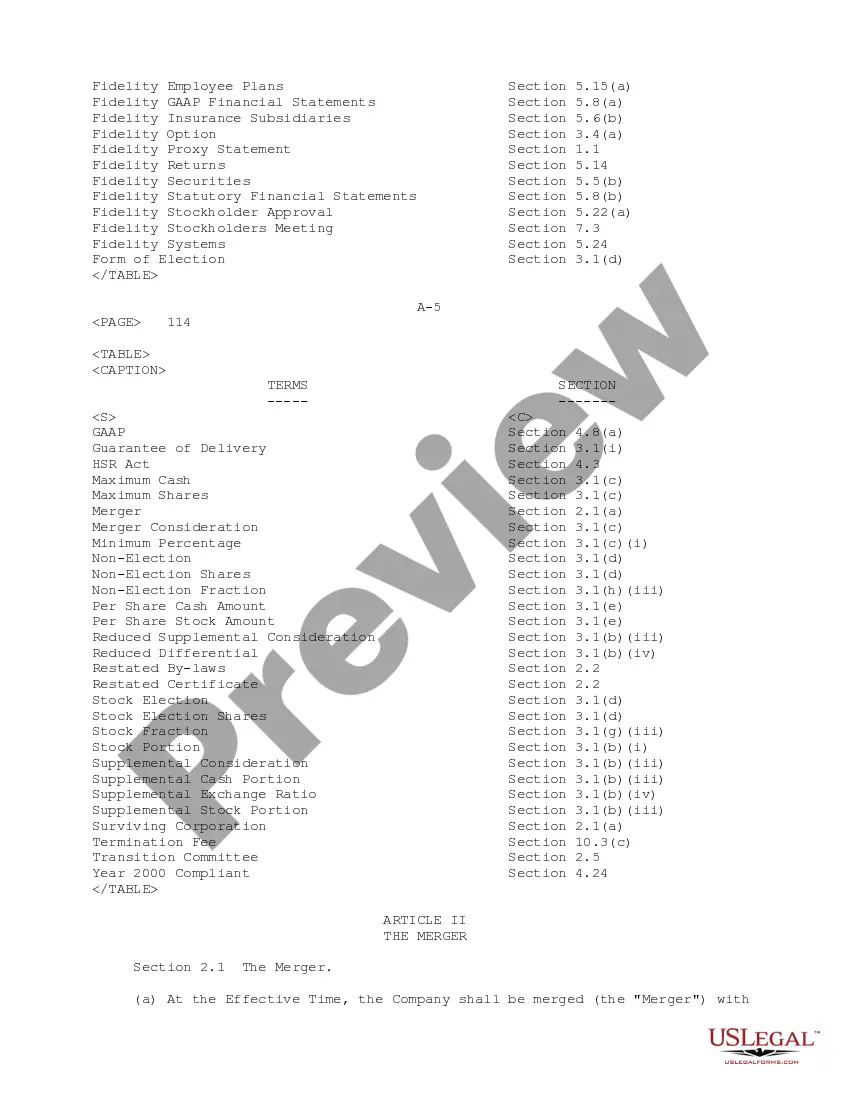

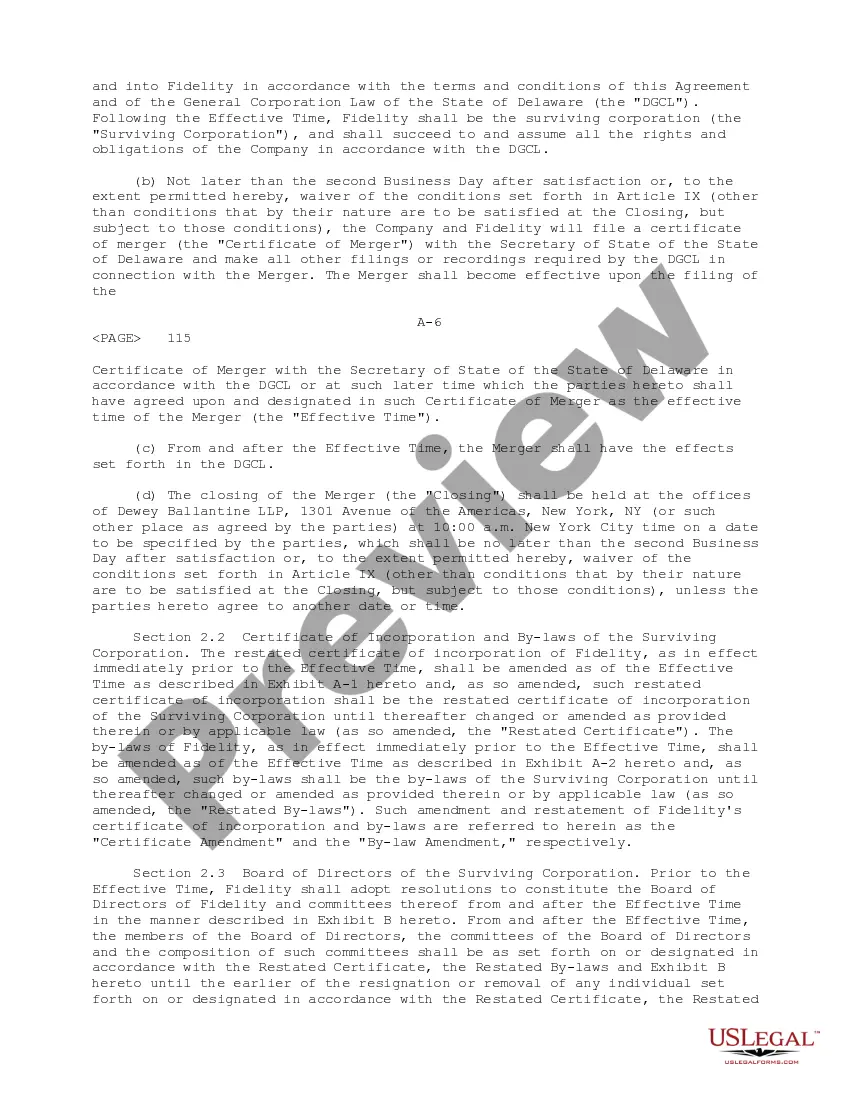

The Wayne Michigan Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp is an important legal document that outlines the terms and conditions of the merger between these two entities. This agreement is specifically relevant to the merger of Fidelity National Financial, Inc. and Chicago Title Corp in the Wayne, Michigan region. The merger agreement typically includes a comprehensive description of the terms, objectives, and procedures involved in the merger. It highlights essential aspects such as the date of the merger, provisions for the transfer of assets and liabilities, the exchange ratio for the stockholders, and the governance structure of the merged entity. Additionally, it will address any regulatory approvals or conditions that need to be met for the merger to be completed. The Wayne Michigan Agreement and Plan of Merger may also encompass additional clauses pertaining to the integration of the two companies, such as the management of personnel, employee benefits, intellectual property rights, and any potential post-merger restructuring plans. Different types of Wayne Michigan Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp may exist depending on the specific circumstances and objectives of the merger. These could include: 1. Standard Agreement and Plan of Merger: This is the typical agreement used when two companies decide to merge, with no additional special provisions or conditions. 2. Cash Merger Agreement: In this type of agreement, the merger involves a cash transaction rather than a stock-for-stock exchange. It outlines the terms of the monetary compensation for the shareholders of the acquired company. 3. Stock-for-Stock Merger Agreement: This agreement specifies the exchange ratio of stock for the shareholders of the target company. It determines the number of shares of the acquiring company's stock that will be allocated for each share of the target company's stock. 4. Reverse Merger Agreement: In certain cases, where the target company is larger or more established, a reverse merger may occur. This agreement stipulates the conditions and terms under which the smaller acquiring company merges into the larger target company. In conclusion, the Wayne Michigan Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp is a legal document that outlines the specifics of the merger between these two entities in the Wayne, Michigan area. It can take different forms depending on the type of merger being pursued, such as a cash transaction or a stock-for-stock exchange.

