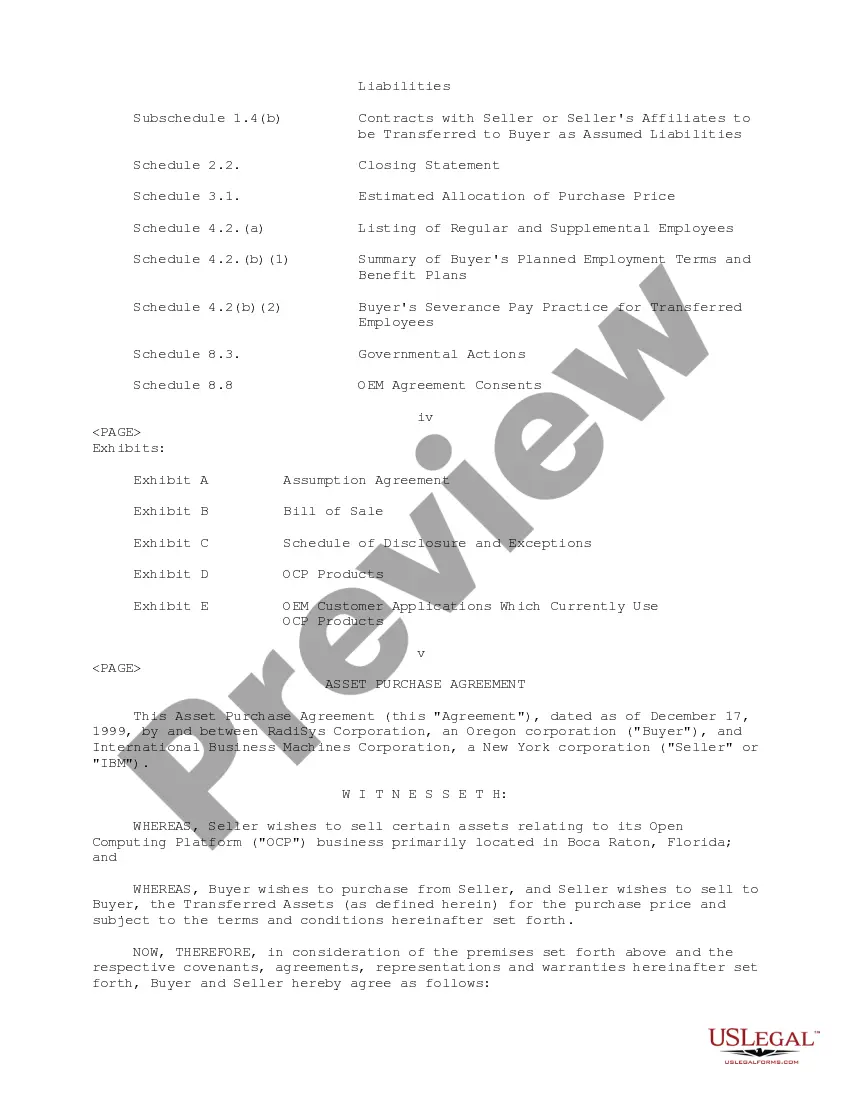

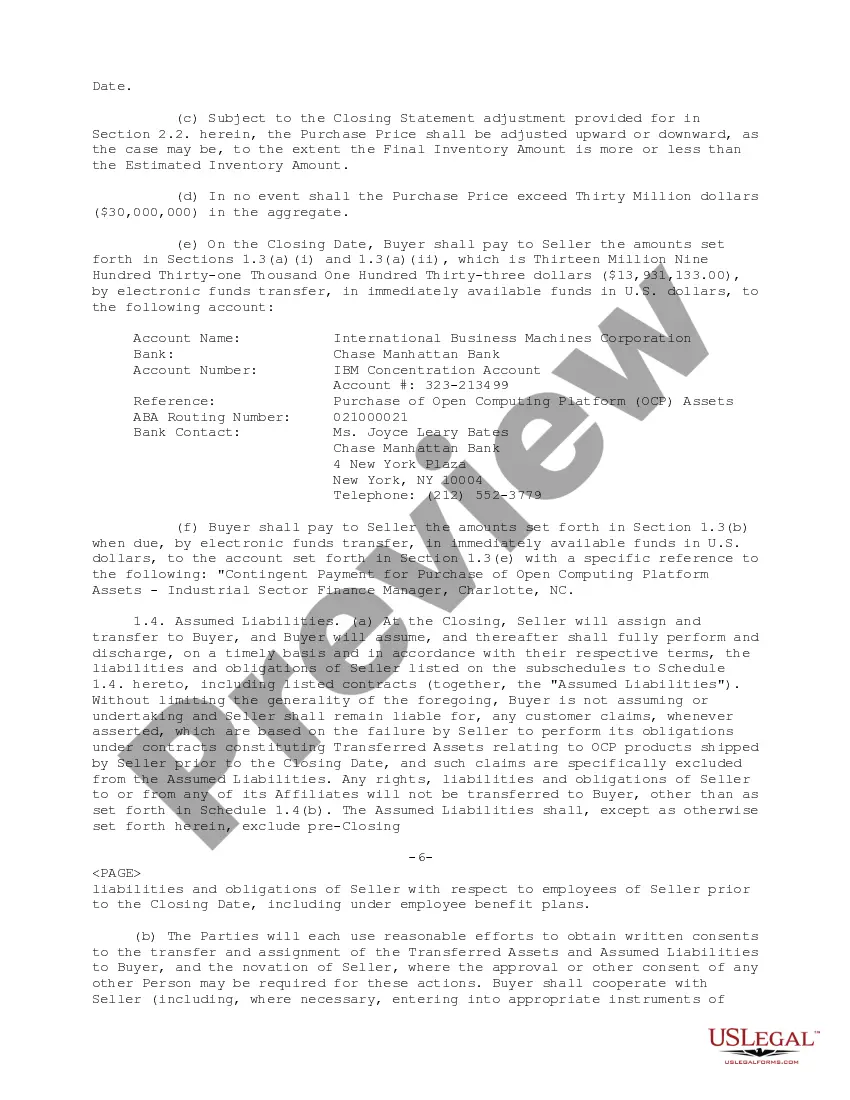

Travis Texas Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation serves as a legally binding document that outlines the terms and conditions for the purchase and transfer of assets between these two entities. This agreement is applicable to the specific scenario between Radius Corporation and International Business Machines Corporation in Travis Texas. 1. Introduction: The agreement begins with an introduction section that provides a background on the participating parties, including full legal names, addresses, and contact details. It also mentions the purpose of the agreement, emphasizing the asset transfer from Radius Corporation to International Business Machines Corporation. 2. Definitions and Interpretation: This section defines key terms and phrases used throughout the agreement to ensure clarity and avoid any misunderstandings. It helps both parties understand the specific language and terminology used within the document. 3. Asset Description: Here, the agreement provides a comprehensive description of the assets being purchased and transferred, including but not limited to intellectual property rights, software, technology, contracts, customer lists, equipment, furniture, and any additional tangible or intangible properties. 4. Purchase Consideration: This section outlines the total purchase consideration amount, specifying the currency and the agreed-upon payment schedule. It may address payment methods, such as direct bank transfers or escrow accounts. 5. Representations and Warranties: Both parties make certain representations and warranties about their authority to enter into the agreement, ownership and title of assets, absence of conflicting agreements, and compliance with laws and regulations. These representations and warranties are crucial to instill trust and protect the interests of both parties. 6. Closing Conditions: This part includes various conditions that must be fulfilled or satisfied before the completion of the asset purchase agreement. These conditions may involve receiving necessary consents, approvals, or waivers from third parties, regulatory bodies, or shareholders. 7. Indemnification: The indemnification section outlines the responsibilities of both parties to indemnify and hold harmless each other from any losses, damages, or liabilities arising from breach of representations and warranties or non-compliance with contractual obligations. 8. Governing Law and Jurisdiction: This portion identifies the applicable laws and regulations governing the agreement and specifies the jurisdiction or venue where any disputes will be resolved, such as Travis Texas courts or arbitration forums. 9. Termination and Remedies: This section highlights the circumstances under which the agreement can be terminated by either party, providing remedies for breach or non-performance. 10. Confidentiality: Both parties commit to maintaining the confidentiality of any non-public information disclosed during the asset purchase process, ensuring that sensitive matters are not shared with unauthorized parties. Note: The document mentioned above is a fictional example. Please consult legal professionals and refer to official templates for actual asset purchase agreements.

Travis Texas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Travis Texas Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Travis Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Travis Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the similar forms or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Travis Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Travis Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to deal with an extremely complicated case, we advise using the services of an attorney to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!