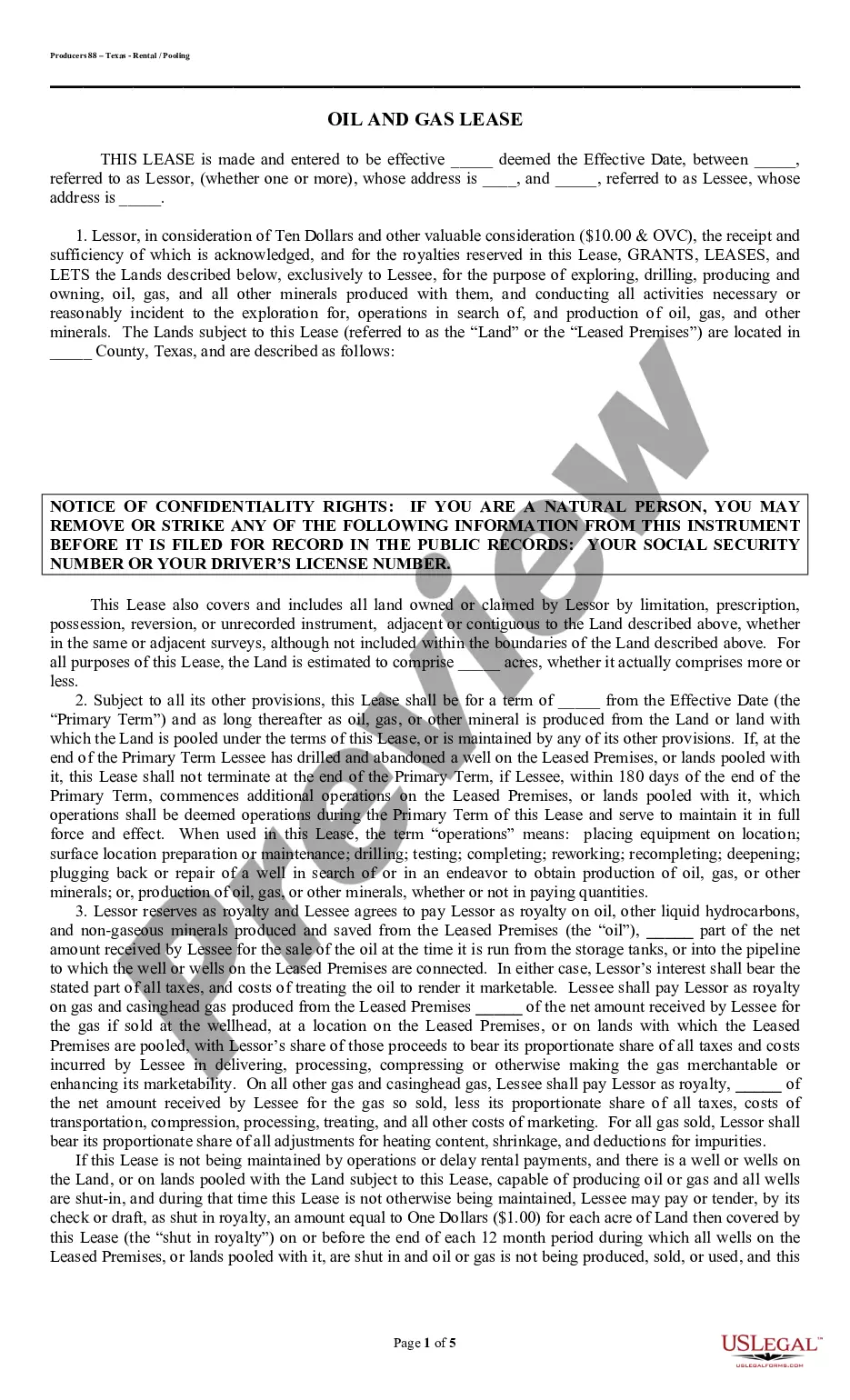

Orange California Expense Limitation Agreement is a legal contract that outlines a specified limit on expenses that can be incurred in a specific situation or agreement. This agreement is often employed in various business transactions or partnerships to safeguard both parties from excessive expenses. The Orange California Expense Limitation Agreement sets a predetermined spending threshold, ensuring that the involved parties agree not to exceed the specified limit without prior consent or approval. This agreement prevents any party from incurring expenses that may disproportionately burden the other party or jeopardize the overall feasibility of the project or partnership. Types of Orange California Expense Limitation Agreement: 1. Business Partnership Expense Limitation Agreement: This type of agreement is commonly implemented in business partnerships or joint ventures. It establishes a clear boundary on the expenses that partners can incur individually or collectively, ensuring equitable distribution of financial responsibility. 2. Real Estate Expense Limitation Agreement: In the real estate sector, this agreement is utilized to govern expenses related to property acquisitions, leasing, development, or renovation. It delineates the maximum amount that can be spent on these activities, protecting both the buyer and seller or the landlord and tenant from excessive financial burdens. 3. Construction Expense Limitation Agreement: Construction projects often involve multiple parties, such as contractors, subcontractors, and clients. To manage expenses effectively, a construction expense limitation agreement can be put in place, establishing a cap on the costs that each party can accrue during the project duration. 4. Service Provider Expense Limitation Agreement: Service-based businesses, such as consulting firms or marketing agencies, may utilize this agreement to regulate expenses incurred while providing services to clients. It ensures that the service provider remains within the confines of the agreed-upon budget, preventing any financial surprises. 5. Procurement Expense Limitation Agreement: Public procurement processes can benefit from an expense limitation agreement, which defines the maximum amount that can be spent on goods or services acquisitions. Such agreements promote transparency, accountability, and fairness in the procurement process. In summary, the Orange California Expense Limitation Agreement is a legally binding contract that restricts expenses to a predetermined limit. It comes in various forms, such as business partnership, real estate, construction, service provider, and procurement expense limitation agreements. These agreements serve to protect the parties involved, ensuring that expenses do not exceed a specified threshold.

Orange California Expense Limitation Agreement

Description

