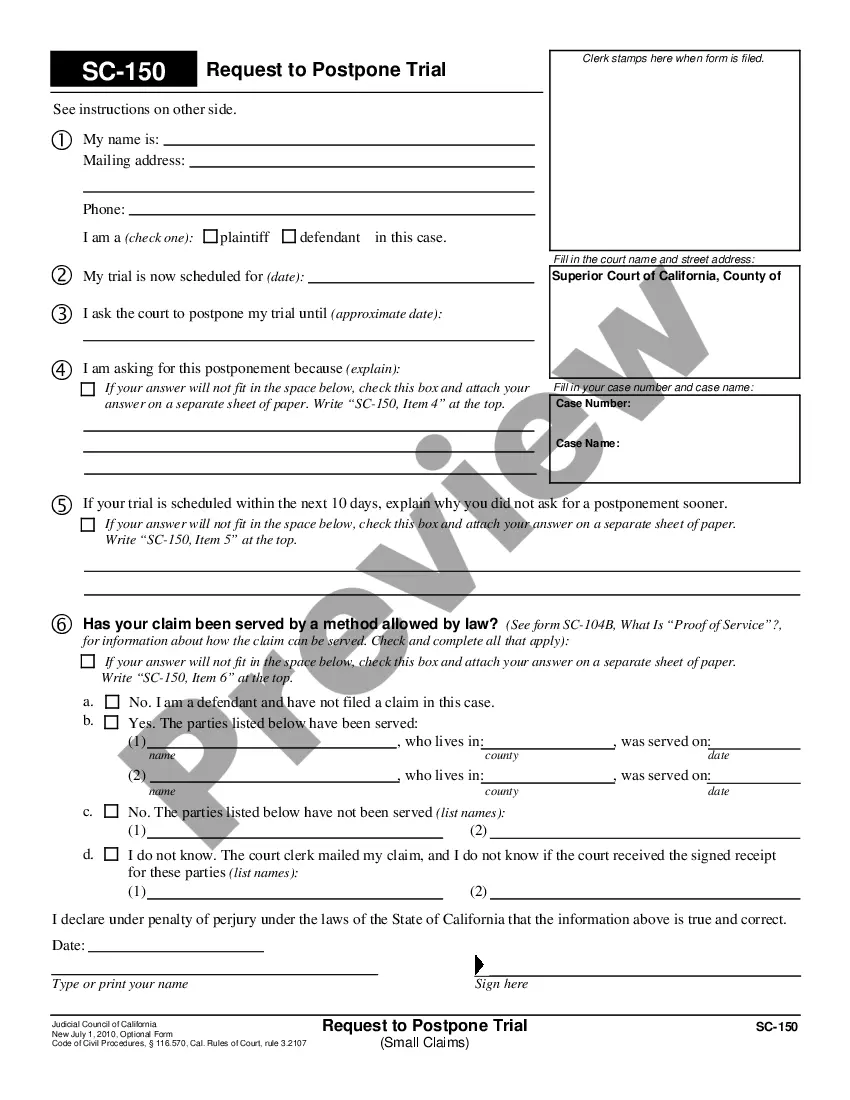

How to fill out Maricopa Arizona Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