Travis Texas Bylaws of First American Insurance Portfolios, Inc.: The Travis Texas Bylaws of First American Insurance Portfolios, Inc. serve as a comprehensive set of rules and regulations that govern the operations and decision-making processes of the company. These bylaws ensure transparency, efficiency, and fair practices within the organization, further strengthening its commitment to providing top-notch insurance services. Here are some vital aspects covered in the Travis Texas Bylaws of First American Insurance Portfolios, Inc.: 1. Board of Directors: The bylaws outline the structure and responsibilities of the Board of Directors, including the number of members, election procedures, term lengths, and their fiduciary duties. This aspect ensures the company is led by capable individuals who will make informed decisions in the best interest of the organization and its stakeholders. 2. Shareholder Meetings: The bylaws also detail the procedures for conducting shareholder meetings, including the notice period requirements, quorum thresholds, voting procedures, and proxy regulations. These provisions foster transparency and inclusivity, allowing shareholders to actively participate in the decision-making process. 3. Committees and Officers: The bylaws identify different types of committees, such as audit committees or compensation committees, and outline their respective roles and responsibilities. It also defines the duties of officers such as the CEO, CFO, and Secretary, further establishing clear lines of authority and accountability within the company's hierarchical structure. 4. Amendment Procedures: The bylaws lay out the specific procedures for making amendments to the bylaws themselves, ensuring that any changes or modifications are made through a fair and transparent process. These provisions provide stability while allowing for flexibility in adapting to changing business environments. 5. Indemnification: Another crucial aspect covered in the bylaws is the indemnification of directors, officers, and employees. It outlines the procedures and conditions under which the company will provide legal protection and reimbursement for any legal actions taken against individuals acting within their roles. By naming the "Travis Texas Bylaws," it suggests that these bylaws are specific to a jurisdiction or area known as Travis, Texas, reinforcing local compliance requirements and regulations. In conclusion, the Travis Texas Bylaws of First American Insurance Portfolios, Inc. are a crucial document that ensures the proper governance and smooth functioning of the company. Compliance with these bylaws helps the organization maintain high standards of professionalism, transparency, and accountability, ultimately benefiting its shareholders, employees, and clients alike.

Travis Texas Bylaws of First American Insurance Portfolios, Inc.

Description

How to fill out Travis Texas Bylaws Of First American Insurance Portfolios, Inc.?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Travis Bylaws of First American Insurance Portfolios, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Travis Bylaws of First American Insurance Portfolios, Inc. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Travis Bylaws of First American Insurance Portfolios, Inc.:

