Wayne Michigan Compensation Agreement refers to a legally binding document governing the terms and conditions of compensation between employers and employees in Wayne, Michigan. This agreement outlines the various types of compensations, benefits, and reimbursement methods that employers provide to their employees. Keywords: Wayne Michigan, Compensation Agreement, employers, employees, terms and conditions, compensations, benefits, reimbursement methods. There are several types of Wayne Michigan Compensation Agreements: 1. Salary and Wages: This agreement outlines the base salary or wages offered to employees for their services. It includes details such as the payment frequency (e.g., weekly, bi-weekly, or monthly) and any provisions for overtime pay, shift differentials, or other additional forms of compensation. 2. Bonus and Incentive Programs: Some employers may offer bonus programs, profit-sharing, or commission-based incentives to motivate employees. A Wayne Michigan Compensation Agreement can stipulate the eligibility criteria, calculation methods, and payment schedules for these additional forms of compensation. 3. Benefits and Perks: This agreement also covers various benefits and perks offered to employees, such as health insurance, retirement plans, paid time off (vacation, sick leave, holidays), flexible work arrangements, and educational assistance. 4. Stock Options and Equity: In certain cases, employers may provide stock options or equity grants to employees as part of their compensation package. The Wayne Michigan Compensation Agreement spells out the terms, conditions, and vesting schedules related to these stock-based compensations. 5. Expense Reimbursement: Some jobs require employees to incur expenses related to their work. The agreement may include provisions for reimbursement of business-related expenses, such as travel, meals, lodging, and equipment purchases. It would detail the submission process, approved expenses, and reimbursement timelines. 6. Termination and Severance: Wayne Michigan Compensation Agreements also address the terms and conditions regarding termination and severance pay. This may include clauses related to notice periods, conditions for termination (e.g., misconduct, redundancy), severance package details, and any non-compete/confidentiality agreements. Overall, the Wayne Michigan Compensation Agreement aims to create a transparent and mutually beneficial agreement between employers and employees in terms of compensation and benefits. It protects the rights and interests of both parties while setting clear expectations and guidelines related to compensation matters.

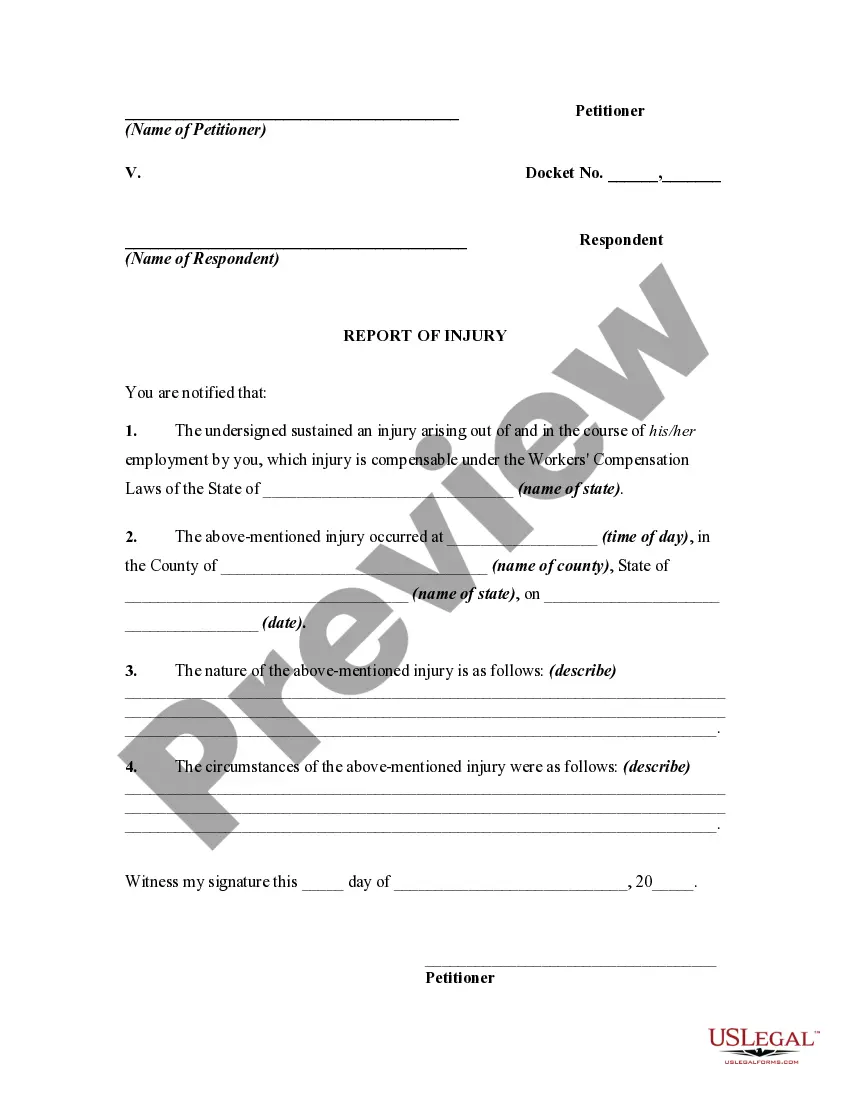

Wayne Michigan Compensation Agreement

Description

How to fill out Wayne Michigan Compensation Agreement?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Wayne Compensation Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with document completion simple.

Here's how to purchase and download Wayne Compensation Agreement.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related forms or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Wayne Compensation Agreement.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Wayne Compensation Agreement, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to cope with an extremely complicated situation, we advise getting an attorney to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!