The Bexar Texas Plan of Merger between Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc. is a comprehensive agreement outlining the merger process and the terms and conditions that will govern the consolidation of these three companies. This plan is designed to effectively combine their resources, strengths, and expertise to create a unified and stronger entity that can better serve their customers, shareholders, and stakeholders. Keywords: Bexar Texas, Plan of Merger, Stamps. Com, Rocket Acquisition Corp., Ship. Com, agreement, merger process, terms and conditions, consolidation, resources, strengths, expertise, unified entity, customers, shareholders, stakeholders. Types of Bexar Texas Plan of Merger between Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc.: 1. Consolidation Merger: Under this type of merger, Stamps. Com, Rocket Acquisition Corp., and Ship. Com would combine their operations into a single entity, eliminating any duplicate functions or redundancies. The merged company would operate under a new name and capitalize on the cost synergies and increased market presence. 2. Vertical Merger: In a vertical merger, Stamps. Com, Rocket Acquisition Corp., and Ship. Com would merge their businesses which belong to different stages of the supply chain or distribution process. This merger would enable them to further integrate their services, enhance efficiency, and provide an end-to-end solution to customers. 3. Conglomerate Merger: A conglomerate merger occurs when Stamps. Com, Rocket Acquisition Corp., and Ship. Com, operating in unrelated industries, decide to merge to diversify their business portfolio and gain a competitive edge. By pooling their resources and expertise, they can explore new markets, exploit complementary strengths, and generate additional revenue streams. 4. Reverse Merger: This type of merger involves Stamps. Com, Rocket Acquisition Corp., and Ship. Com, with the latter two being publicly traded shell companies, merging into Stamps. Com. The goal is to allow Rocket Acquisition Corp. and Ship. Com to become publicly traded entities without going through the traditional initial public offering (IPO) process. 5. Amalgamation Merger: An amalgamation merger involves Stamps. Com, Rocket Acquisition Corp., and Ship. Com merging under a single legal entity, combining their assets, liabilities, and operations. This merger results in a unified organization with stronger financial stability, enhanced market presence, and increased bargaining power in the industry. Each type of merger listed above represents a unique approach to integrate Stamps. Com, Rocket Acquisition Corp., and Ship. Com's businesses and achieve their respective strategic objectives. The chosen type of merger will depend on various factors, including the companies' industry focus, market opportunities, financial considerations, and regulatory requirements.

Bexar Texas Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

Description

How to fill out Bexar Texas Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

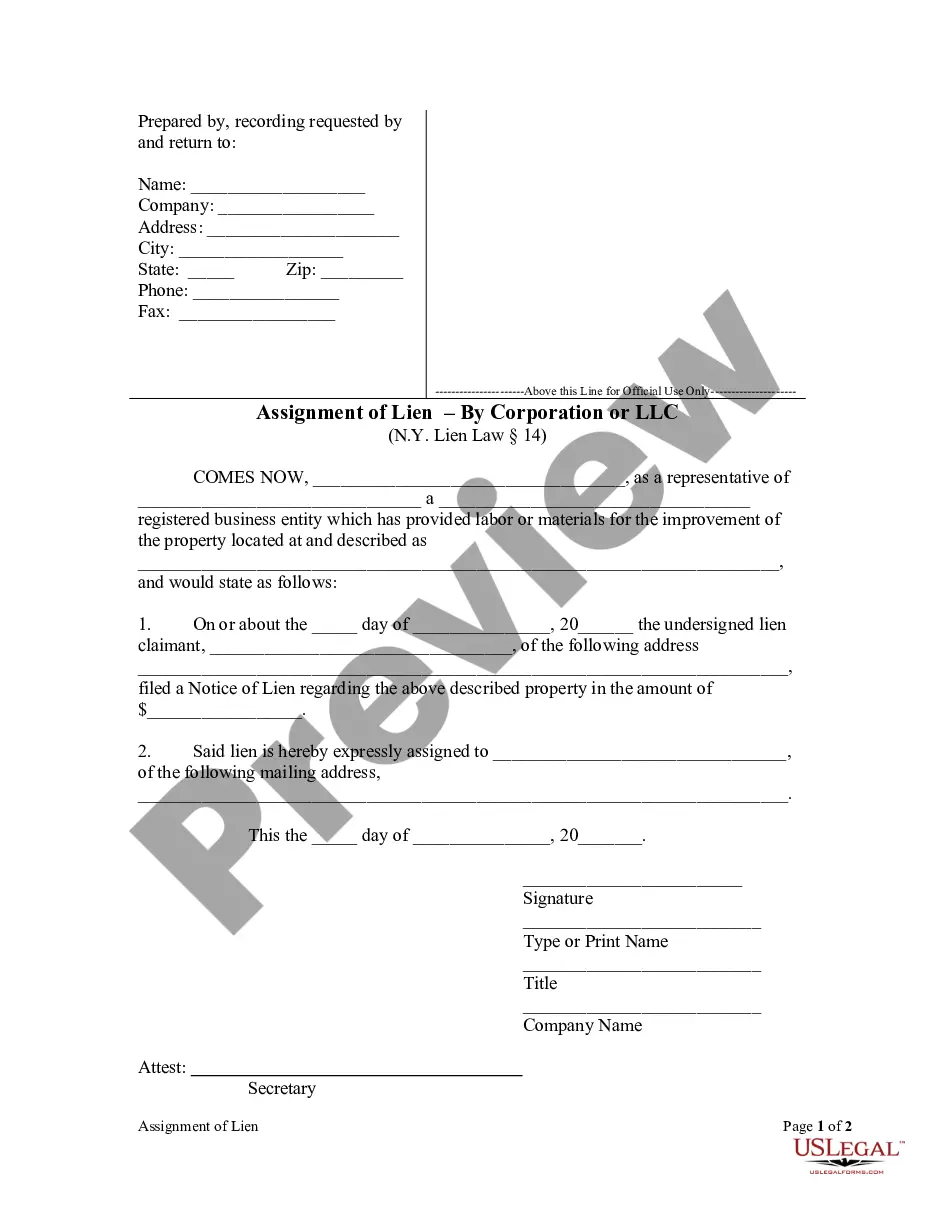

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Bexar Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc., with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to purchase and download Bexar Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc..

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Bexar Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc..

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Bexar Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc., log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you need to cope with an extremely difficult situation, we recommend getting an attorney to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!