How to fill out Orange California Expense Limitation Agreement?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Orange Expense Limitation Agreement.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Orange Expense Limitation Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Orange Expense Limitation Agreement:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Orange Expense Limitation Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Generally, an expense limitation agreement is based on the fund's expense ratio (expenses / net assets) and computed each day so that on any single day a fund's shareholders will not experience an expense ratio in excess of that specified in the expense limitation agreement with the fund's advisor.

Be sure that your financial affidavit is notarized before filing it with the Court, as the statute requires the document be sworn.

A typical fund may incur the following expenses: Management fee. The management fee is paid by an investor to the portfolio management company as compensation for managing funds on their behalf.Legal expenses.Transfer agent fees.Marketing fees.

An expense limit is a limit placed on the operating expenses incurred by a mutual fund. The expense limit is expressed as a percentage of the fund's average net assets and represents a cap on the fees a shareholder may be charged.

The Income and Expense Declaration is used whenever you are requesting a court order regarding money. Assistance: Parties who are acting as their own attorneys may receive help from the Self Help Center to complete these forms.

Expense Waiver. Expense Waivers, also referred to as expense offsets, expense reimbursements, etc., represent the amount the fund company waives or assumes in order to keep the fund's actual (net) expenses low. A company may reduce different components of overall expenses: management fee, 12b-1 fee, other fees etc.

A capped fund imposes an upper limit on the amount of fees it can charge investors in any given year. Capping the expense ratio on a fund can keep fees in check and attract cost-conscious investors. A capped fund may also refer to an upper limit placed on the weight of any particular asset in its portfolio.

How to Fill Out a Financial Affidavit for Divorce in Florida - 2018 - \nYouTube YouTube Start of suggested clip End of suggested clip Case you're gonna start with the 18 d r and then whatever the the sequence of numbers are followingMoreCase you're gonna start with the 18 d r and then whatever the the sequence of numbers are following that you know goes to 0 0 0 1 2 3 division is going to be for instance R.

How to Fill Out a Financial Affidavit for Divorce in Florida - 2018 - \nYouTube YouTube Start of suggested clip End of suggested clip Case you're gonna start with the 18 d r and then whatever the the sequence of numbers are followingMoreCase you're gonna start with the 18 d r and then whatever the the sequence of numbers are following that you know goes to 0 0 0 1 2 3 division is going to be for instance R.