The Harris Texas Expense Limitation Agreement, also known as the Harris County Expense Limitation Agreement, is a legal document that outlines the set limits on expenses for various entities within Harris County, Texas. This agreement aims to control and regulate the spending of taxpayer funds by defining the maximum amount that can be spent by the county or specific departments for particular purposes. The primary purpose of the Harris Texas Expense Limitation Agreement is to ensure responsible financial management and prevent unnecessary or excessive spending. By establishing clear guidelines and limitations, it helps maintain transparency and accountability in the handling of public funds. Key elements that may be included in the Harris Texas Expense Limitation Agreement are: 1. Spending Categories: This agreement typically categorizes expenses into various types such as personnel costs, operational expenses, capital projects, contracted services, and other specific budgetary items. 2. Budget Caps: The agreement sets clear limits on the amount of money that can be spent within each spending category. For instance, it may specify that personnel costs should not exceed a certain percentage of the total budget or establish maximum spending caps for capital projects. 3. Approval Process: The agreement may define the procedure and authority required to approve expenditures that exceed the established limitations. This process ensures that any extraordinary spending is thoroughly reviewed and approved by the appropriate authorities. 4. Reporting and Monitoring: The agreement often mandates periodic reporting and monitoring of expenses to ensure compliance with the established limitations. Regular financial reports and audits enable transparency and accountability while identifying any potential violations or deviations from the agreed-upon spending limits. 5. Amendments and Renewals: The agreement specifies terms regarding its duration and the possibility of amendments or renewals if necessary. These clauses allow flexibility in adjusting the limitations over time to address changing financial needs or unforeseen circumstances. It is important to note that there may be variations or different types of Harris Texas Expense Limitation Agreements tailored for specific entities within Harris County, such as county departments, agencies, or public institutions. These variations may involve specific spending limitations or conditions unique to each entity, but the fundamental objective remains the same — ensuring responsible fiscal management and controlling expenses to safeguard taxpayer dollars.

Harris Texas Expense Limitation Agreement

Description

How to fill out Harris Texas Expense Limitation Agreement?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Harris Expense Limitation Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Harris Expense Limitation Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Harris Expense Limitation Agreement:

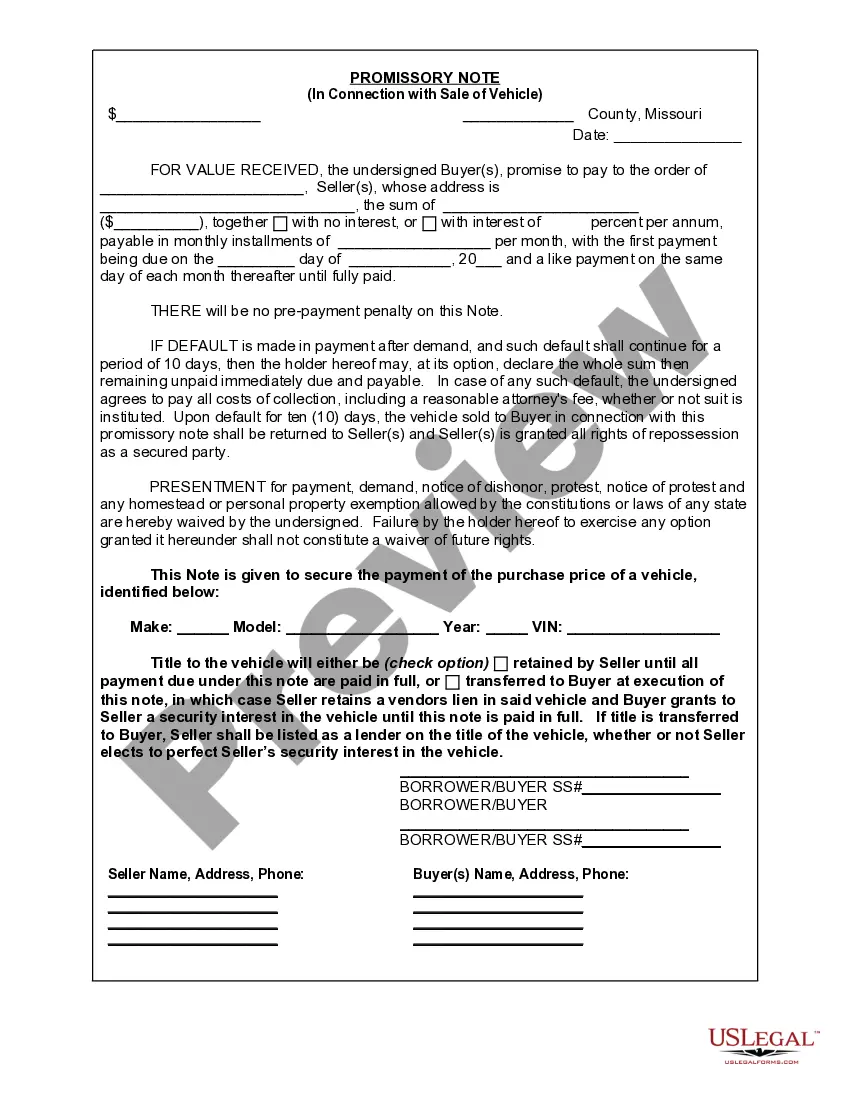

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!