Oakland Michigan Plan of Merger: The Oakland Michigan Plan of Merger refers to a specific merger agreement between Micro Component Technology, Inc. (MCT), MCT Acquisition, Inc., and ASECB Corporation. This plan outlines the details and terms of the merger between these entities, aiming to combine their resources, expertise, and market presence. Keywords: — Oakland Michigan: This refers to the location where the plan of merger is taking place, indicating that it is specific to the state of Michigan, United States. — Plan of Merger: This highlights the main focus of the document, outlining the strategic plan that will guide the merger process between the involved companies. — Micro Component Technology, Inc.: This is the name of one of the merging entities, highlighting the specific organization that will be part of the merger. — MCT Acquisition, Inc.: Another merging party, this company is acquiring Micro Component Technology, Inc., indicating a change in ownership and control. ASECBco Corporation: The third merging entity, ASECB Corporation is entering into the merger agreement, signifying their intention to combine forces with the other organizations. Different Types of Oakland Michigan Plan of Merger: While there may not be different types of the Oakland Michigan Plan of Merger specifically, it is essential to note that there can be various merger structures and types. Some common types of mergers include: 1. Horizontal Merger: In this type, two companies operating in the same industry and at the same level of the value chain merge their operations to enhance market share, reduce competition, and achieve economies of scale. 2. Vertical Merger: This merger occurs between companies in the same industry but at different stages of the value chain. It aims to integrate the supply chain and achieve greater efficiency and control over the production process. 3. Conglomerate Merger: In this type of merger, two companies from different industries or sectors merge their operations to diversify their business portfolio, reduce risk, and gain synergistic benefits from combining different expertise. 4. Reverse Merger: Unlike a traditional merger, a reverse merger occurs when a private company acquires a public company, allowing the private entity to become publicly traded without an initial public offering (IPO). 5. Statutory Merger: This type involves merging two or more companies into a single existing company, dissolving the merging entities in the process. It is important to review the specific details of the Oakland Michigan Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc., and ASECB Corporation to determine the exact structure and type of merger being pursued in this case.

Oakland Michigan Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

How to fill out Oakland Michigan Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

