The San Jose California Agreement and Plan of Merger is a legal document that outlines the terms and conditions of the merger between Fidelity National Financial, Inc. and Chicago Title Corp. This agreement provides a comprehensive framework for the integration and consolidation of the two companies, ensuring a smooth transition and alignment of operations. Keywords: San Jose California, Agreement and Plan of Merger, Fidelity National Financial, Inc., Chicago Title Corp, merger, terms and conditions, integration, consolidation, transition, operations. There are different types of San Jose California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp. These may include: 1. Asset Acquisition Agreement: This type of agreement focuses on the acquisition of specific assets, such as real estate properties, contracts, intellectual property rights, and other valuable resources held by Chicago Title Corp. Fidelity National Financial, Inc. agrees to purchase these assets as part of the merger deal. 2. Stock Purchase Agreement: In this variation of the San Jose California Agreement and Plan of Merger, Fidelity National Financial, Inc. purchases the outstanding shares of Chicago Title Corp's common stock. This allows Fidelity National Financial, Inc. to gain control and ownership of the entire company by acquiring a majority or all of the stock. 3. Merger Agreement with Cash Consideration: This type of agreement involves the payment of cash as consideration for the merger between Fidelity National Financial, Inc. and Chicago Title Corp. The agreement specifies the amount and timing of cash payments to be made by Fidelity National Financial, Inc. to Chicago Title Corp's shareholders. 4. Merger Agreement with Share Exchange: In this scenario, the San Jose California Agreement and Plan of Merger stipulates that Fidelity National Financial, Inc. will exchange its own shares for the outstanding shares of Chicago Title Corp. This allows the shareholders of Chicago Title Corp. to become shareholders of Fidelity National Financial, Inc. 5. Reverse Merger Agreement: This variation of the San Jose California Agreement and Plan of Merger presents a scenario where Chicago Title Corp. acquires Fidelity National Financial, Inc. Through this agreement, the ownership of Fidelity National Financial, Inc. will be transferred to Chicago Title Corp., resulting in a reverse merger. In conclusion, the San Jose California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp. encompasses various types of agreements tailored to different merger scenarios, ensuring legal and operational alignment during the consolidation process.

