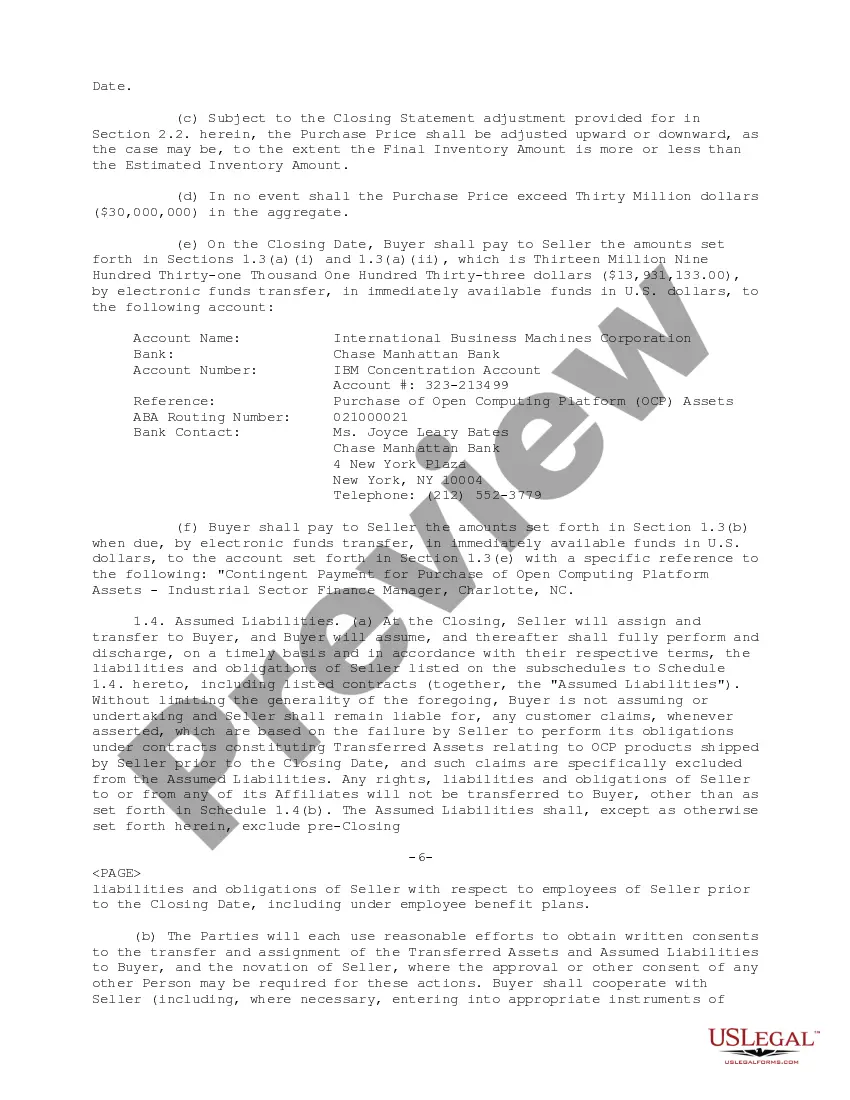

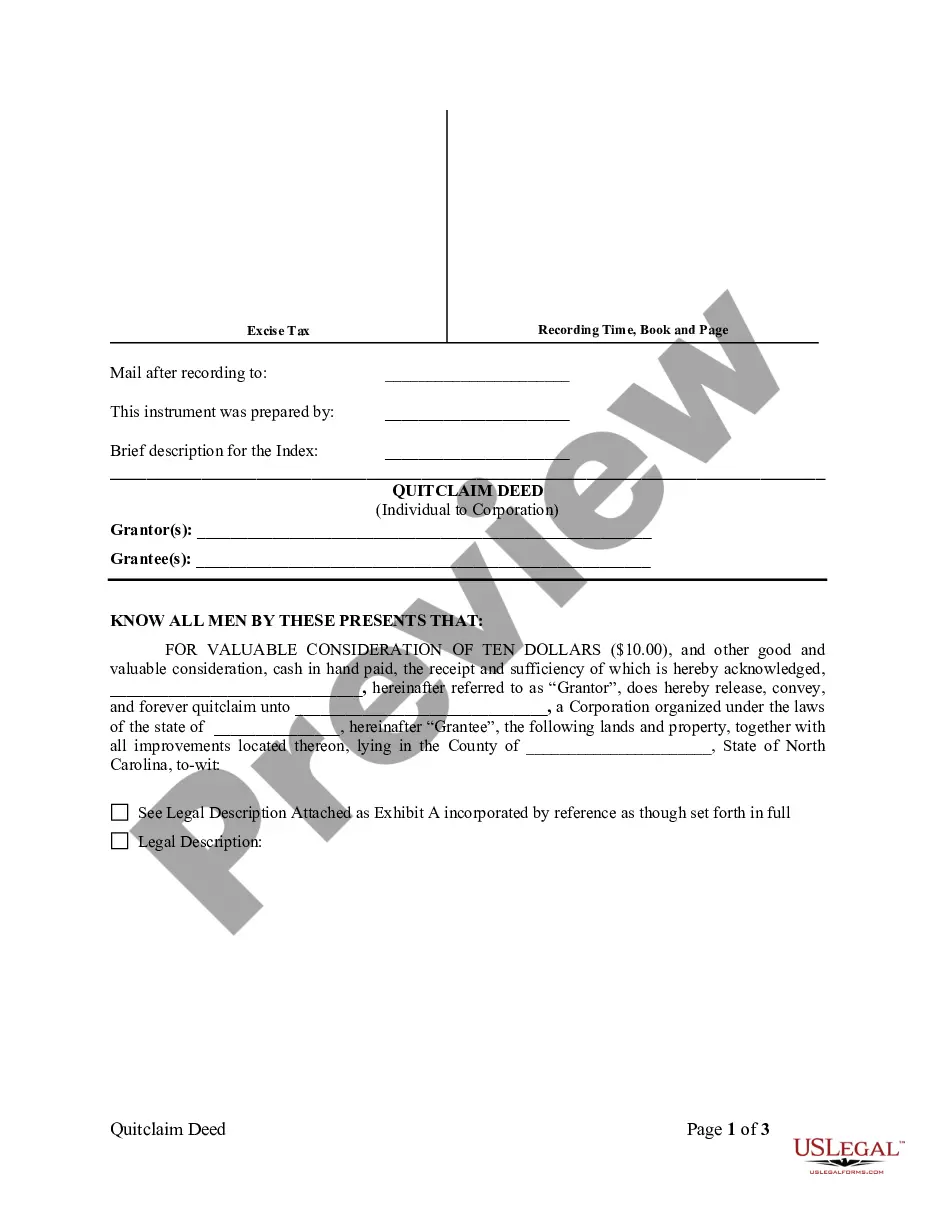

Collin Texas, located in the northeast region of the state, is a vibrant and rapidly growing county known for its rich history, diverse population, and robust economy. With a thriving business community and a strong focus on innovation and technology, Collin Texas offers numerous opportunities for companies to expand and grow. One notable agreement that exemplifies Collin Texas' business potential is the Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation (IBM). This comprehensive agreement outlines the terms and conditions under which Radius Corporation agrees to sell certain assets to IBM, thereby facilitating the acquisition process. The Collin Texas Sample Asset Purchase Agreement encompasses various key aspects, including the identification and description of the assets involved, specific purchase price and payment terms, representations and warranties provided by both parties, and conditions precedent and after the closing of the transaction. Furthermore, the agreement covers intellectual property rights, indemnification provisions, and dispute resolution mechanisms, ensuring a transparent and fair business environment. It is essential to note that Collin Texas has witnessed multiple types of Sample Asset Purchase Agreements between Radius Corporation and IBM. Some of these variations include: 1. Stock Purchase Agreement: This type of agreement involves the sale and purchase of a company's stock, which may grant the buyer ownership, voting rights, and access to the target company's assets and liabilities. 2. Asset Purchase Agreement: In contrast to a stock purchase agreement, this type involves the transfer of specific assets and liabilities from one entity to another. It allows the buyer to select and acquire only the desired assets, avoiding any unwanted liabilities that may exist within the target company. 3. Merger Agreement: This agreement enables two or more companies to combine their assets and operations to form a new entity. It involves a more comprehensive integration process and typically requires the approval of shareholders and regulatory authorities. 4. Joint Venture Agreement: In some cases, Radius Corporation and IBM may opt to establish a joint venture, where they form a new entity to pursue a specific project or achieve mutual goals. This agreement outlines each party's roles, responsibilities, and financial contributions. Overall, the Collin Texas Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation reflects the county's dynamic business landscape and the potential for collaboration and growth between industry-leading organizations.