Maricopa Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York:

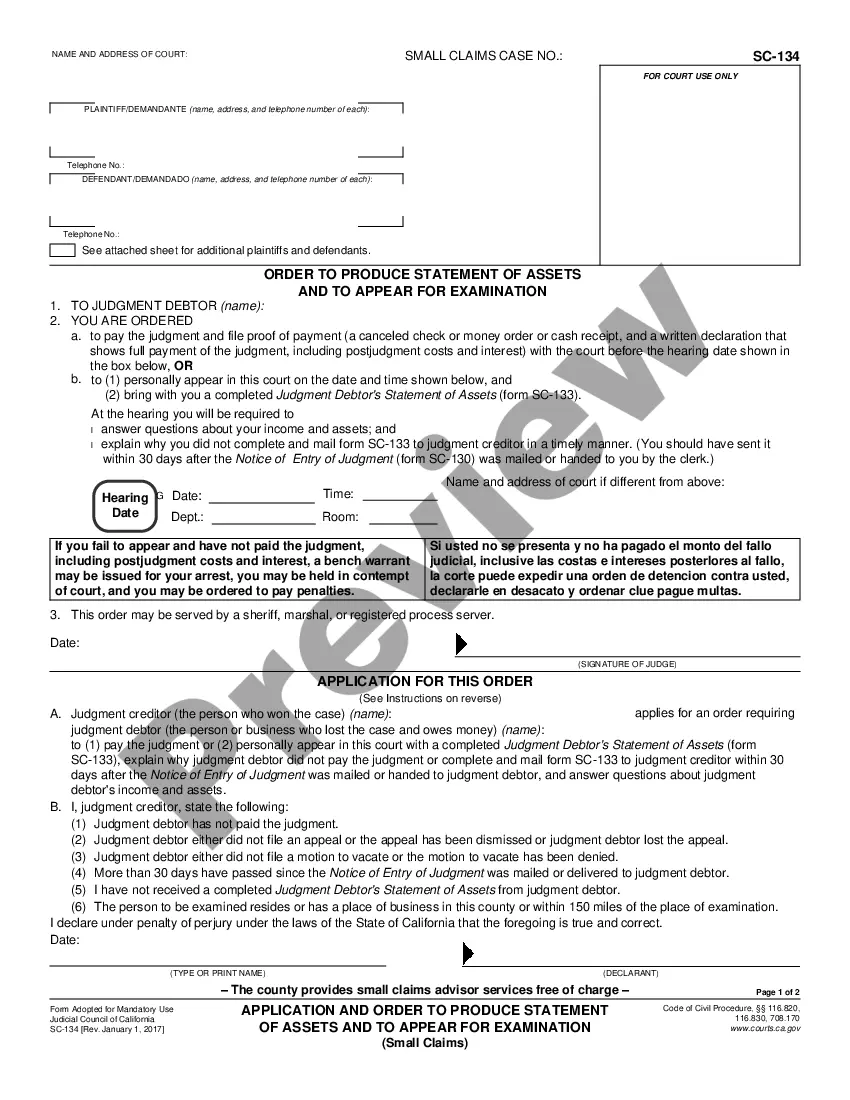

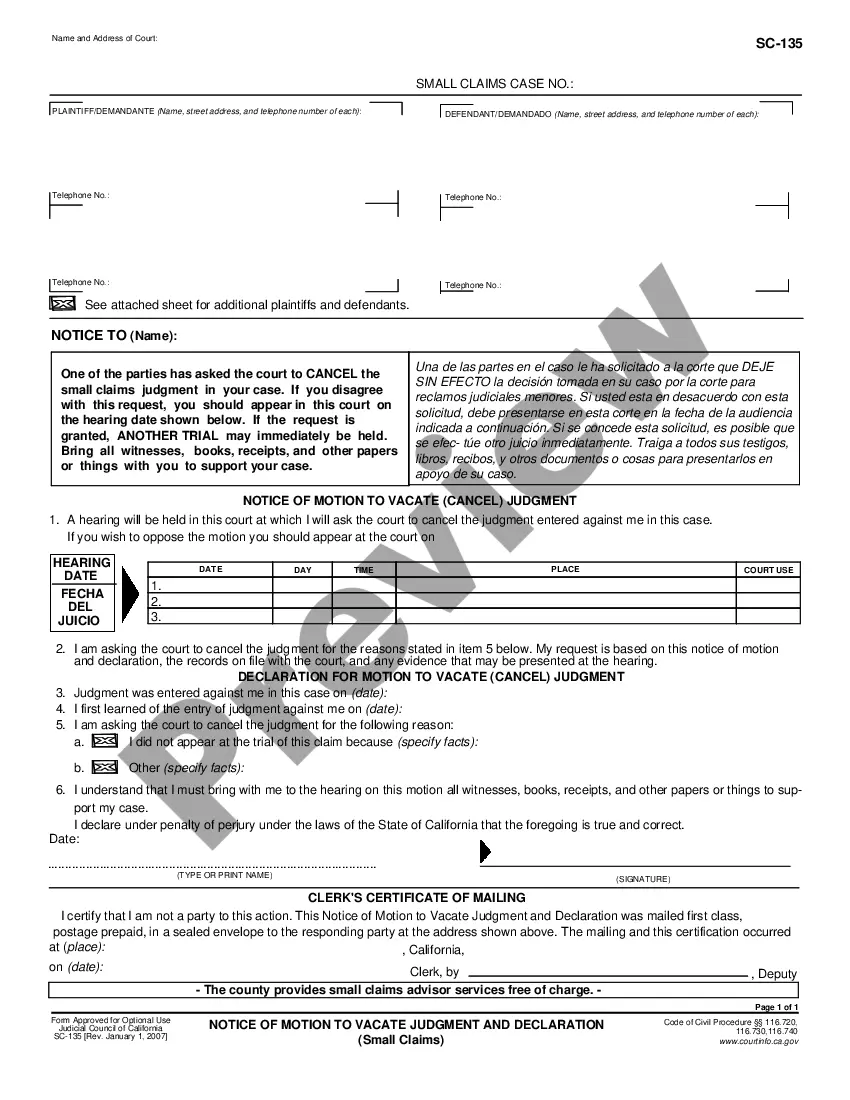

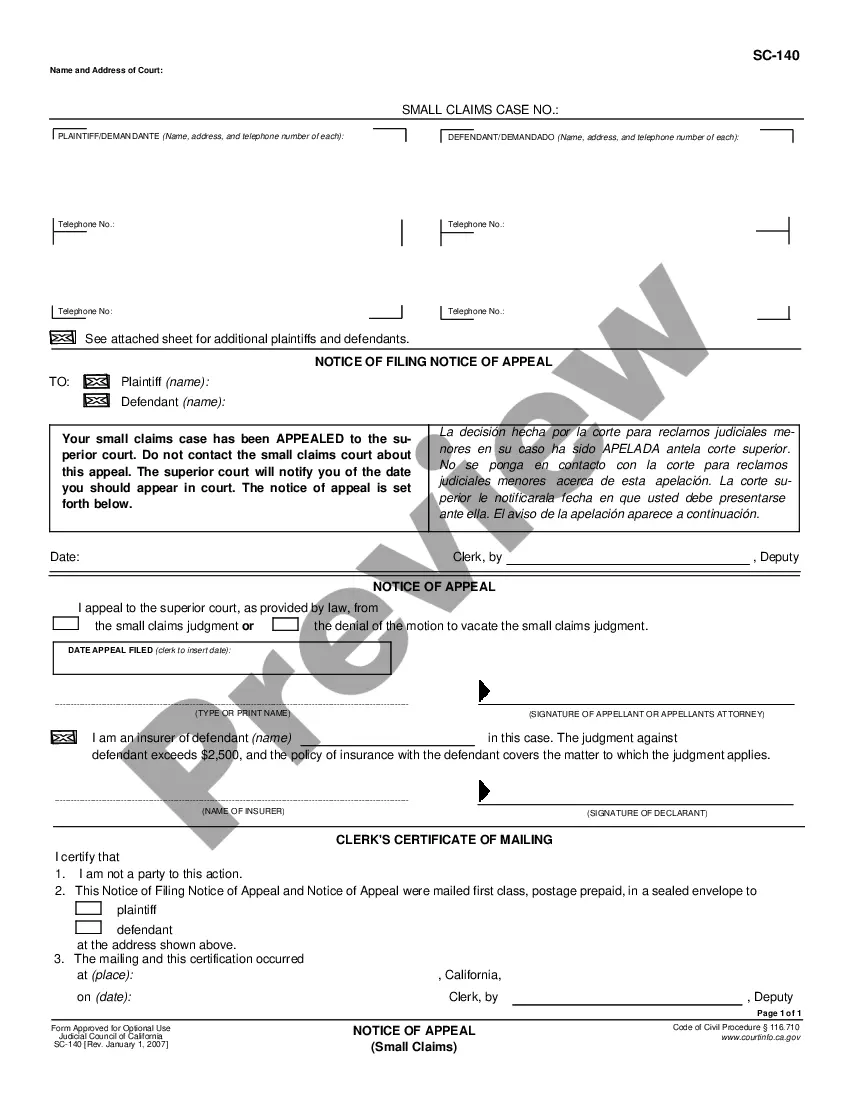