San Jose California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

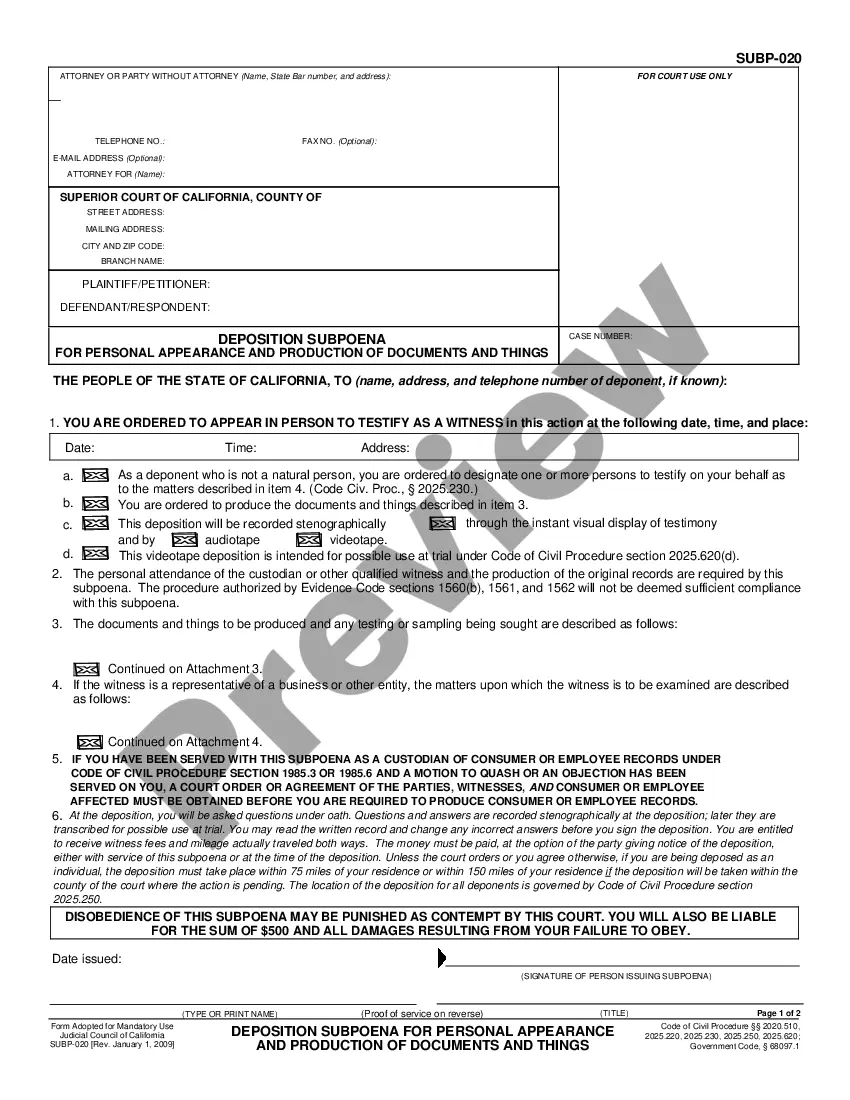

How to fill out San Jose California Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Jose Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the recent version of the San Jose Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Jose Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your San Jose Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

FNF moved into its new corporate headquarters in Santa Barbara, California. FlexNet and Chicago Title's CastleLink operation are merged to form Fidelity National Lender's Solution - the single solution for mortgage products and services.

FNF announces its plan to acquire Chicago Title Corp. and its title insurance subsidiaries - Chicago Title and Ticor Title, thus creating the world's largest title insurance organization. FNF completes its acquisition of Chicago Title Corp., creating the largest title insurance organization in the world.

ATLANTA, July 6, 2016Assurant, Inc. (NYSE: AIZ) announced today its acquisition of American Title, Inc., a leader in title and valuation services for home equity lenders.

Announces the Acquisition of Commonwealth Land Title, Lawyers Title and United Title from LandAmerica Financial Group, Inc. Fidelity National Financial, Inc. Announces the Acquisition of Commonwealth Land Title, Lawyers Title and United Title from LandAmerica Financial Group, Inc.

