The Dallas Texas Administration Agreement is a contractual document that outlines the terms and conditions of the administrative services provided by First American Insurance Portfolios, Inc. (FAIR) to U.S. Bank National Association (US BNA) in Dallas, Texas. This agreement sets forth the responsibilities, rights, and obligations of both parties involved in the administration of insurance portfolios. The main objective of the Dallas Texas Administration Agreement is to establish a seamless and efficient administration process for insurance portfolios managed by US BNA and underwritten by FAIR. The agreement encompasses various administrative services, such as policy management, claims administration, premium collection, data reporting, and customer service. By utilizing FAIR's expertise and resources, US BNA aims to optimize the administration of its insurance portfolios and enhance customer experience. Some of the key components that may be covered in different types of Dallas Texas Administration Agreements between FAIR and US BNA include: 1. Policy Management: This entails the effective management of insurance policies, including policy issuance, policyholder updates, endorsements, and cancellations. FAIR ensures accurate policy administration and maintains up-to-date records throughout the policy lifecycle. 2. Claims Administration: FAIR handles the efficient processing and settlement of insurance claims on behalf of US BNA. This involves verifying claims, assessing coverage, coordinating with adjusters and service providers, and disbursing claim payments promptly. 3. Premium Collection: FAIR takes responsibility for premium collection from policyholders, ensuring timely and accurate billing, addressing inquiries related to premiums, and overseeing the reconciliation of premium transactions. 4. Data Reporting: FAIR provides comprehensive reporting services to US BNA, including regular updates on policy data, premium collections, claims status, and key performance indicators. This enables US BNA to monitor and evaluate the performance of its insurance portfolios. 5. Customer Service: FAIR acts as a dedicated point of contact for policyholders, responding to inquiries, providing assistance, and offering high-quality customer service. They handle diverse customer requests, such as policy inquiries, claims guidance, and premium payment support. The Dallas Texas Administration Agreement between FAIR and US BNA is tailored to meet the specific needs and requirements of both parties involved. It serves as a foundation for a collaborative partnership that aims to streamline insurance administration processes, enhance operational efficiency, and ultimately deliver optimal outcomes for policyholders.

