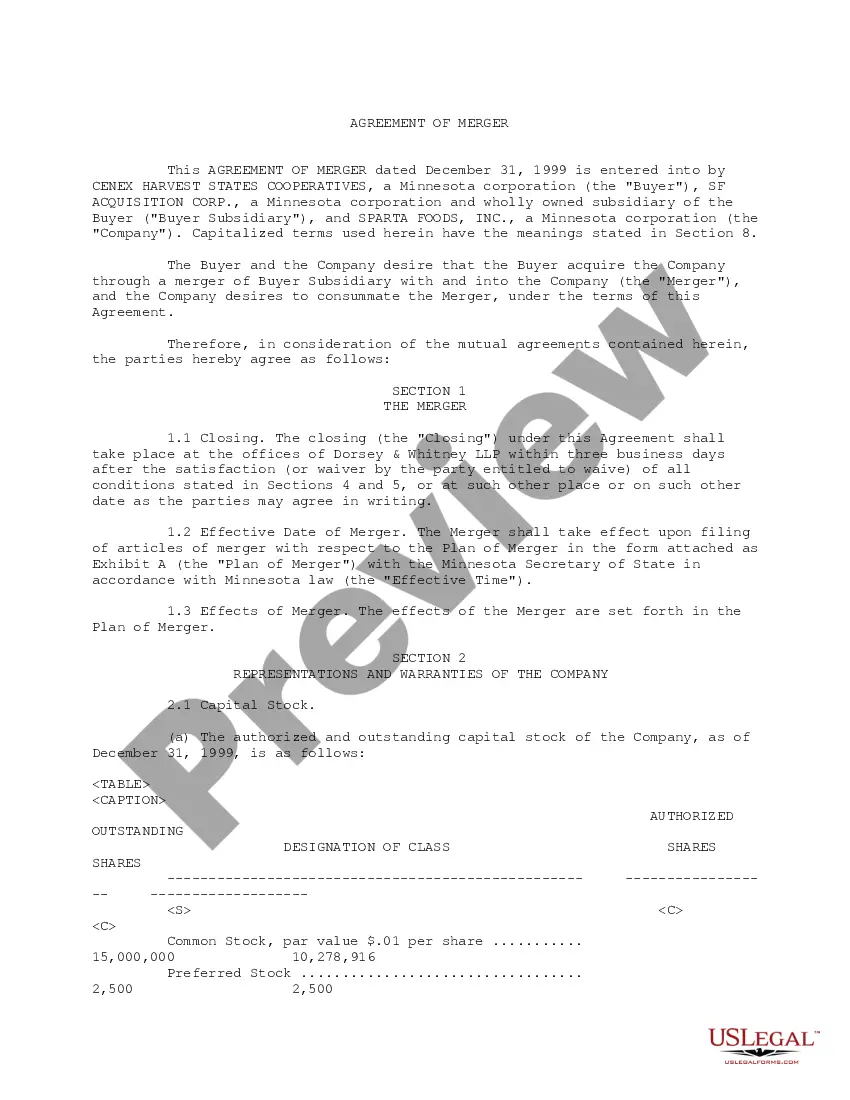

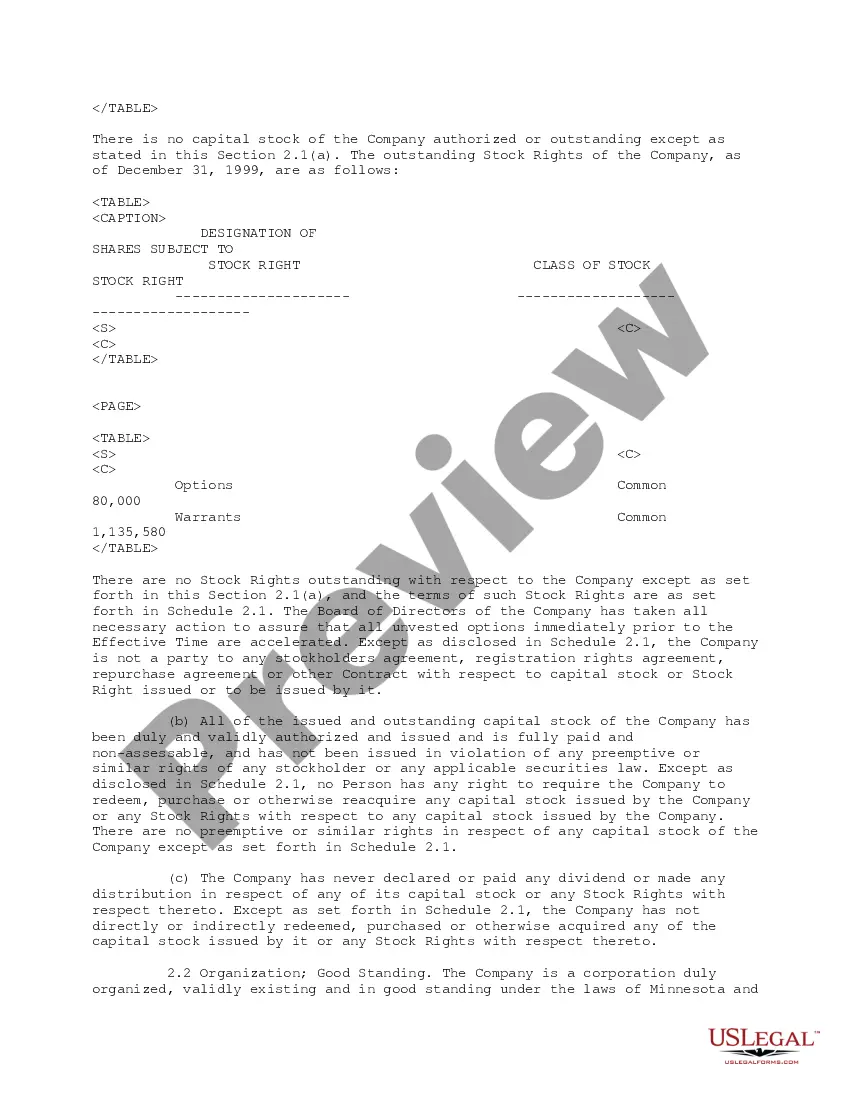

Alameda California Merger Agreement between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. is a legally binding contract that outlines the terms and conditions of the merger between these three entities. This merger agreement represents a strategic consolidation of resources, assets, and operations to enhance market competitiveness and overall growth prospects. Key Keywords: Alameda California, Merger Agreement, CEDEX Harvest States Cooperative, SF Acquisition Corporation, Sparta Foods, Inc., consolidation, resources, assets, operations, market competitiveness, growth prospects. Different Types of Alameda California Merger Agreement between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc.: 1. Asset Acquisition Merger Agreement: This type of merger agreement involves the transfer of specific assets from one company to another, typically with consideration in the form of cash, stock, or a combination of both. The agreement delineates the assets being acquired, their valuation, and the terms governing the transaction. 2. Stock Swap Merger Agreement: In this type of merger agreement, the shareholders of the acquiring company exchange their shares for the shares of the target company. The agreement specifies the exchange ratio, which determines the number of target company shares to be received for every share of the acquiring company. 3. Cash Merger Agreement: This agreement involves the target company's shareholders receiving a cash payment in exchange for their shares. The agreement establishes the cash price per share, the payment methods, and the conditions for completing the merger. 4. Statutory Merger Agreement: This type of merger agreement is governed by specific state laws and involves the consolidation of two or more companies into a new entity. The agreement details the rights, responsibilities, and ownership structure of the new entity formed as a result of the merger. 5. Joint Venture Agreement: While not strictly a merger agreement, a joint venture agreement represents a collaborative endeavor between two or more companies. It outlines the terms, contributions, and responsibilities of each party involved in the joint venture, enabling them to operate collectively while maintaining separate legal entities. Each type of Alameda California Merger Agreement is tailored to the specific needs and objectives of the companies involved, whether it be consolidating assets, combining ownership, or forming a new entity altogether. The agreements serve as a blueprint for the successful completion of the merger, ensuring a smooth transition and alignment of interests.

Alameda California Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Alameda California Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Alameda Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Alameda Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Alameda Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.:

- Make sure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Alameda Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!