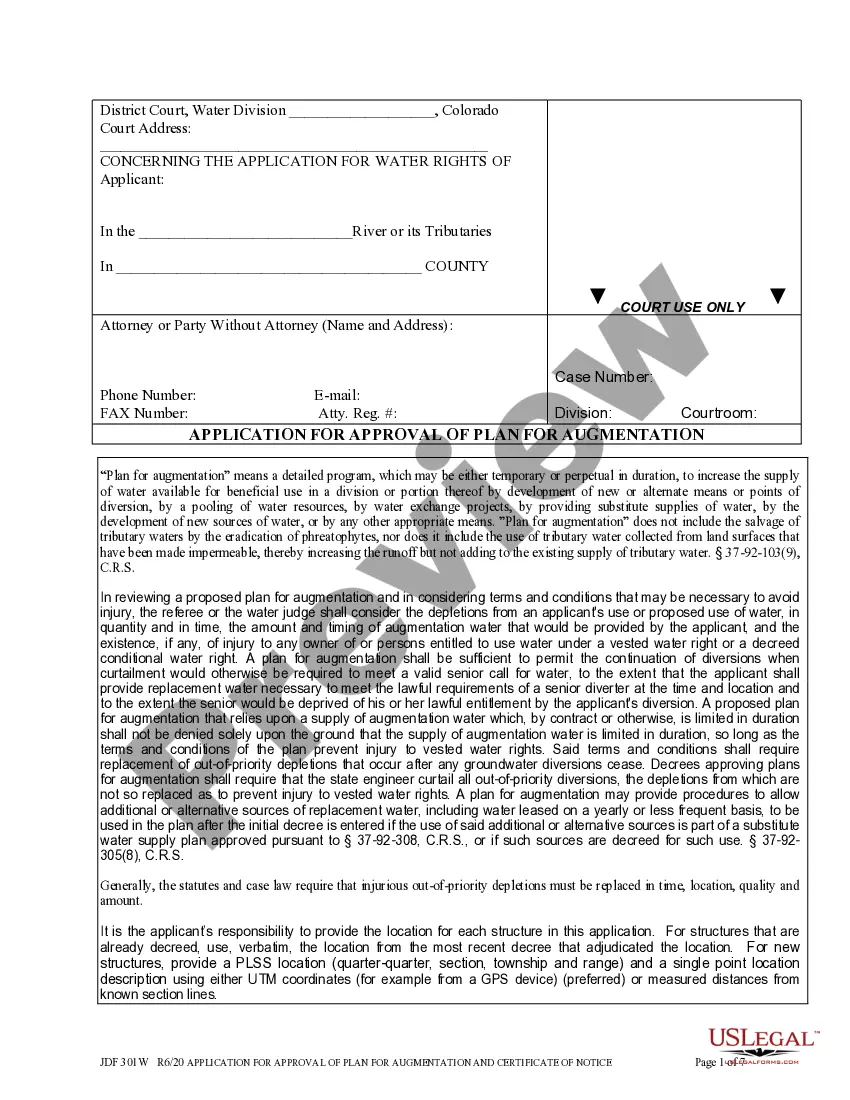

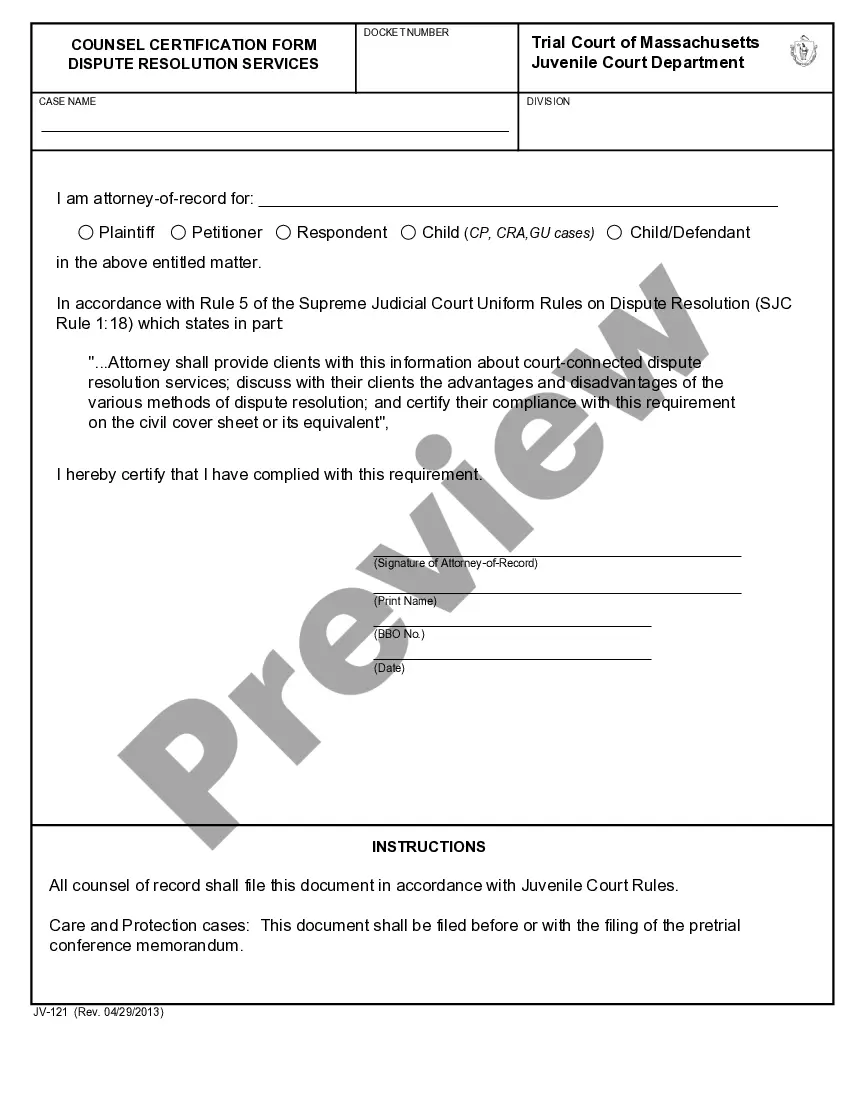

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Oakland Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Oakland Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Oakland Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

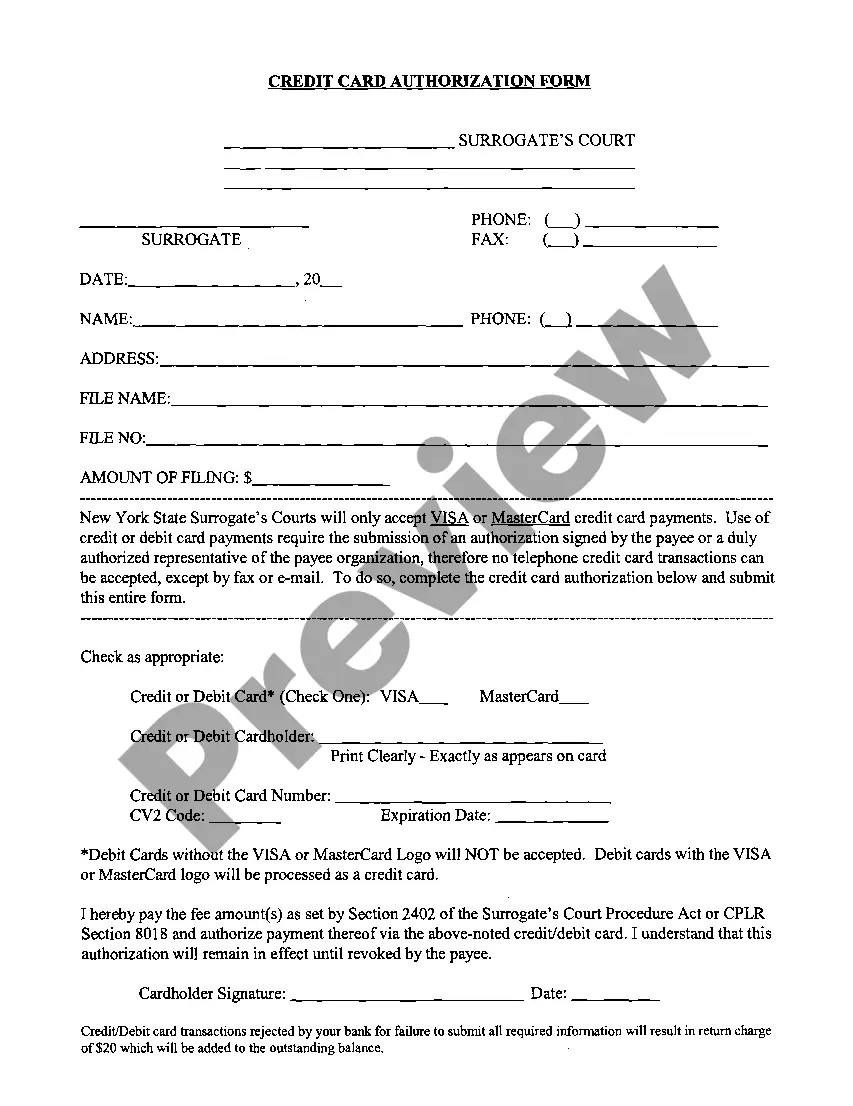

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Oakland Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

A merger is a corporate strategy to combine with another company and operate as a single legal entity. The companies agreeing to mergers are typically equal in terms of size and scale of operations.

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. 1.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.