The Hennepin Minnesota Investment Advisory Agreement is a legally binding document between First American Insurance Portfolios, Inc. and U.S. Bank National Association. This agreement outlines the terms and conditions for the provision of investment advisory services by U.S. Bank National Association to First American Insurance Portfolios, Inc. in Hennepin County, Minnesota. The agreement delineates the roles and responsibilities of both parties involved in the investment advisory relationship. First American Insurance Portfolios, Inc. serves as the client or investor seeking professional advice and guidance for their investment portfolio. U.S. Bank National Association acts as the investment advisor, providing expertise and recommendations tailored to the specific needs and objectives of First American Insurance Portfolios, Inc. Keywords: Hennepin Minnesota Investment Advisory Agreement, First American Insurance Portfolios, Inc., U.S. Bank National Association, investment advisory services, terms and conditions, investment advisory relationship, investment portfolio, advice and guidance, investment advisor, expertise, recommendations, needs and objectives. Different types of Hennepin Minnesota Investment Advisory Agreements between First American Insurance Portfolios, Inc. and U.S. Bank National Association may include variations in the scope of services, fees, and duration. Some examples of distinct types could be: 1. Hennepin Minnesota Investment Advisory Agreement with Fixed Fee Structure: This agreement establishes a fixed fee structure for the investment advisory services provided by U.S. Bank National Association. It outlines the specific services included within the agreed-upon fee and any additional charges for supplementary services. 2. Hennepin Minnesota Investment Advisory Agreement with Performance-Based Fees: In this type of agreement, the fees payable by First American Insurance Portfolios, Inc. to U.S. Bank National Association are based on the performance of the investment portfolio. The agreement would define the metrics and benchmarks used to calculate the fees, ensuring alignment of interests between the investment advisor and the client. 3. Hennepin Minnesota Investment Advisory Agreement with Limited Scope: This agreement establishes a limited scope of services wherein U.S. Bank National Association provides advisory services for specific investment strategies, sectors, or asset classes designated by First American Insurance Portfolios, Inc. The agreement would outline the specific areas of focus, making it ideal for clients who wish to retain control over certain aspects of their investment portfolio. 4. Hennepin Minnesota Investment Advisory Agreement with Term: A term-based agreement specifies a contractual period for which the investment advisory services will be provided. It outlines the start and end dates of the agreement, ensuring clarity regarding the duration of the engagement between First American Insurance Portfolios, Inc. and U.S. Bank National Association.

Hennepin Minnesota Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

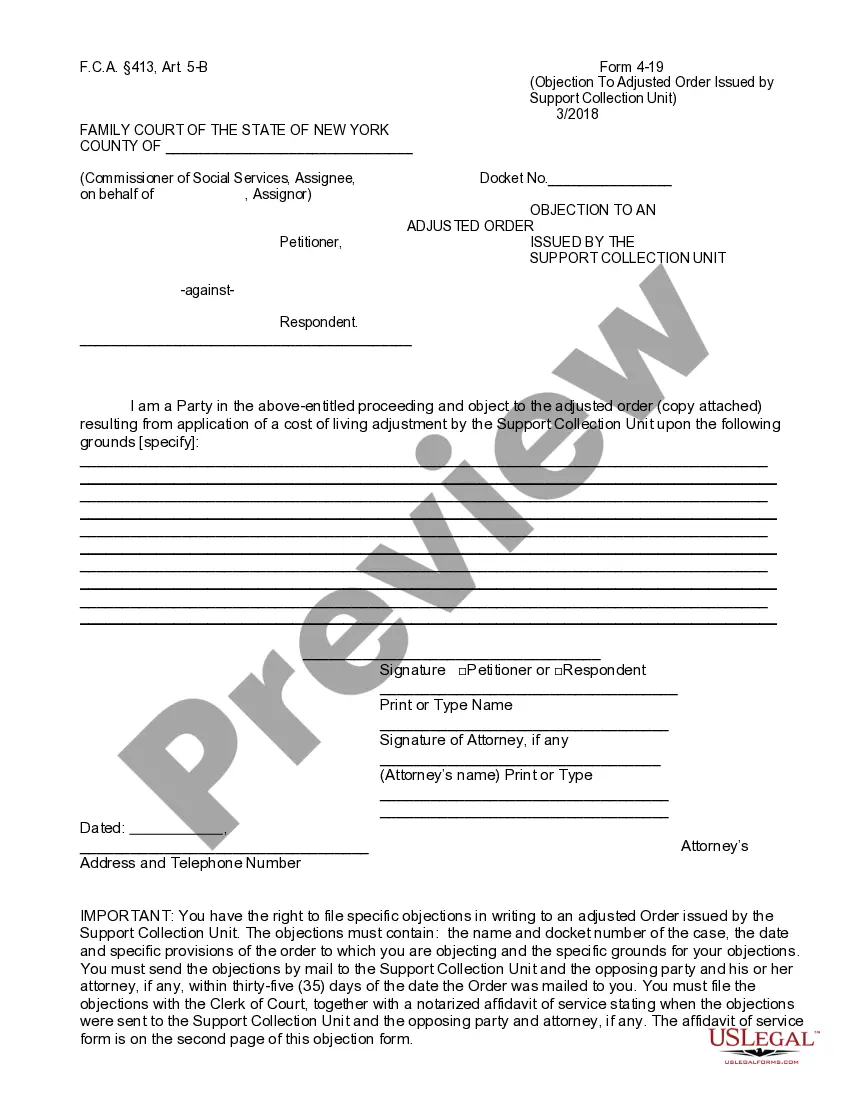

How to fill out Hennepin Minnesota Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Hennepin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc., it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the current version of the Hennepin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc., you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Hennepin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!