The Maricopa Arizona Administration Agreement is a legally binding contract between First American Insurance Portfolios, Inc. and U.S. Bank National Association. This agreement outlines the terms and conditions for the administration of various financial services in the Maricopa Arizona area. It ensures efficient and effective management of financial assets, compliance with regulations, and the provision of quality services to customers. First American Insurance Portfolios, Inc. (FAIR) is an established insurance provider, offering a range of insurance products and services. U.S. Bank National Association is a reputable banking institution known for its expertise in financial management and administration. Together, they enter into the Maricopa Arizona Administration Agreement to collaborate and provide comprehensive financial solutions to individuals, businesses, and organizations within Maricopa, Arizona. The administration agreement encompasses various types of services, each tailored to meet specific financial needs in the region. These services may include: 1. Insurance Administration: This type of agreement outlines the responsibilities and authorities regarding the administration of insurance policies offered by FAIR. It ensures smooth processing of policy applications, timely claims resolution, and effective risk assessment. 2. Investment Administration: This agreement focuses on the management and administration of investment portfolios. U.S. Bank National Association may handle investment transactions, portfolio monitoring, and reporting, ensuring compliance with legal and regulatory requirements. 3. Trust Administration: Trust services may be covered by a separate administration agreement. Such an agreement specifies the roles and responsibilities of both parties in managing and administering various types of trusts, such as estate planning, charitable trusts, and special needs trusts. 4. Retirement Plan Administration: In cases where FAIR offers retirement plans, a separate administration agreement may outline the responsibilities of U.S. Bank National Association in managing retirement accounts, processing distributions, and ensuring compliance with applicable laws and regulations. The Maricopa Arizona Administration Agreement establishes a framework for collaboration, outlining the roles, rights, and obligations of both parties. It ensures efficient and effective administration of financial services, enhancing the overall customer experience. By leveraging the expertise and resources of both organizations, FAIR and U.S. Bank National Association aim to provide comprehensive financial solutions and support the growth and prosperity of the Maricopa Arizona community.

Maricopa Arizona Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association

Description

How to fill out Maricopa Arizona Administration Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Association?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Maricopa Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association:

