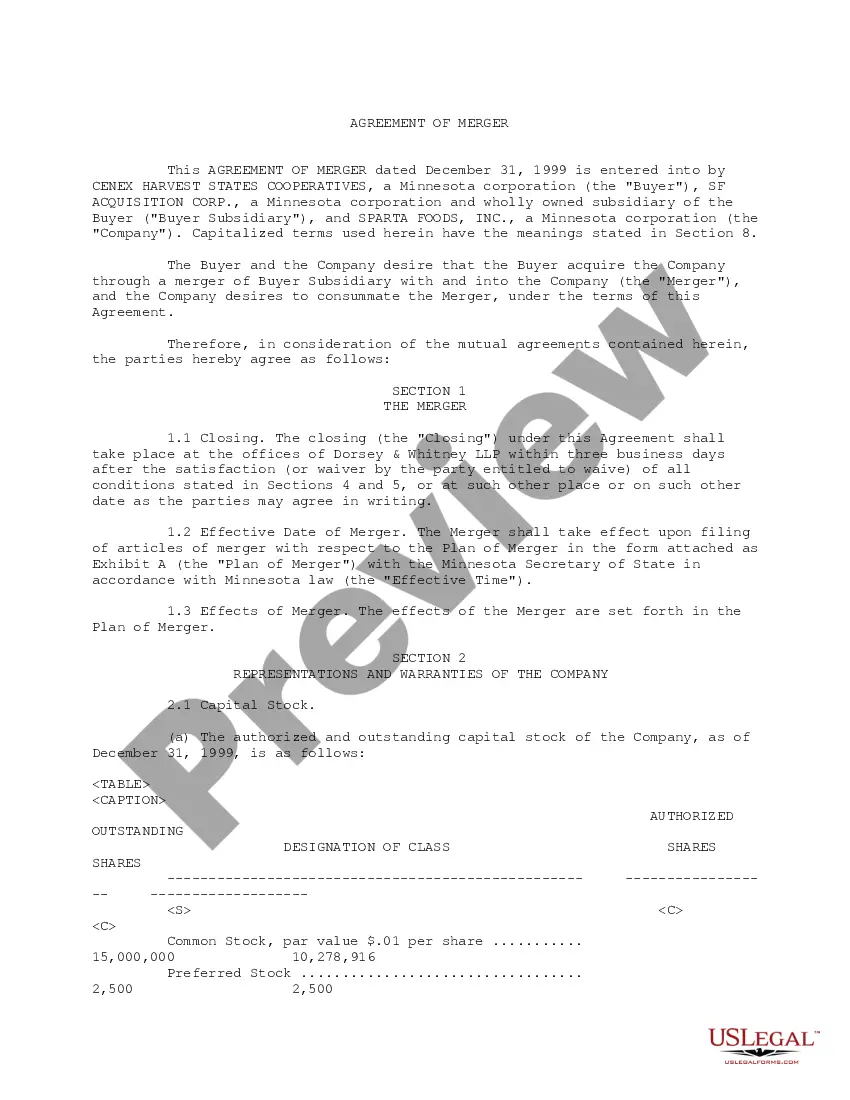

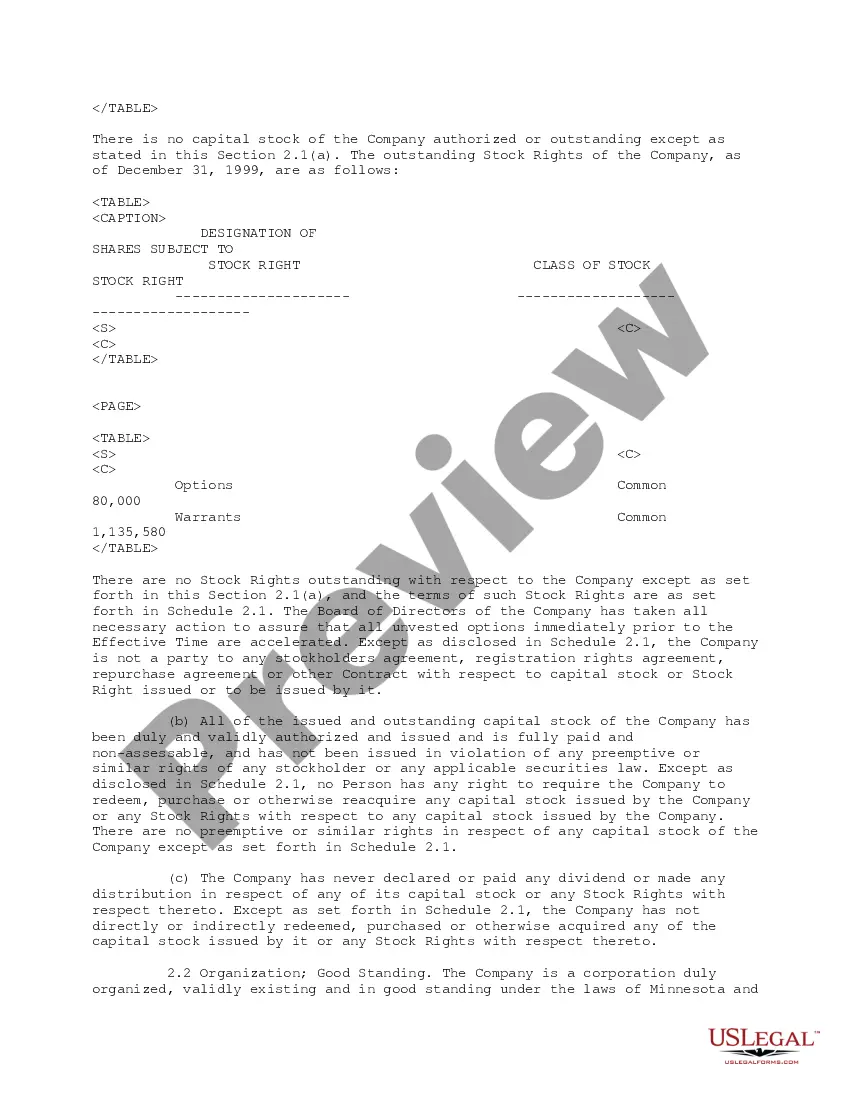

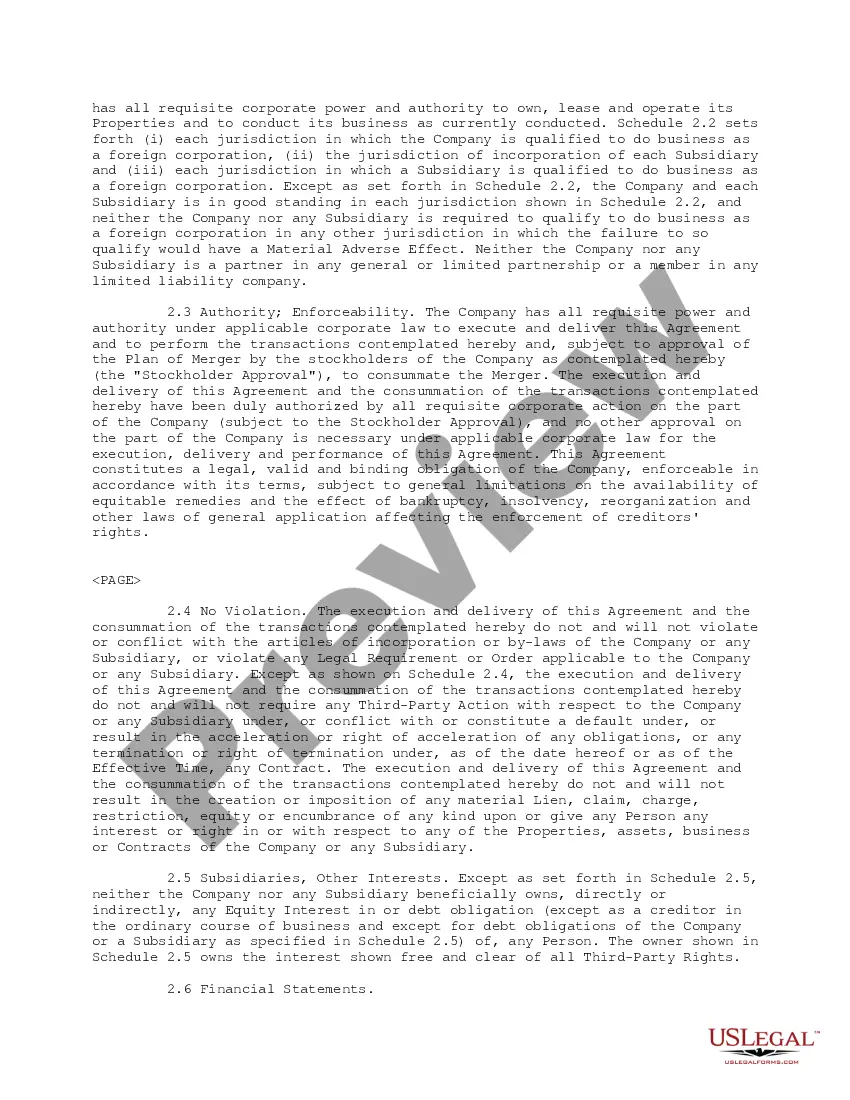

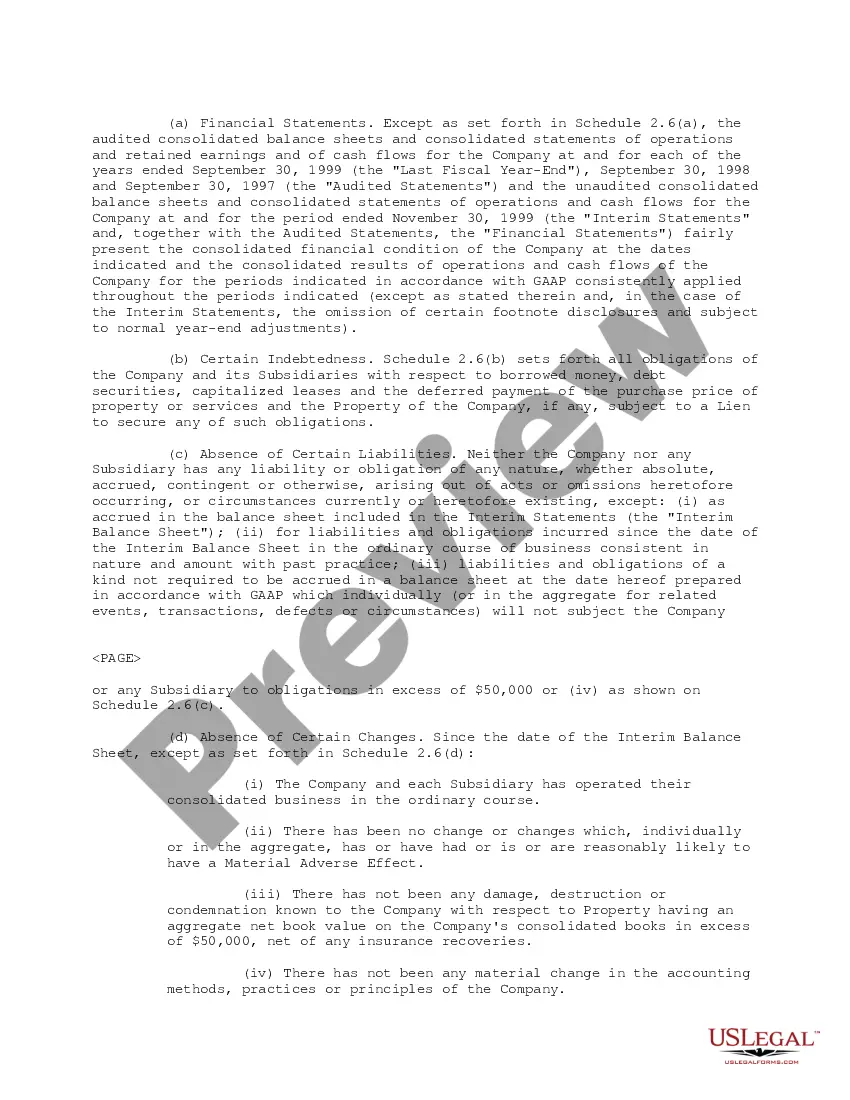

The Nassau New York Merger Agreement refers to a specific merger agreement that involves CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc. This agreement outlines the terms and conditions under which the merger will take place, bringing together the respective entities in a strategic business move. The merging parties, CEDEX Harvest States Cooperative, SF Acquisition Corporation, and Sparta Foods, Inc., have come together to finalize a comprehensive agreement that will provide a framework for the merger. This agreement aims to govern various aspects of the merger, including legal, financial, and operational matters. Keywords: Nassau New York, Merger Agreement, CEDEX Harvest States Cooperative, SF Acquisition Corporation, Sparta Foods, Inc., merger, terms and conditions, strategic, entities, business move, merging parties, comprehensive agreement, legal, financial, operational. Different types of Nassau New York Merger Agreements: 1. Asset Purchase Merger Agreement: This type of agreement focuses on the transfer and acquisition of assets between the merging parties. It outlines the specific assets, such as intellectual property, inventory, equipment, or real estate, that will be transferred as part of the merger. 