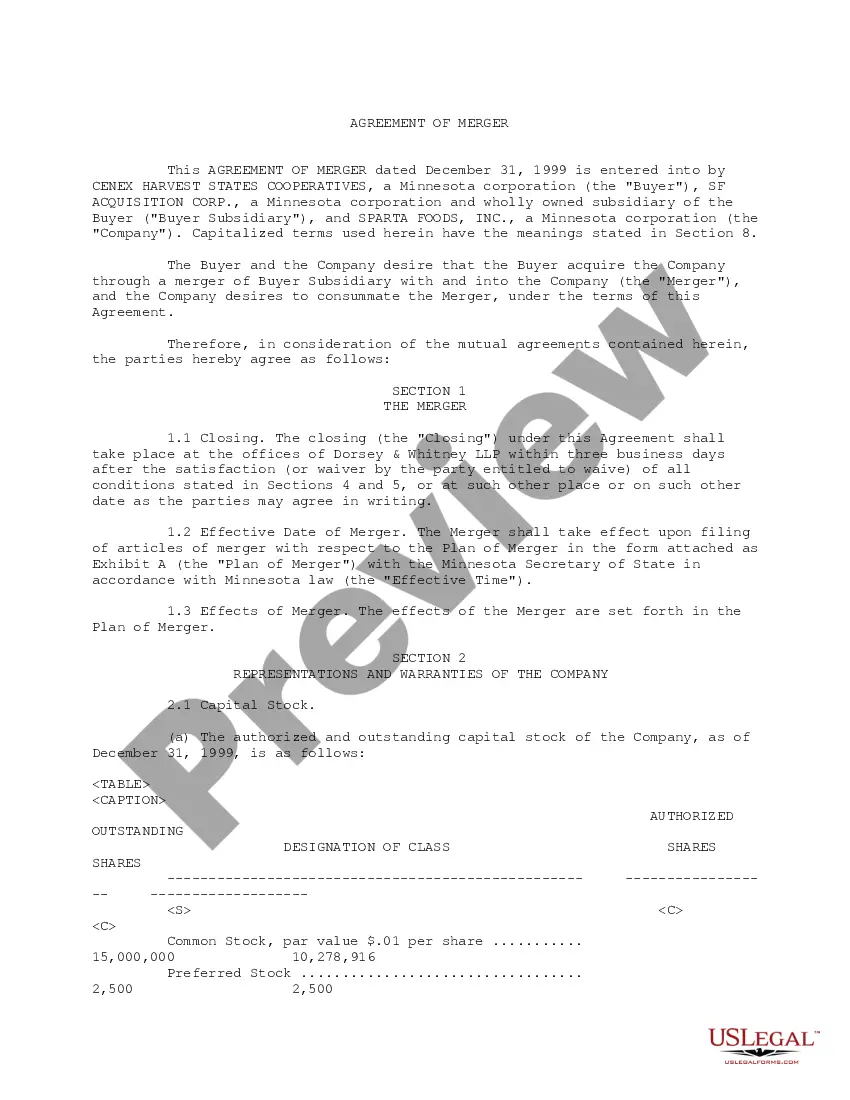

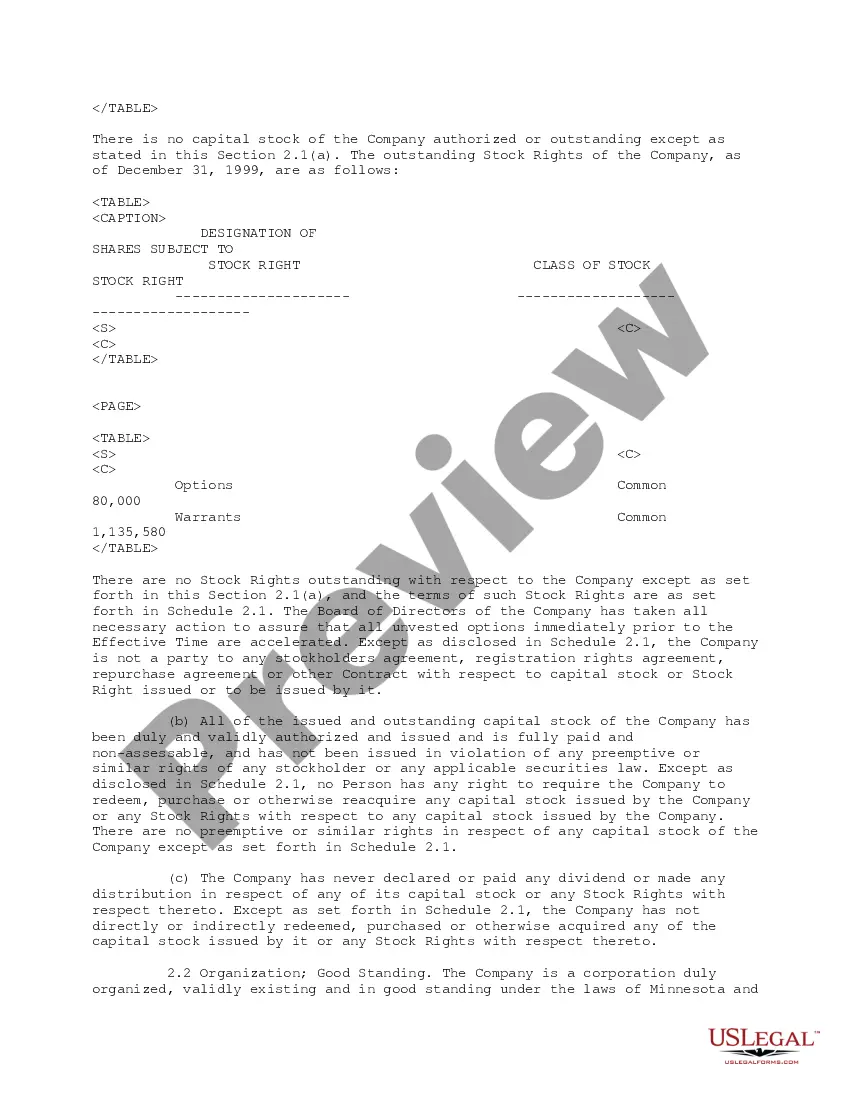

Franklin Ohio Merger Agreement refers to the contractual terms and conditions that outline the merger between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. This legal document details the various aspects of the merger and ensures that all parties involved have a clear understanding of their rights, responsibilities, and obligations. The Franklin Ohio Merger Agreement specifies the terms of the merger, including the exchange ratio of shares, the treatment of outstanding stock options, and any adjustments to be made to the purchase price. It also covers the allocation of assets and liabilities, governance and management changes, and any potential restrictions on the actions of the merged entity. Keywords: Franklin Ohio, Merger Agreement, CEDEX Harvest States Cooperative, SF Acquisition Corporation, Sparta Foods, Inc., merger, contractual terms, conditions, rights, responsibilities, obligations, exchange ratio, shares, outstanding stock options, purchase price, allocation of assets, allocation of liabilities, governance changes, management changes, restrictions, merged entity. Different types of Franklin Ohio Merger Agreement between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. can include: 1. Asset Merger Agreement: This type of agreement focuses on the transfer of specific assets from one company to another. It outlines the assets to be transferred, their valuation, and any associated terms and conditions. 2. Stock merger Agreement: In a stock merger, the shareholders of one company receive shares in the acquiring company in exchange for their existing shares. This agreement details the exchange ratio, stock valuation, and any conditions attached to the stock transfer. 3. Cash Merger Agreement: A cash merger involves one company acquiring another company by paying cash to the shareholders of the target company. This agreement specifies the cash consideration, payment terms, and other related financial aspects. 4. Statutory Merger Agreement: This type of agreement is required when two companies merge to form a new entity. It outlines the legal and procedural aspects of the merger, including the rights and obligations of the newly formed entity. Keywords: Asset Merger Agreement, Stock Merger Agreement, Cash Merger Agreement, Statutory Merger Agreement, transfer of assets, stock transfer, exchange ratio, stock valuation, cash consideration, payment terms, legal aspects, procedural aspects, newly formed entity.