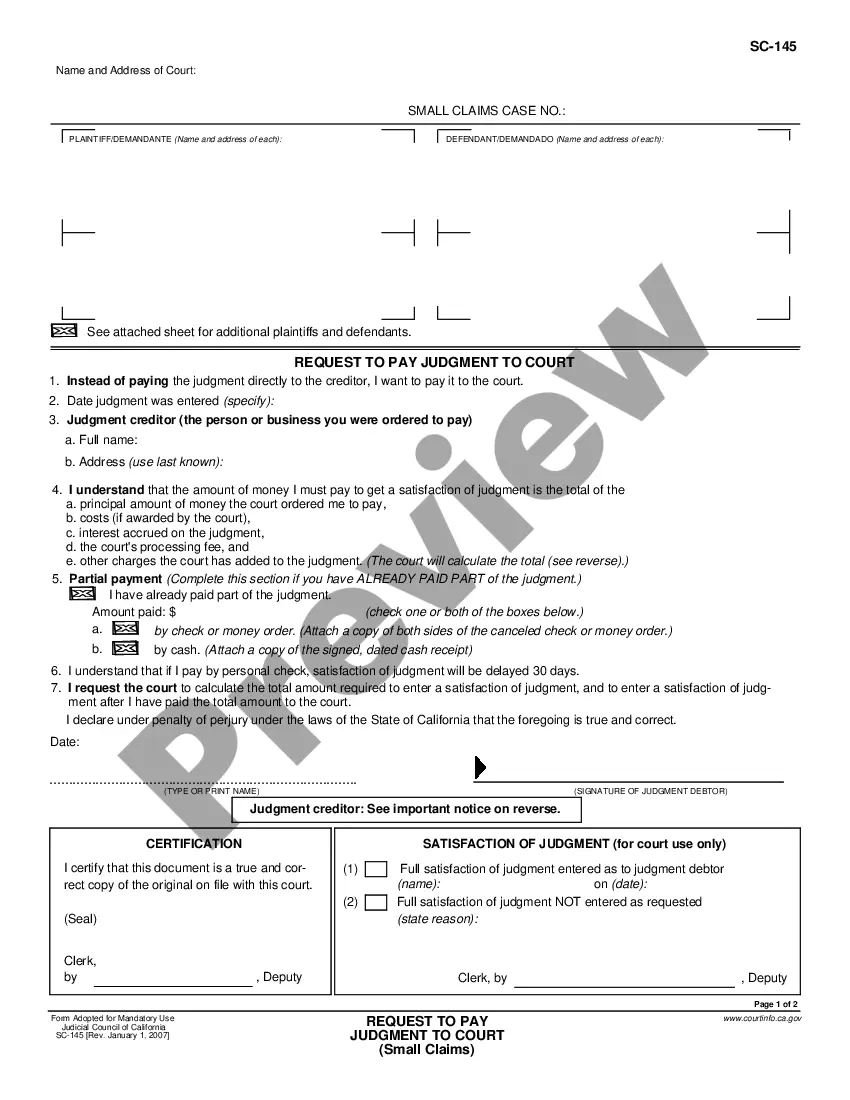

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!