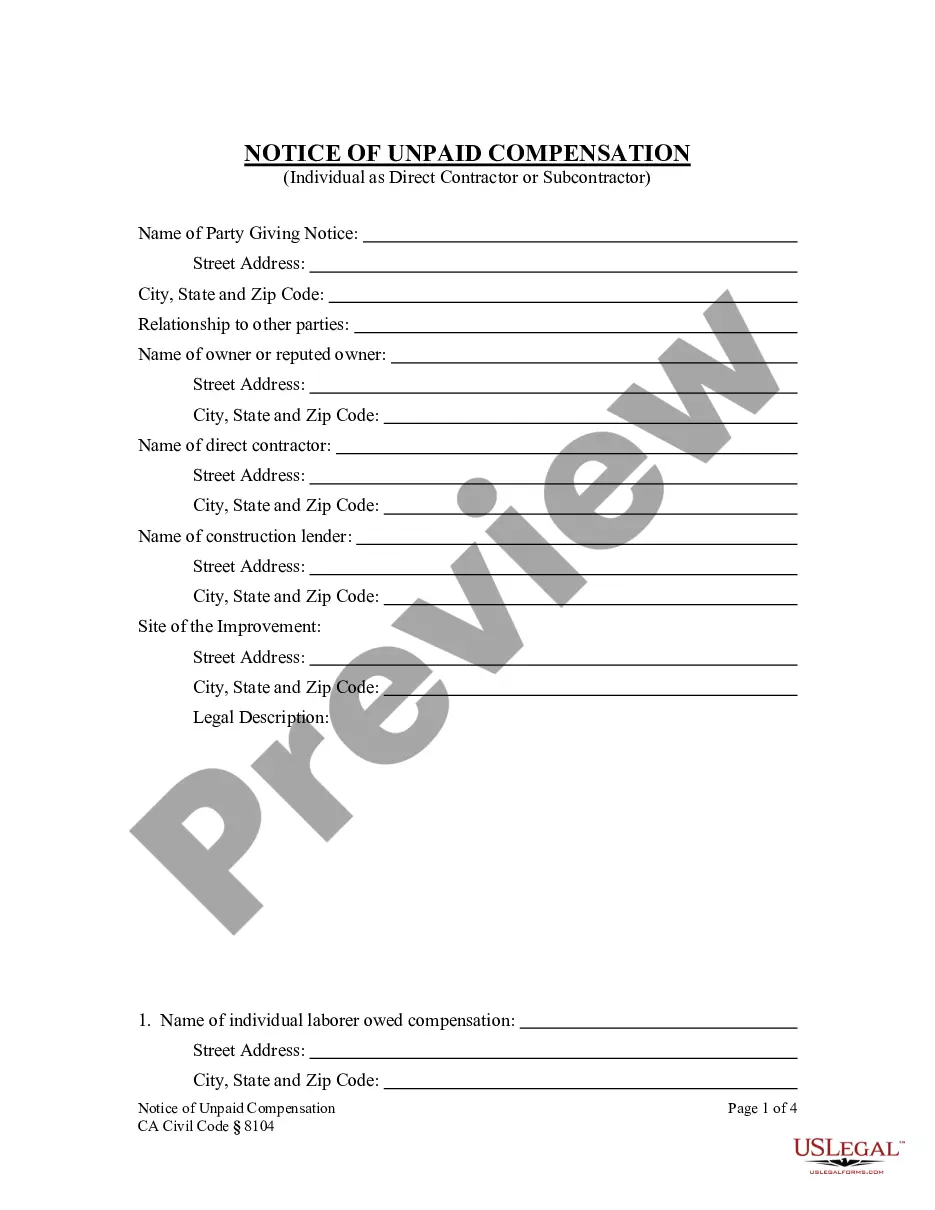

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

In Southern California, the seller customarily pays the premium for title insurance. It has been the practice in Northern California that the buyer customarily pays the premium for title insurance, or occasionally the premium is split between buyer and seller.

RANK50. The Santa Ana, Calif., company specializing in title insurance for homebuyers and businesses jumped 43 spots on the list this year.

The Top 10 1Walmart. 2Amazon. 3Apple. 4CVS Health. 5UnitedHealth Group. 6Exxon Mobil. 7Berkshire Hathaway. 8Alphabet.

First American Financial 2022 Fortune 500 Fortune.

An owner's title insurance policy is not required in California. But it could offer you valuable legal protection at a relatively affordable price.

Stock and Trading information. First American Financial Corporation shares are traded on the New York Stock Exchange (NYSE) under the ticker symbol FAF.

In Florida, the seller customarily pays for title insurance. However, in some counties, including Collier County, Sarasota County, Broward County, and Miami-Dade County, the buyer typically pays. Again, this is not a rule ? buyers can always try to negotiate.

The term Fortune 500 refers to a list of 500 of the largest companies in the United States compiled by Fortune magazine every year. Companies are ranked by their annual revenues for their respective fiscal years. This list includes both public and private companies using publicly available revenue data.

The title insurance premium may actually amount to less than one percent of the purchase price of the home, and less than ten percent of the total closing costs. The buyer's title policy is good for as long as you and your heirs own the property with the payment of only one premium.

First American Trust has provided wealth management services for more than four decades, with $4 billion currently under management and administration.