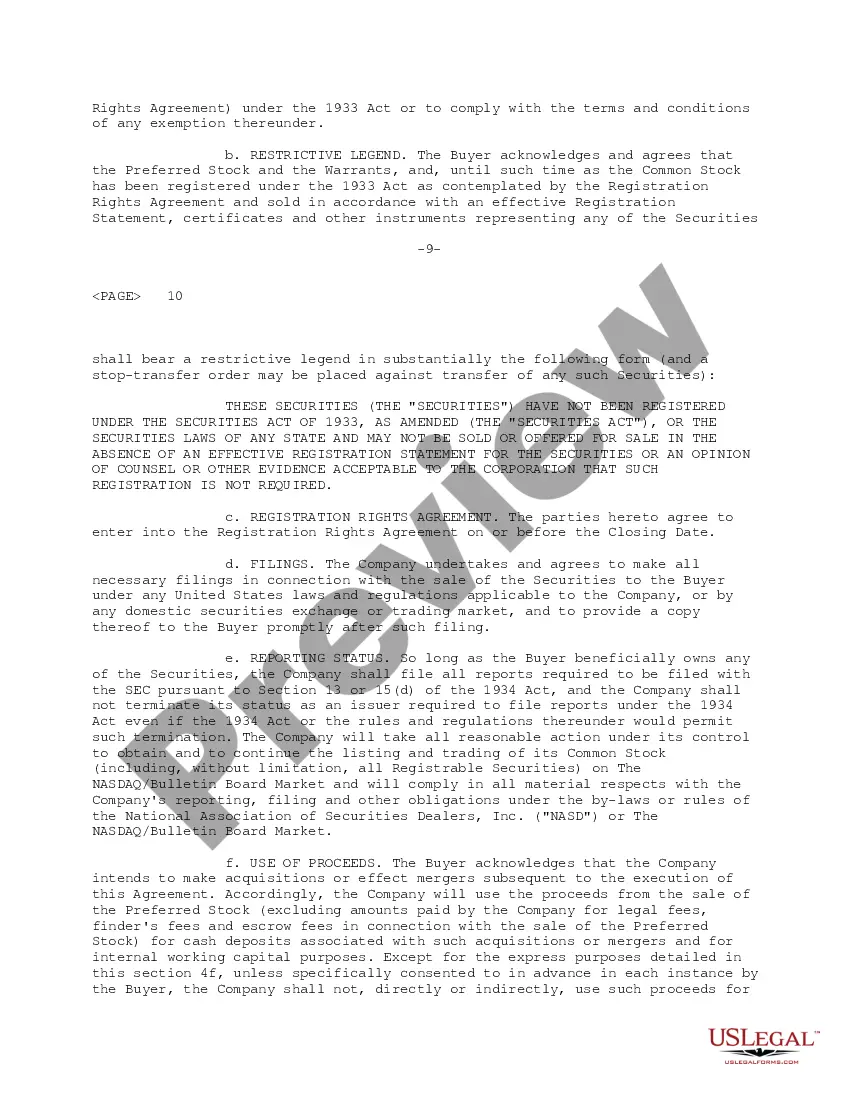

Franklin Ohio Sample Purchase Agreement between EAT, Inc. and Wentworth, LLC This Franklin Ohio Sample Purchase Agreement serves as a legally binding contract between EAT, Inc., a company registered in Ohio, and Wentworth, LLC, also an Ohio-based company. This agreement outlines the terms and conditions of the purchase and sale of a specific asset or property. Keywords: Franklin Ohio, Sample Purchase Agreement, EAT, Inc., Wentworth, LLC, legally binding contract, terms and conditions, purchase and sale, asset, property. 1. Introduction: The agreement begins with an introductory section that states the intention of both parties to enter into a purchase agreement. It provides the legal names and addresses of EAT, Inc. and Wentworth, LLC, clearly identifying the buyer and seller. 2. Definitions: This section defines key terms used throughout the agreement to eliminate ambiguity and ensure a mutual understanding of the agreement's provisions. 3. Sale and Purchase: The agreement specifies the asset or property being purchased and sold, providing a detailed description of its location, boundaries, and any included fixtures or improvements. It outlines the purchase price, payment terms, and any specified methods of payment. 4. Closing Procedures: This section describes the closing process, including agreed-upon dates, location, and responsibilities of both parties. It may include a provision for a title search and examination, ensuring a clear title transfer. 5. Representations and Warranties: EAT, Inc. and Wentworth, LLC provide representations and warranties related to their authority, ownership of the property, and compliance with laws and regulations. Both parties assure that they possess the necessary power and authority to execute the agreement. 6. Indemnification: This clause outlines the responsibilities of each party regarding liabilities, claims, and damages arising before or after the closing of the purchase. It specifies the indemnification obligations of EAT, Inc. and Wentworth, LLC. 7. Default and Remedies: The agreement addresses the potential default of either party and establishes the remedies available to the non-defaulting party. It outlines the steps to be taken in case of breach or default, which may include monetary damages, specific performance, or termination of the agreement. 8. Governing Law and Jurisdiction: This section specifies that the agreement will be governed by the laws of the state of Ohio, particularly Franklin County. It denotes the jurisdiction in which any legal action arising from the agreement shall be brought. Additional types of Franklin Ohio Sample Purchase Agreement between EAT, Inc. and Wentworth, LLC may pertain to various types of assets or properties, such as: 1. Real estate purchase agreement. 2. Equipment purchase agreement. 3. Intellectual property purchase agreement. 4. Stock or equity purchase agreement. 5. Business asset purchase agreement. It is important to note that the specifics of each agreement type may vary based on the nature of the asset or property being purchased.

