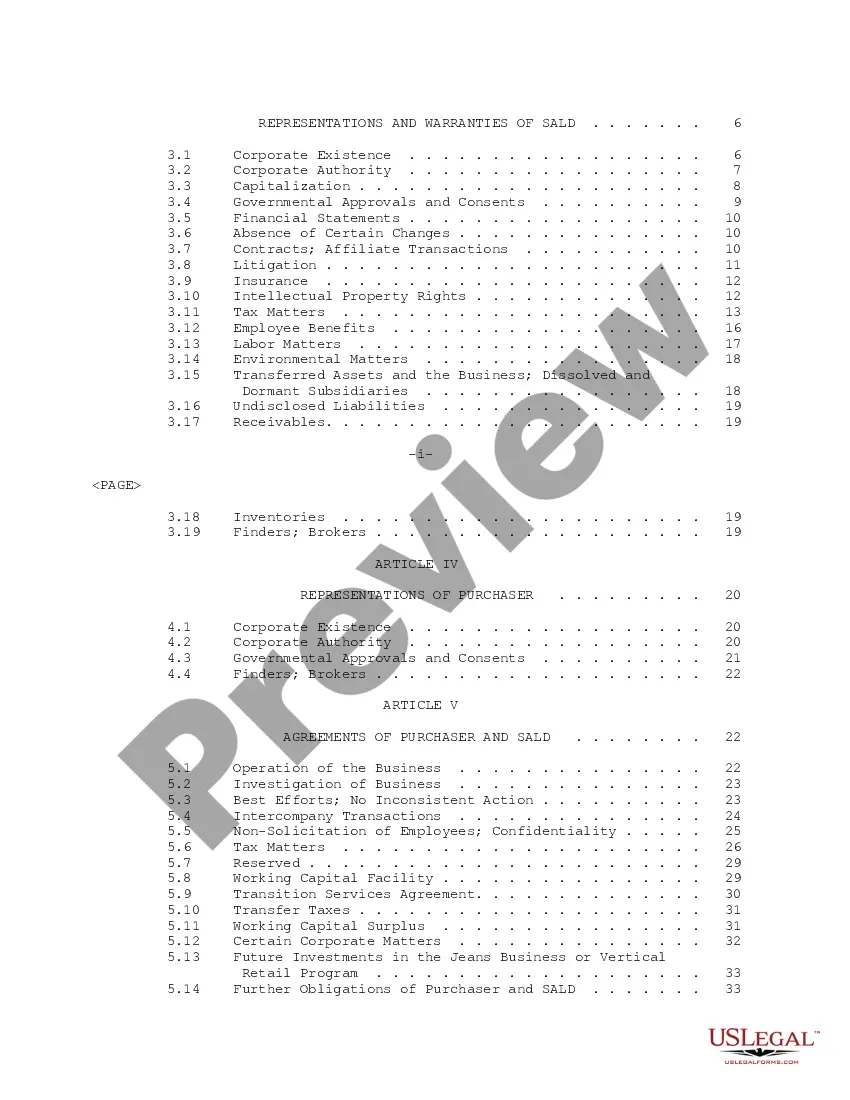

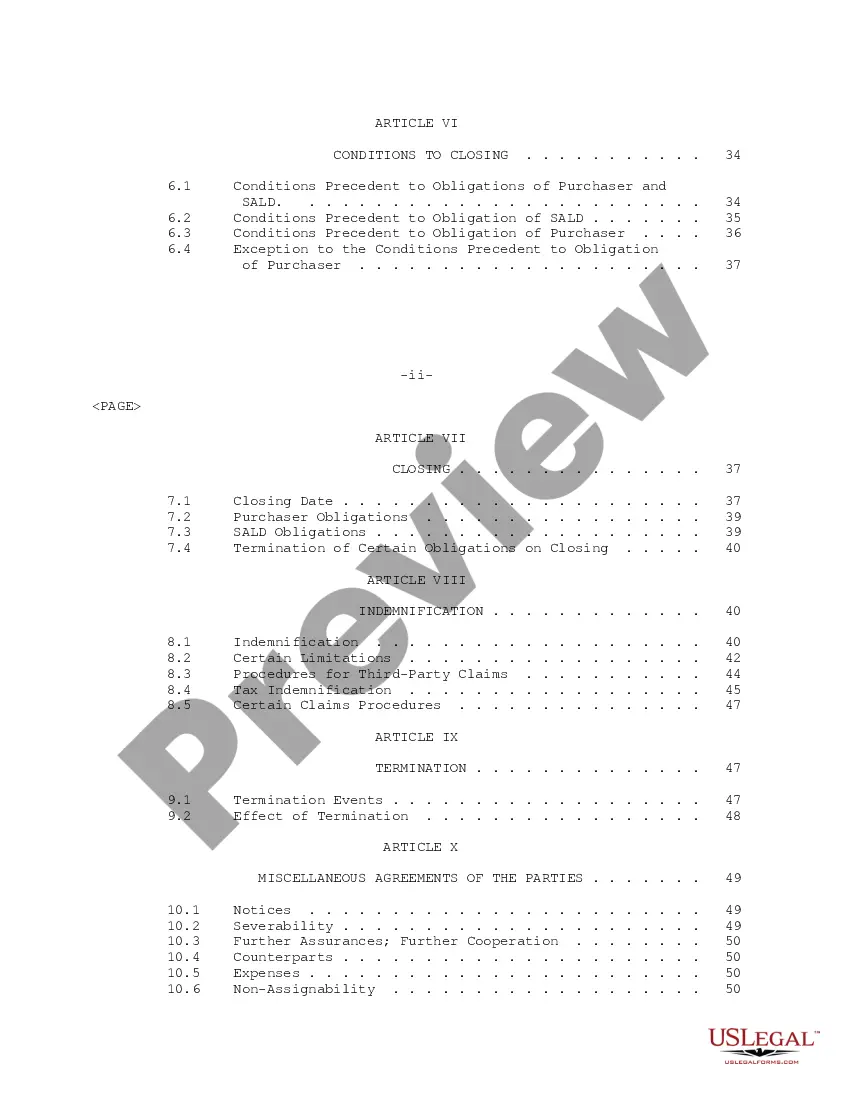

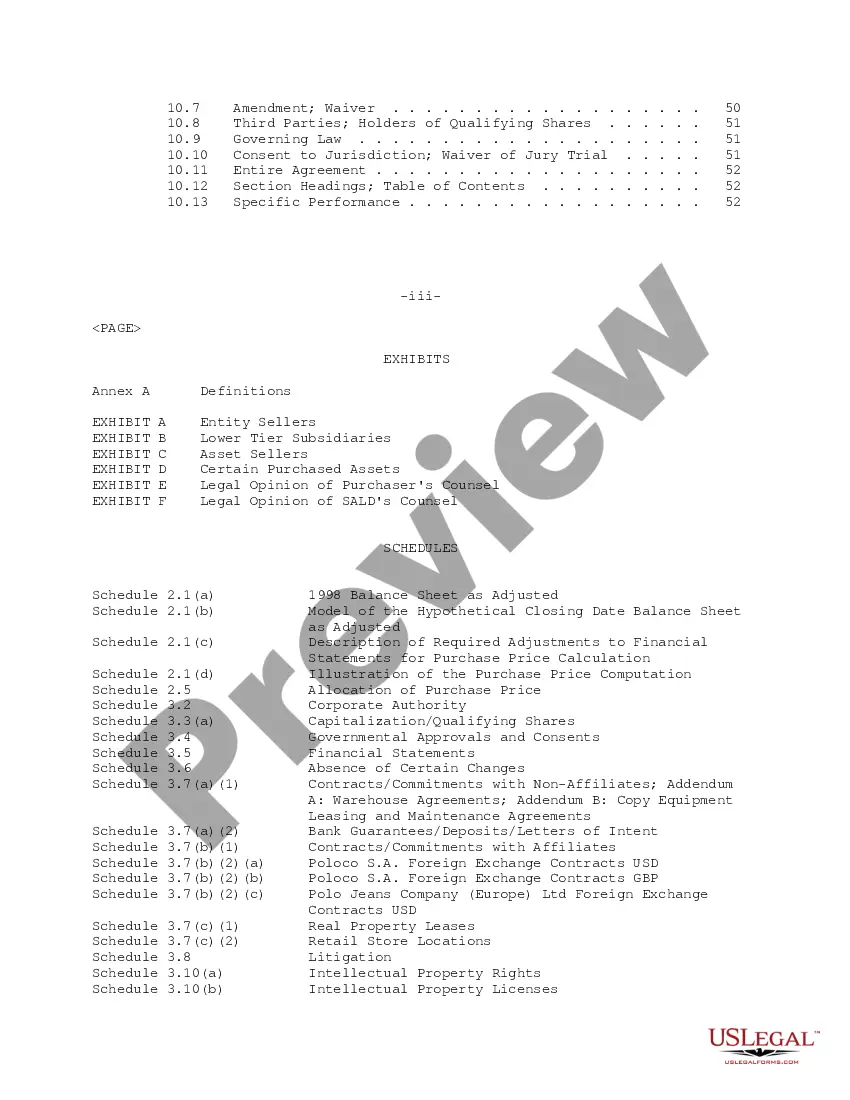

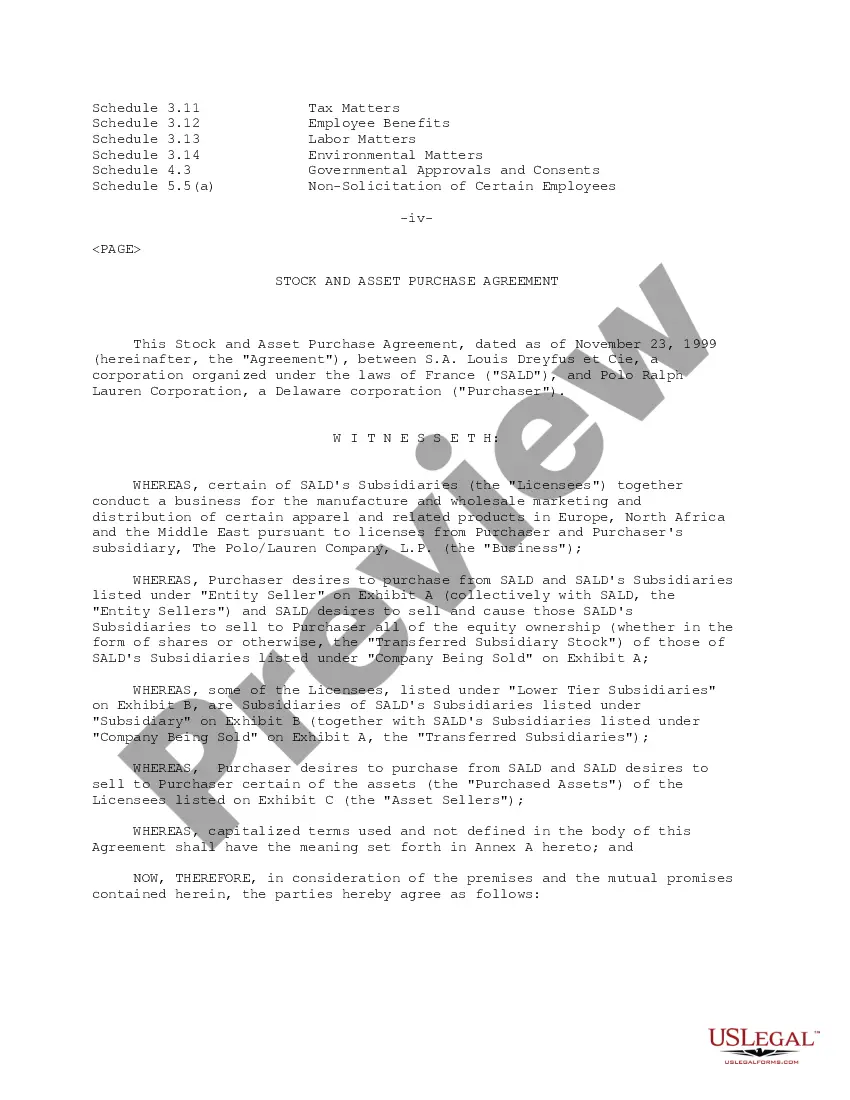

Phoenix, Arizona, rich in culture and natural beauty, is the vibrant capital city of the state. With its year-round sunshine and stunning desert landscapes, Phoenix has attracted businesses from various sectors, including the fashion industry. Polo Ralph Lauren Corporation, a renowned fashion brand known for its iconic designs, has entered into a Sample Stock Purchase Agreement with S.A. Louis Dreyfus Et CIE, a global merchant and processor of agricultural products. This Sample Stock Purchase Agreement documents the terms and conditions under which Polo Ralph Lauren Corporation is acquiring shares from S.A. Louis Dreyfus Et CIE. The agreement outlines the rights, obligations, and responsibilities of both parties involved. It provides a formal framework for conducting the stock purchase transaction, ensuring transparency, and protecting the interests of both entities. Within the realm of Phoenix Arizona Sample Stock Purchase Agreements between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, there might be different types of agreements based on various factors, such