The Franklin Ohio Investment Advisory Agreement is a comprehensive contract between First American Insurance Portfolios, Inc. and U.S. Bank National Association. This agreement outlines the terms and conditions under which investment advisory services are provided by First American Insurance Portfolios, Inc. to U.S. Bank National Association. The agreement serves as a legally binding document that clarifies the responsibilities and obligations of both parties involved in the investment advisory relationship. It ensures a clear understanding of the services provided, the fees involved, and the limitations of liability. Key provisions in the Franklin Ohio Investment Advisory Agreement may include: 1. Scope of Services: This section defines the specific investment advisory services that First American Insurance Portfolios, Inc. will provide to U.S. Bank National Association. It may include portfolio management, investment research, asset allocation recommendations, and other related services. 2. Duties and Responsibilities: This outlines the duties and responsibilities of both parties. It may detail U.S. Bank National Association's obligation to provide necessary information, documents, and access to relevant accounts or assets. It also covers First American Insurance Portfolios, Inc.'s responsibilities to act in the best interest of U.S. Bank National Association and exercise due care and diligence. 3. Compensation: The agreement will outline the fees and compensation structure for the investment advisory services. It may specify whether the fees are based on a percentage of assets under management, a fixed fee, or a combination of both. It may also detail any additional expenses that U.S. Bank National Association may incur, such as custodial fees or transaction costs. 4. Termination: This section describes the conditions under which either party can terminate the agreement. It may outline notice periods, termination fees (if any), and procedures for transferring or liquidating assets upon termination. 5. Confidentiality and Privacy: The agreement will address the confidentiality and privacy obligations of both parties, ensuring the protection of sensitive information and compliance with relevant laws and regulations. Different types of Franklin Ohio Investment Advisory Agreements between First American Insurance Portfolios, Inc. and U.S. Bank National Association may include variations in the scope of services provided or specific terms based on the needs and goals of U.S. Bank National Association. These variations may arise when structuring different investment strategies, offering specialized advisory services, or catering to specific asset classes or investment vehicles. However, the core provisions related to duties, responsibilities, compensation, termination, and confidentiality are likely to remain consistent across these different types of agreements.

Franklin Ohio Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

How to fill out Franklin Ohio Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Franklin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc., you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Franklin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Franklin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.:

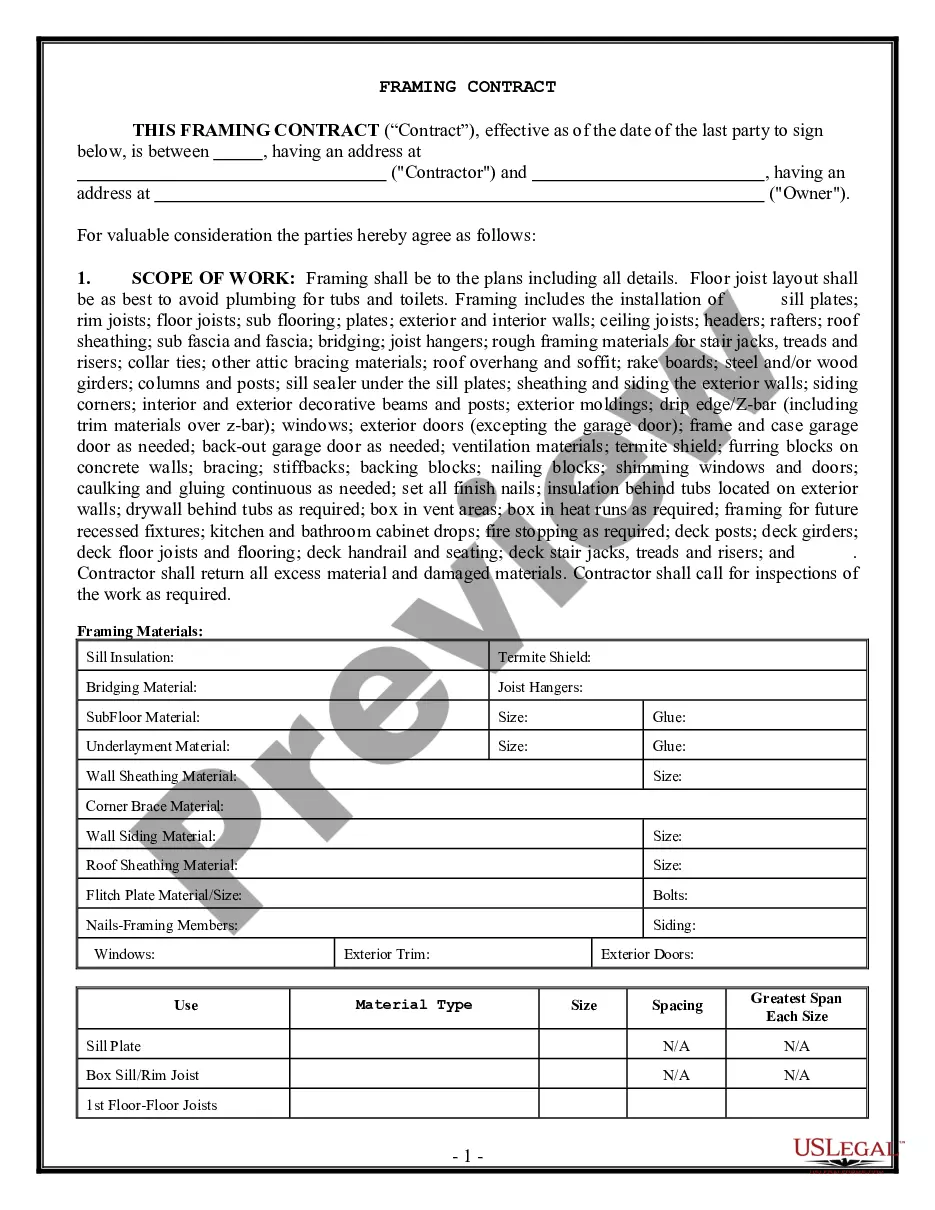

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!