The Harris Texas Merger Agreement refers to a legal contract that outlines the terms and conditions for the merger between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. This agreement highlights the various aspects of the merger, such as the roles and responsibilities of each party, the exchange of stock or assets, and governance structure going forward. Keywords: Harris Texas Merger Agreement, CEDEX Harvest States Cooperative, SF Acquisition Corporation, Sparta Foods, Inc., merger, legal contract, terms and conditions, roles and responsibilities, exchange of stock or assets, governance structure. Different types of Harris Texas Merger Agreement between CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc., could include: 1. Stock-for-Stock Merger Agreement: This type of merger agreement involves the exchange of shares between the involved parties. In this scenario, shareholders of Sparta Foods, Inc., would receive CEDEX Harvest States Cooperative or SF Acquisition Corporation stock in exchange for their Sparta Foods shares. 2. Asset Acquisition Merger Agreement: This agreement involves the acquisition of specific assets of Sparta Foods, Inc., by CEDEX Harvest States Cooperative or SF Acquisition Corporation. The assets may include physical properties, equipment, intellectual property rights, or any other valuable resources and rights owned by Sparta Foods. 3. Cash-for-Stock Merger Agreement: In this arrangement, shareholders of Sparta Foods, Inc., would receive a fixed amount of cash per share in exchange for their stock. CEDEX Harvest States Cooperative or SF Acquisition Corporation would provide the cash consideration as per the agreed terms. 4. Joint Venture Merger Agreement: This type of merger agreement establishes a strategic alliance between the participating companies, CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. They may form a new entity or operate under a separate joint venture agreement, sharing resources, risks, and profits for a specific business objective. 5. Short Form Merger Agreement: This agreement may be utilized if one of the merging companies, typically CEDEX Harvest States Cooperative or SF Acquisition Corporation, already owns a significant portion of the outstanding stock of Sparta Foods, Inc. The agreement facilitates the absorption of Sparta Foods into the parent company without the need for a full shareholder vote.