Wayne Michigan Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out Wayne Michigan Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

If you need to get a reliable legal form provider to obtain the Wayne Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to look for or browse Wayne Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Wayne Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Wayne Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

Announces the Acquisition of Commonwealth Land Title, Lawyers Title and United Title from LandAmerica Financial Group, Inc. Fidelity National Financial, Inc. Announces the Acquisition of Commonwealth Land Title, Lawyers Title and United Title from LandAmerica Financial Group, Inc.

In a move that creates the nation's largest title-insurance company, Fidelity National Financial Inc. said it agreed to acquire larger rival Chicago Title Corp. for $1.2 billion in cash and stock.

First American Title is the largest title insurance company, with a 21% market share and more than $4 billion in premiums in 2020 41% more than the next-largest company. However, Chicago Title, Fidelity National Title and Commonwealth Land Title are all owned by one parent company, Fidelity National Title Group.

Contact Us. (FNF®) or its wholly owned subsidiary, Micro General Corporation.

Chicago Title Corporation achieved a major milestone in 1999 when it signed a definitive agreement on August 1 to be acquired by Fidelity National Financial, Inc., creating the pre-eminent company in the title insurance industry. The historic merger was finalized in March 20, 2000.

Chicago Title Corporation achieved a major milestone in 1999 when it signed a definitive agreement on August 1 to be acquired by Fidelity National Financial, Inc., creating the pre-eminent company in the title insurance industry. The historic merger was finalized in March 20, 2000.

FNF is the nation's largest title insurance company through its title insurance underwriters - Fidelity National Title, Chicago Title, Commonwealth Land Title, Alamo Title and National Title of New York - that collectively issue more title insurance policies than any other title company in the United States.

Fidelity National Financial, Inc. (NYSE:FNF), a Fortune 500 company, is a provider of title insurance and settlement services to the real estate and mortgage industries....Fidelity National Financial. Fidelity National Financial corporate headquartersProductsTitle insurance, mortgage services & other diversified services11 more rows

Our Strength. Ticor Title is a member of the Fidelity National Financial, Inc. family of companies. FNF is a leading provider of title insurance, mortgage services, and diversified services.