as: 1. Asset Purchase Agreement: If the transaction involves the purchase of specific assets, rather than shares, a separate agreement known as an Asset Purchase Agreement may be drafted. This agreement would detail the assets being acquired, their valuation, and any associated terms and conditions. 2. Share Purchase Agreement with Private Placement: In case the transaction includes a private placement of shares by Polo Ralph Lauren Corporation to S.A. Louis Dreyfus Et CIE, a Share Purchase Agreement with Private Placement provisions would be formulated. This agreement would encompass the sale and issuance of the additional shares along with any regulatory compliance specifics. 3. Stock Purchase Agreement with Earn out: In situations where future considerations, often tied to predefined performance milestones, become part of the deal, a Stock Purchase Agreement with Earn out provisions may come into play. This agreement would outline the terms and conditions for the additional payment or purchase price adjustments based on specified criteria being met. It is vital for both S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, as parties to the Sample Stock Purchase Agreement, to ensure that all critical aspects of the transaction are covered. Elements such as purchase price, payment terms, representations and warranties, due diligence, closing conditions, indemnification clauses, and dispute resolution mechanisms should be meticulously addressed to minimize risks and promote a smooth transaction. In conclusion, the Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation exemplifies the potential opportunities and collaboration between fashion industry leaders and global merchants within the thriving business community of Phoenix, Arizona.

Phoenix Arizona Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation

Description

How to fill out Phoenix Arizona Sample Stock Purchase Agreement Between S.A. Louis Dreyfus Et CIE And Polo Ralph Lauren Corporation?

Creating paperwork, like Phoenix Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, to manage your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for various cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Phoenix Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before getting Phoenix Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation:

- Make sure that your document is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Phoenix Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!