Dallas Texas Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association

Description

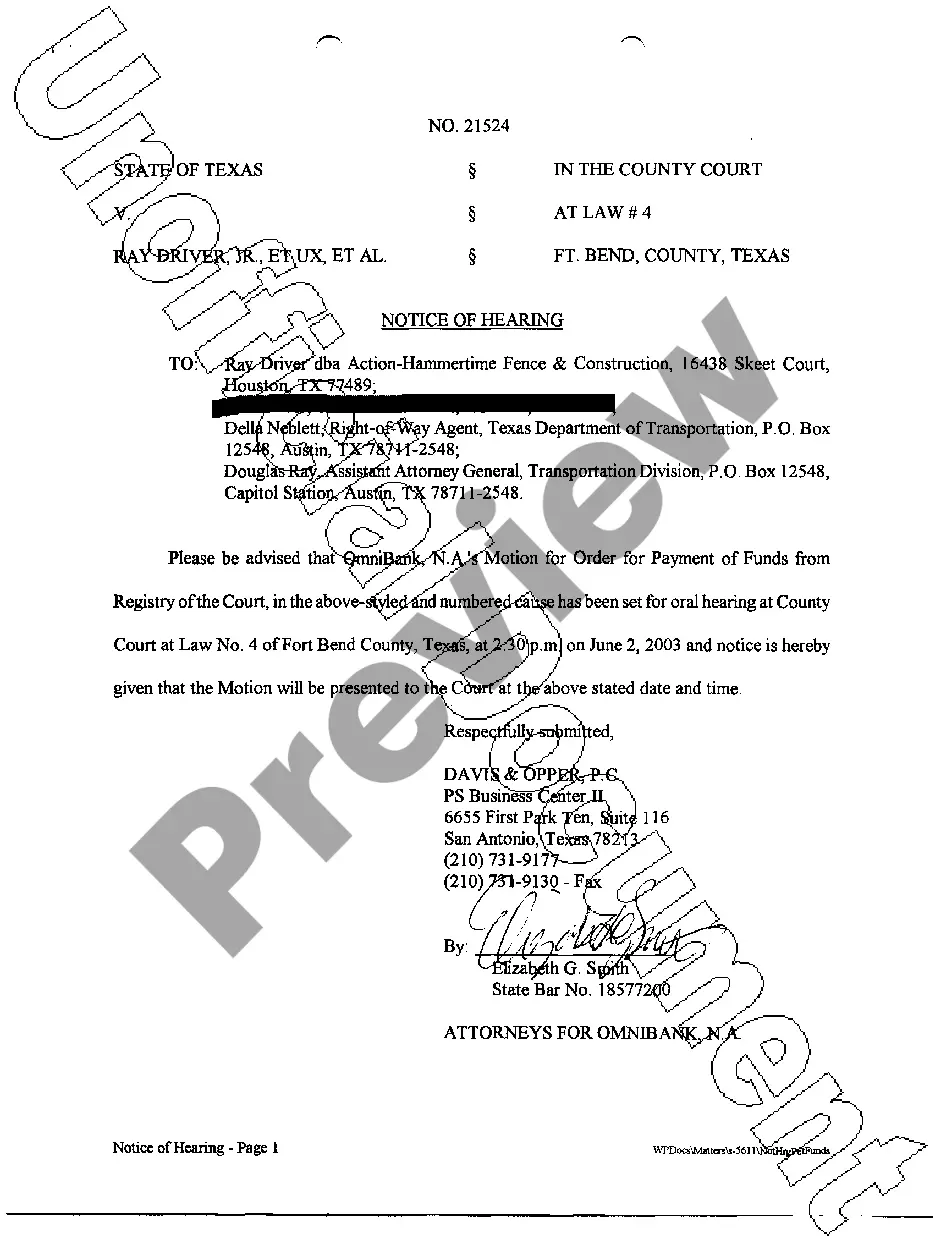

How to fill out Dallas Texas Administration Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Association?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Dallas Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Dallas Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Dallas Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association:

- Ensure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Dallas Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

2022 Rank2021 RankFirm11Morgan Stanley Private Wealth Management22Morgan Stanley Private Wealth Management34Morgan Stanley Private Wealth Management48Merrill Private Wealth Management63 more rows

Business Owners Advisory Services are not fiduciary in nature, and U.S. Bank and U.S. Bancorp Investments serves in a non-fiduciary role when providing these services. Business Owners Advisory Services are not legal or tax advice.

A trust is a contract that gives an individual or an institution?like U.S. Bank, for example?the authority to hold legal title to assets while managing them for the benefit of others. Trusts can help you ensure that your assets are distributed and managed according to your wishes.

It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States....U.S. Bancorp. Corporate headquarters, U.S. Bancorp Center, in MinneapolisIndustryBanking Financial servicesFoundedJuly 13, 186319 more rows

Top 10 Owners of US Bancorp StockholderStakeShares ownedBerkshire Hathaway, Inc. (Investm...8.06%119,805,135The Vanguard Group, Inc.7.27%108,030,789BlackRock Fund Advisors4.68%69,553,002SSgA Funds Management, Inc.3.95%58,688,0346 more rows

Why choose U.S. Bank Investment Services? We're more than partners. We take the time to get to know you.

U.S. Bancorp (?U.S. Bancorp? or the ?Company?) is a multi-state financial services holding company headquartered in Minneapolis, Minnesota. U.S. Bancorp was incorporated in Delaware in 1929 and operates as a financial holding company and a bank holding company under the Bank Holding Company Act of 1956.

U.S. Bancorp (stylized as us bancorp) is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States.

Overall, the Automated Investor offering from U.S. Bank is a solid robo. Clients can expect all of the classic offerings of a robo-advisor: asset allocation that is automatically rebalanced as needed, potential tax advantages through tax-loss harvesting, and a variety of ETFs.

Private banking provides investment-related advice and aims to address the entire financial circumstances of each client. Wealth management generally involves advice and execution of investments on behalf of affluent clients.