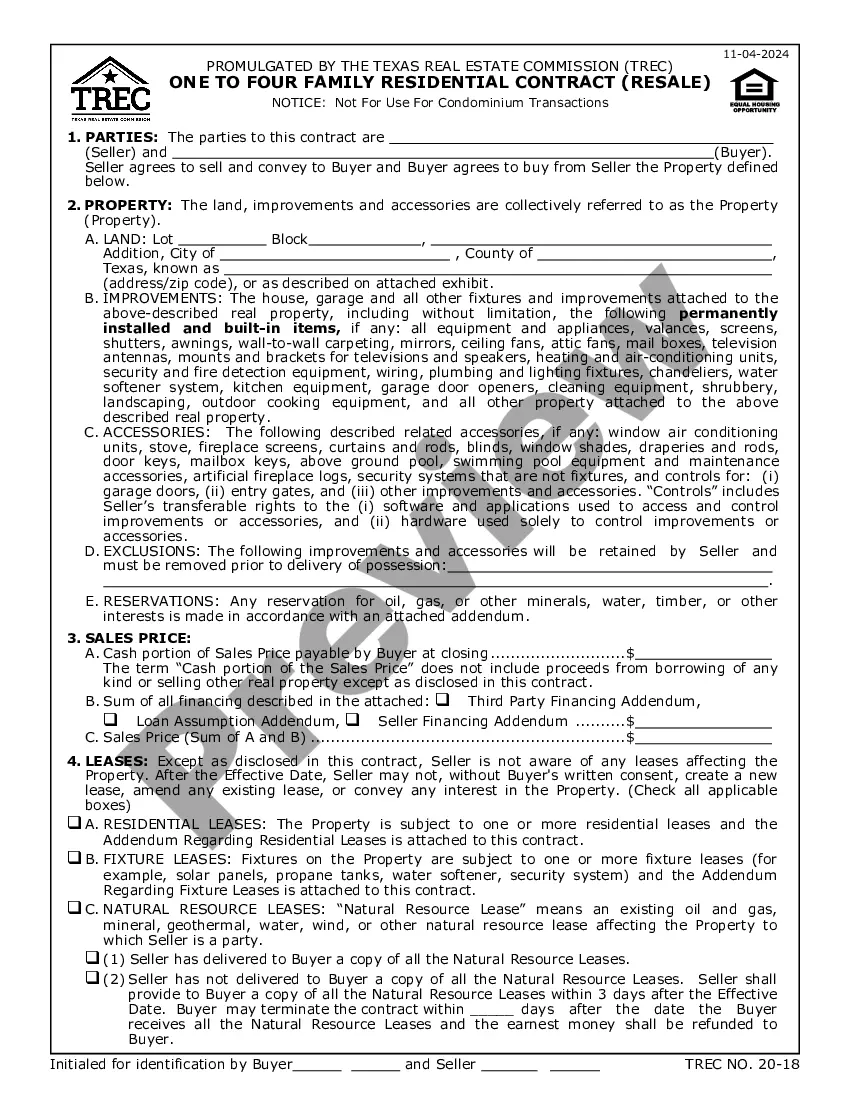

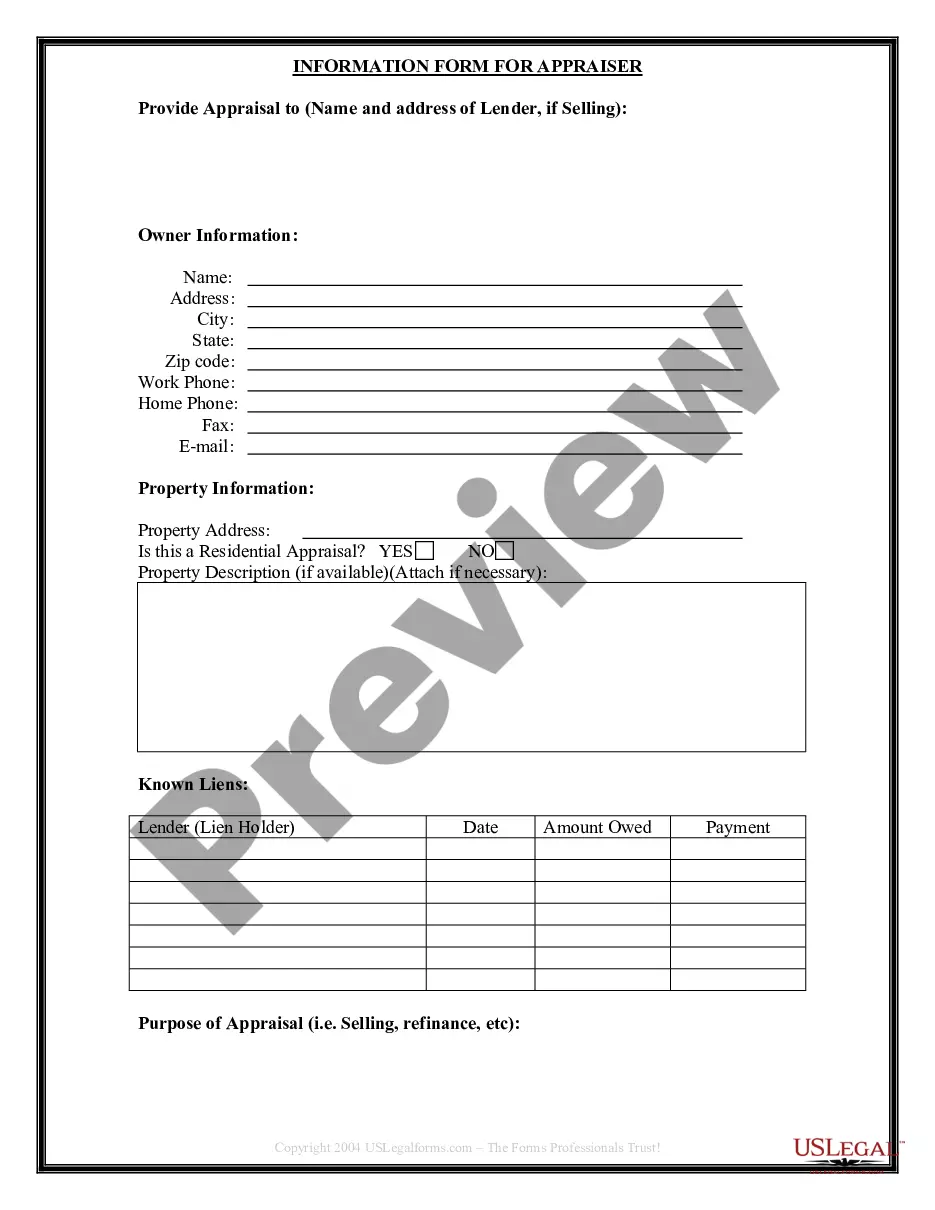