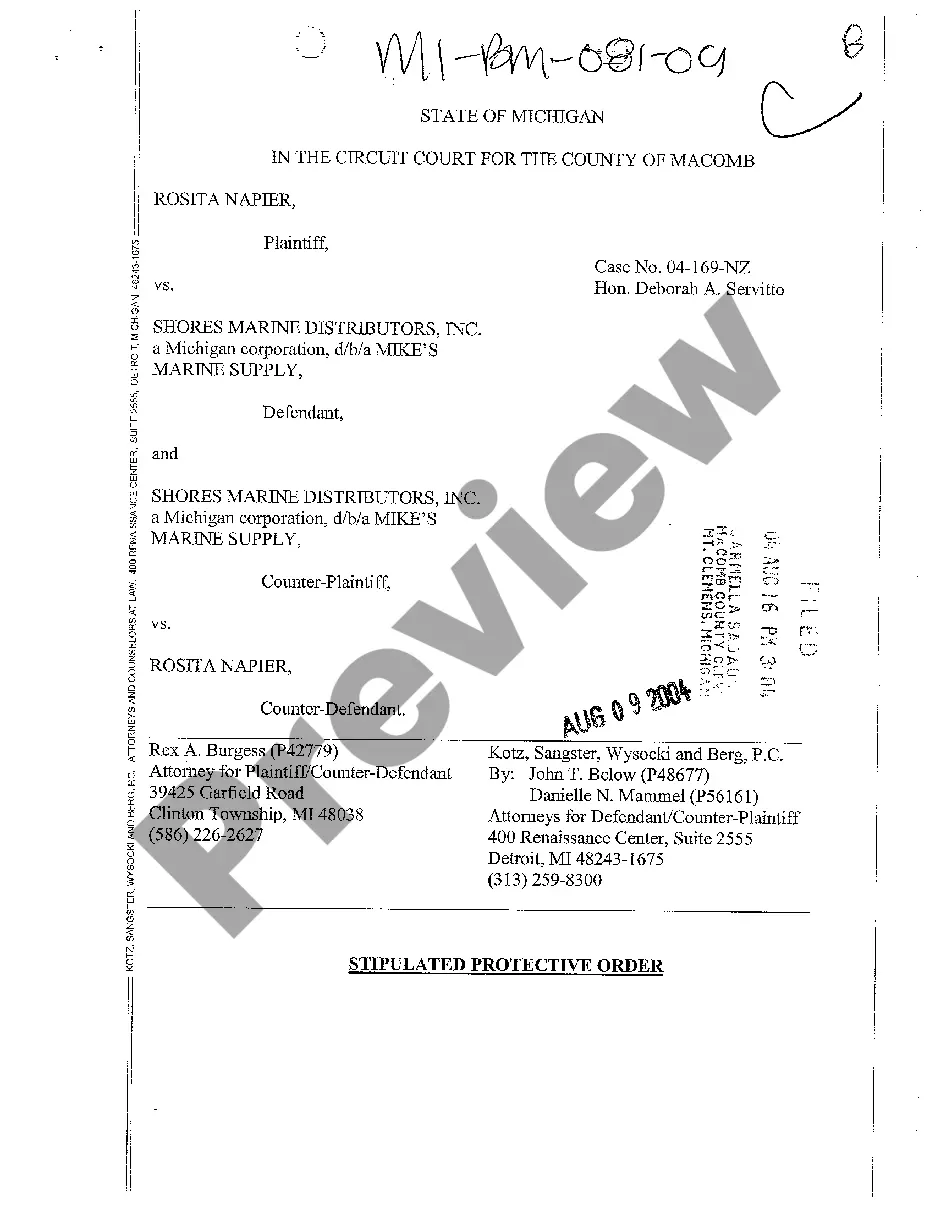

Chicago Title Corporation achieved a major milestone in 1999 when it signed a definitive agreement on August 1 to be acquired by Fidelity National Financial, Inc., creating the pre-eminent company in the title insurance industry. The historic merger was finalized in March 20, 2000.

We know the company today as Commonwealth Land Title Insurance Company. Commonwealth is now a proud member of the Fidelity National Financial, Inc. (NYSE: FNF) family of title companies, which collectively represent the largest title insurance and escrow services company in the world.

FNF is the nation's largest title insurance company through its title insurance underwriters - Fidelity National Title, Chicago Title, Commonwealth Land Title, Alamo Title and National Title of New York - that collectively issue more title insurance policies than any other title company in the United States.

Contact Us. (FNF®) or its wholly owned subsidiary, Micro General Corporation.

Interesting Questions

More info

Filed by Louis J. Gerhard. (Dot. No. 11-21) Filed by New Orleans, Louisiana. (Dot. No. 11-26) Filed by New Orleans, Louisiana. (Dot. No. 11-27) Filed by New Orleans, Louisiana. (Dot. No. 11-28) Filed by New Orleans, Louisiana. (Dot. No. 11-29) Filed by Atlanta, Georgia and New Orleans, Louisiana. (Dot. No. 11-30) Filed by New England, Massachusetts. (Dot. No. 11-31) Filed by Los Angeles, California. (Dot. No. 11-32) Filed by New Orleans, Louisiana. (Dot. No. 11-33) Filed by New Orleans, Louisiana. (Dot. No. 11-34) Filed by New Orleans, Louisiana. (Dot. No. 11-35) Filed by New Orleans, Louisiana. (Dot. No. 11-36) Filed by New Orleans, Louisiana. (Dot. No. 11-37) Filed by New York, New York City. (Dot. No. 11-38) Filed by New York, New York City. (Dot. No. 11-39) Filed by New Orleans, Louisiana. (Dot. No. 11-40) Filed by New Orleans, Louisiana. (Dot. No. 11-41) Filed by New Orleans, Louisiana. (Dot. No. 11-42) Filed by New Orleans, Louisiana. (Dot. No.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.