Franklin Ohio Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Franklin Ohio Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Franklin Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Franklin Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Franklin Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.:

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

It is a co-owner (alongside Mitsui & Co.) of Ventura Foods, a vegetable oil processor. CHS Inc....CHS Inc. TypePrivate. Secondary agricultural cooperativeHeadquartersInver Grove Heights, Minnesota , United StatesKey peopleJay Debertin (CEO)RevenueUS$38.4 billion (2021)Operating incomeUS$515.3 million (2021)10 more rows

Cenex®, the energy brand of CHS, is dedicated to bringing energy solutions to market that will meet a broad range of needs. Its high-quality fuels, lubricants and propane fuel cars and buses, keep farm equipment and fleets running smoothly, and heat homes across the country.

On April 27, 2020, CHS announced that an affiliate of the company has signed a definitive agreement to sell its majority ownership interest in 842011bed St. Cloud Regional Medical Center and its associated healthcare operations in St. Cloud, Florida, to a subsidiary of Orlando Health.

Though CHS is a privately held agricultural cooperative, some of its preferred stock is publicly traded and it makes regular reports to the SEC. GAIN ACCESS TO EVERY LOCAL INSIGHT, LEAD AND MORE!

CHS is a diversified global agribusiness cooperative owned by farmers and local cooperatives across the United States.

CHS (formerly Cenex Harvest States Cooperatives) is a diversified energy, grains and foods company owned by farmers, ranchers, cooperatives and thousands of preferred stockholders. It owns both the Cenex and company-operated Zip Trip c-store brands....CHS Inc. Headquarters:Inver Grove Heights, Minn.Website: more rows

United in 1998 CENEX, Inc. and Harvest States Cooperatives merged in June 1998, forming Cenex Harvest States Cooperatives (CHS).

Cannabinoid hyperemesis syndrome (CHS): a condition of cyclic attacks of nausea and vomiting in people who are chronic users of cannabis.

For more than 80 years, Cenex® has been the energy brand of CHS. Today, Cenex provides communities across America with TOP TIER2122 gasoline and premium diesel fuels through its network of 1,450 retail locations in 19 states.