Franklin Ohio Sample Purchase Agreement between ESAT, Inc. and Wentworth, LLC

Description

How to fill out Franklin Ohio Sample Purchase Agreement Between ESAT, Inc. And Wentworth, LLC?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Franklin Sample Purchase Agreement between ESAT, Inc. and Wentworth, LLC without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Franklin Sample Purchase Agreement between ESAT, Inc. and Wentworth, LLC by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

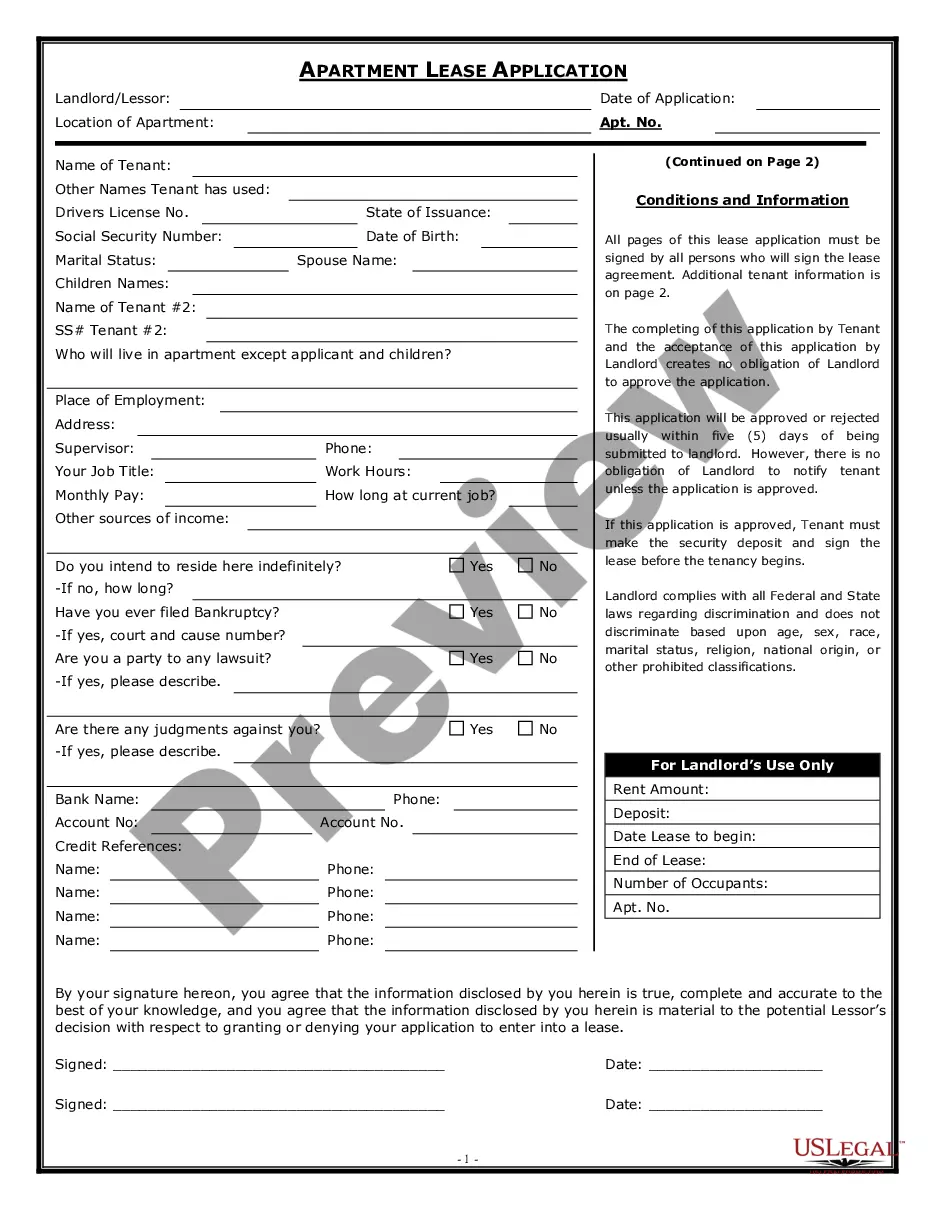

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Franklin Sample Purchase Agreement between ESAT, Inc. and Wentworth, LLC:

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!