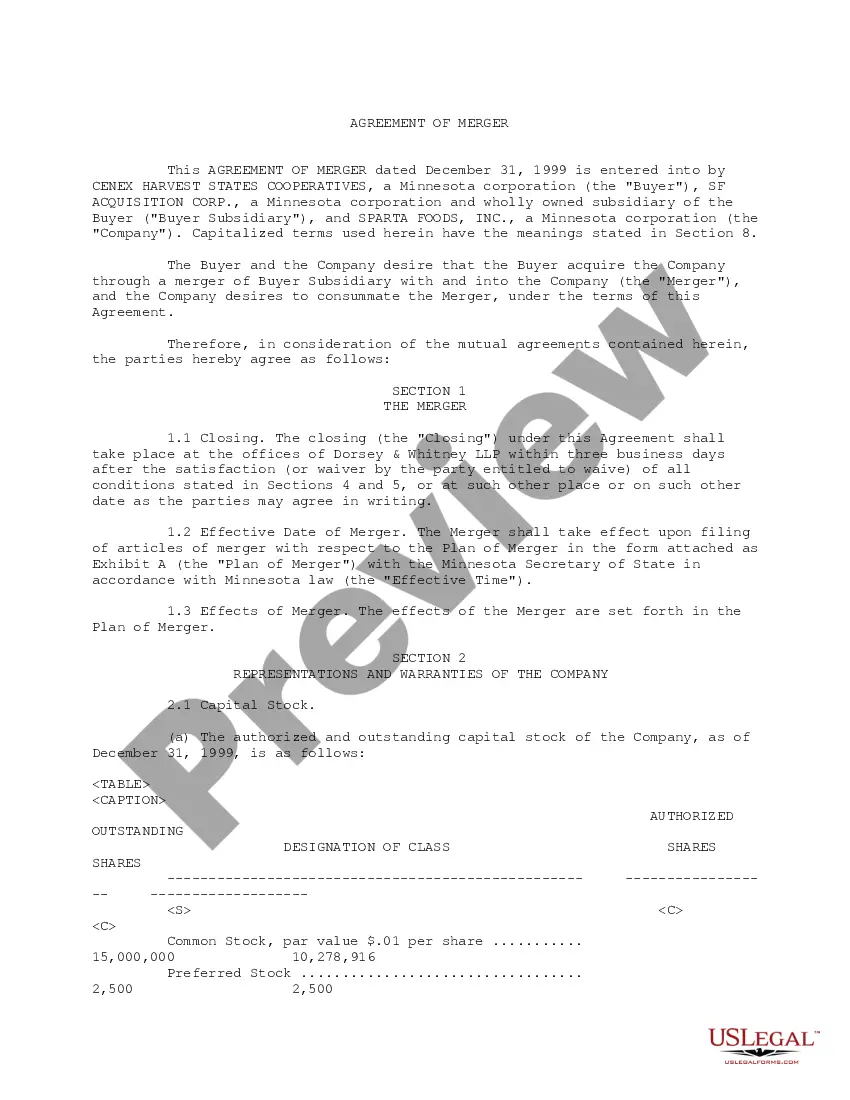

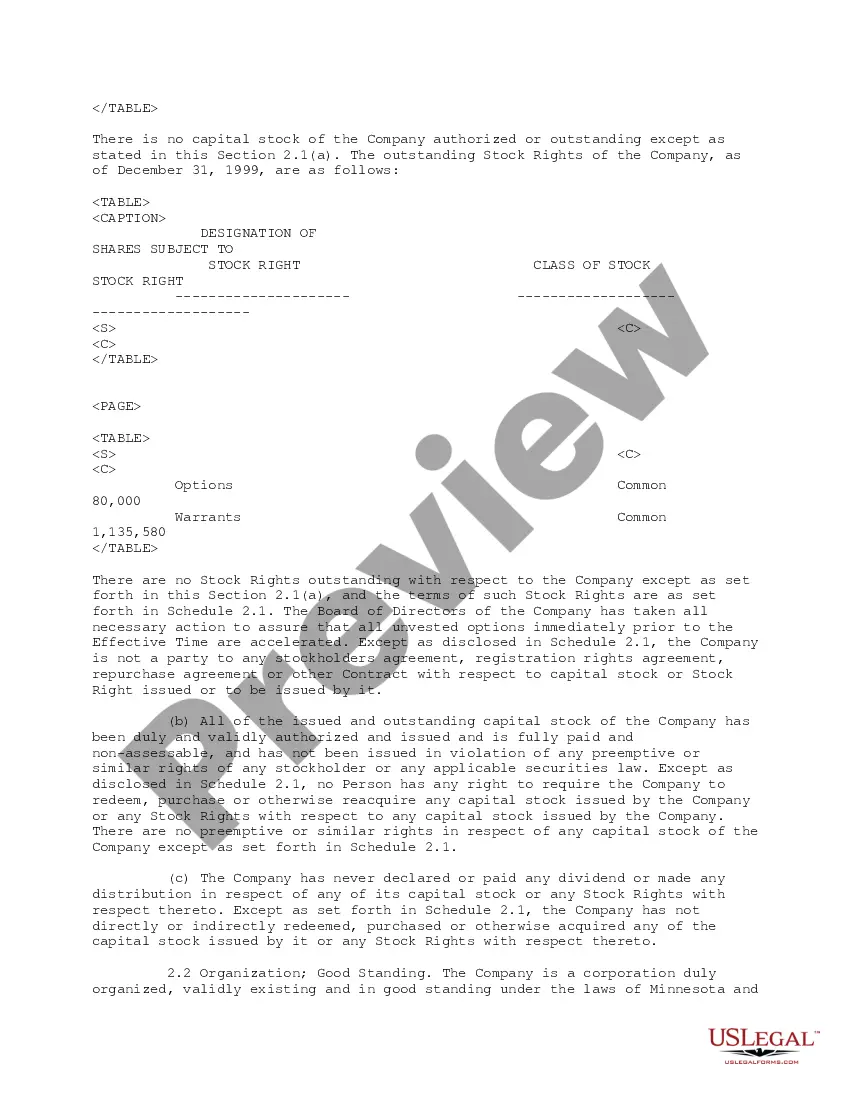

Harris Texas Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Harris Texas Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Draftwing forms, like Harris Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for various cases and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Harris Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Harris Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.:

- Make sure that your form is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Harris Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Cenex was formed in 1998 through a merger of Cenex Inc. and Harvest States Cooperatives. CHS, based in Inver Grove Heights, is a diversified agricultural foods company, owned by farmers, ranchers and cooperatives in 27 states in the western U.S.

CHS symptoms often subside within two days, although some effects persist for several weeks.

CHS is a cooperative, which means it's governed by the farmers and local cooperatives that own it. Our owners have elected 17 full-time farmers or ranchers to serve on the CHS Board of Directors, representing eight regions from across the country.

Cannabinoid hyperemesis syndrome (CHS) is a condition that leads to repeated and severe bouts of vomiting. It is rare and only occurs in daily long-term users of marijuana. Marijuana has several active substances. These include THC and related chemicals.

We have retail operations in more than 450 communities in 16 states serving more than 140,000 customers.

For more than 80 years, Cenex® has been the energy brand of CHS. Today, Cenex provides communities across America with TOP TIER? gasoline and premium diesel fuels through its network of 1,450 retail locations in 19 states.

CHS Inc. is a Fortune 500 secondary cooperative owned by United States agricultural cooperatives, farmers, ranchers, and thousands of preferred stock holders....CHS Inc. TypePrivate. Secondary agricultural cooperativeHeadquartersInver Grove Heights, Minnesota , United StatesKey peopleJay Debertin (CEO)12 more rows

What are the treatments for CHS? There is no cure for CHS. If your healthcare provider has diagnosed you with CHS, treatment will include medications to help manage your symptoms, but the only way to prevent future episodes of nausea and vomiting is to stop using cannabis.