2. Stock Purchase Merger Agreement: In this type of agreement, the acquiring party purchases the stocks or shares of the target company from its shareholders, thereby gaining control over the company's operations and assets. This agreement details the terms of the stock purchase and the rights and obligations of each party involved. 3. Merger of Equals Agreement: In cases where two companies of relatively equal size and influence merge, a merger of equals agreement is drawn up. This agreement ensures that both entities are treated fairly in terms of ownership, management, voting rights, and representation in the newly merged company. 4. Joint Venture Merger Agreement: Sometimes, two or more companies enter into a joint venture through a merger agreement. This type of agreement establishes the terms and conditions under which the joint venture will operate, including the sharing of profits, decision-making authority, and licensing of intellectual property. 5. Reverse Merger Agreement: In a reverse merger agreement, a privately held company acquires a publicly traded company, allowing the private company to go public without undergoing the traditional initial public offering (IPO) process. This agreement outlines the terms of the reverse merger and the resulting ownership structure of the merged entity.

Nassau New York Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Nassau New York Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Nassau Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Nassau Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

CHS (formerly Cenex Harvest States Cooperatives) is a diversified energy, grains and foods company owned by farmers, ranchers, cooperatives and thousands of preferred stockholders. It owns both the Cenex and company-operated Zip Trip c-store brands....CHS Inc. Headquarters:Inver Grove Heights, Minn.Website: more rows

It is a co-owner (alongside Mitsui & Co.) of Ventura Foods, a vegetable oil processor. CHS Inc....CHS Inc. TypePrivate. Secondary agricultural cooperativeHeadquartersInver Grove Heights, Minnesota , United StatesKey peopleJay Debertin (CEO)RevenueUS$38.4 billion (2021)Operating incomeUS$515.3 million (2021)10 more rows

United in 1998 CENEX, Inc. and Harvest States Cooperatives merged in June 1998, forming Cenex Harvest States Cooperatives (CHS).

On April 27, 2020, CHS announced that an affiliate of the company has signed a definitive agreement to sell its majority ownership interest in 842011bed St. Cloud Regional Medical Center and its associated healthcare operations in St. Cloud, Florida, to a subsidiary of Orlando Health.

For more than 80 years, Cenex® has been the energy brand of CHS. Today, Cenex provides communities across America with TOP TIER2122 gasoline and premium diesel fuels through its network of 1,450 retail locations in 19 states.

CHS is a diversified global agribusiness cooperative owned by farmers and local cooperatives across the United States.

Though CHS is a privately held agricultural cooperative, some of its preferred stock is publicly traded and it makes regular reports to the SEC. GAIN ACCESS TO EVERY LOCAL INSIGHT, LEAD AND MORE!

Cenex®, the energy brand of CHS, is dedicated to bringing energy solutions to market that will meet a broad range of needs. Its high-quality fuels, lubricants and propane fuel cars and buses, keep farm equipment and fleets running smoothly, and heat homes across the country.

Cannabinoid hyperemesis syndrome (CHS): a condition of cyclic attacks of nausea and vomiting in people who are chronic users of cannabis.