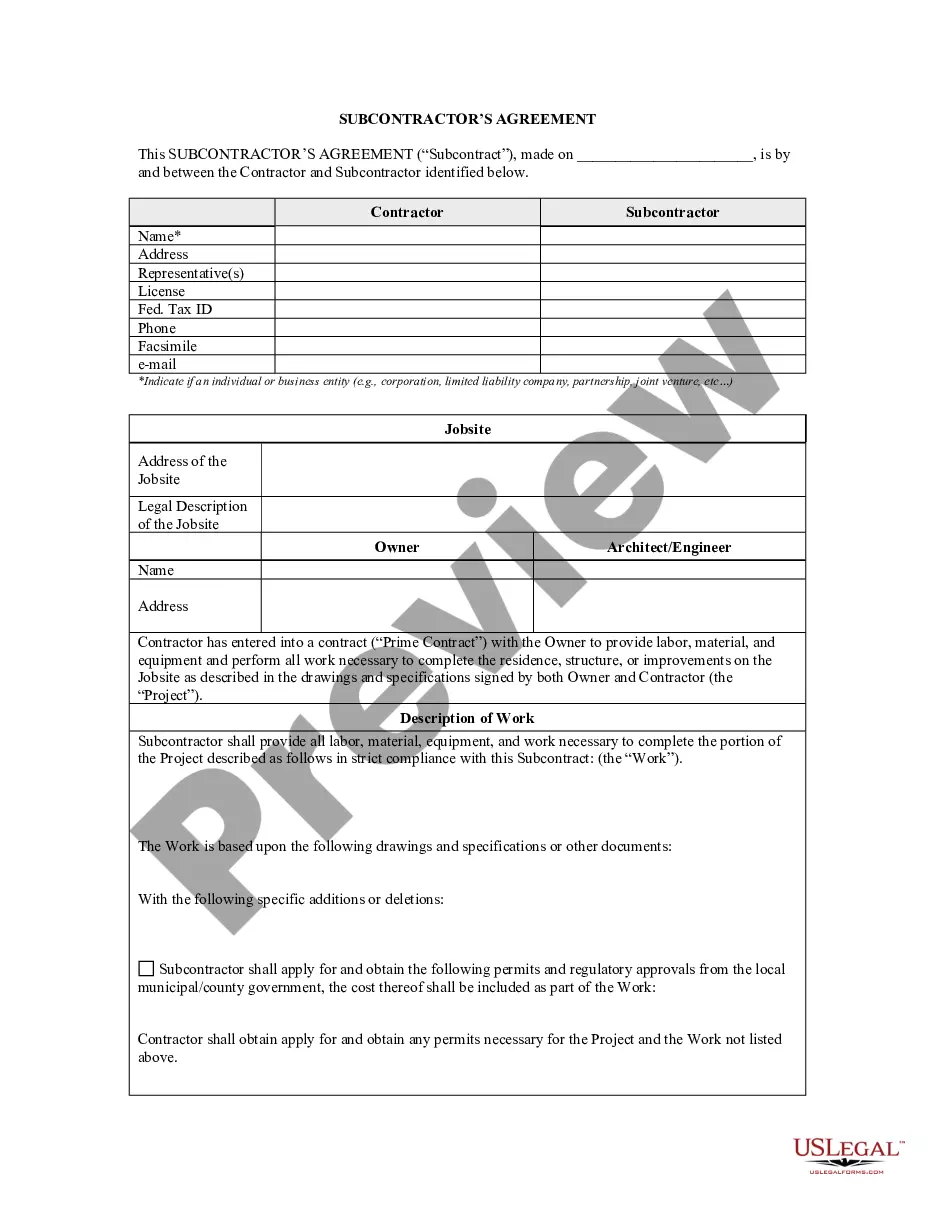

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!