Collin Texas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Collin Texas Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Collin Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Collin Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Collin Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample:

- Ensure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Collin Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Here are several advantages of an asset purchase transaction: A major tax advantage is that the buyer can step up the basis of many assets over their current tax values and obtain tax deductions for depreciation and/or amortization.

You'll need to officially let your employees go when you sell your business. From there, they can choose to either accept or reject the offer of new employment with the buyers of your business. Either way, you'll need to formally terminate their employment with you.

In an asset acquisition strategy a company chooses the assets, and sometimes liabilities, it wishes to obtain, as opposed to a traditional acquisition where it buys the entire company. Choosing the specific assets and liabilities reduces risk and potential losses.

By definition, employees are not assets since companies do not have control over them. Workers must convert raw materials be they commodities or blank computer screens into finished inventory to be paid, but if these workers want to quit, they can take their skills and training with them.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved).

What is included in your contract will differ based on your circumstances, but a starting agreement should include: Party information.Definitions.Purchased assets.Purchase price.Additional covenants.Warranties or disclaimers.Indemnification.Breach of contract provisions.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

In an asset purchase, workers are considered terminated by the seller. This will trigger a distribution opportunity for the workers under the seller's 401(k) plan. The buyer may want to facilitate tax-free rollovers from the seller's plan to its plan.