The Harris Texas Plan of Merger is a legal agreement that outlines the merger between Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc. This merger is aimed at creating a synergistic alliance that will enhance the companies' capabilities in the digital shipping industry. The merger will result in the consolidation of resources, expertise, and networks, leading to increased market share and improved customer satisfaction. The Harris Texas Plan of Merger presents multiple types of mergers that can occur between the involved companies. Some of these types are: 1. Horizontal Merger: This type of merger occurs when two companies operating in the same industry combine their operations. Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc. may pursue a horizontal merger to leverage their complementary strengths and establish a dominant presence in the digital shipping market. 2. Vertical Merger: This merger type involves companies operating at different stages of the supply chain. For example, if Stamps. Com, Inc. is mainly focused on providing shipping technology solutions, Rocket Acquisition Corp. specializes in logistics, and Ship. Com, Inc. focuses on last-mile delivery services, a vertical merger could occur to streamline operations and improve efficiency across the supply chain. 3. Conglomerate Merger: In a conglomerate merger, companies operating in unrelated industries merge to diversify their business offerings and expand into new markets. Although it is less likely in the case of Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc., a conglomerate merger could be considered if there are potential synergies or growth opportunities in other sectors. The Harris Texas Plan of Merger will include detailed provisions regarding the securities exchange ratio, governance structure post-merger, treatment of employees and contracts, integration plans, and financial considerations. The primary objective of this merger is to create a stronger market presence, enhance operational efficiency, and maximize shareholder value. In summary, the Harris Texas Plan of Merger between Stamps. Com, Inc., Rocket Acquisition Corp., and Ship. Com, Inc. represents a transformative consolidation in the digital shipping industry. It brings together companies with complementary strengths and aims to leverage their expertise to achieve market dominance, increased efficiency, and improved customer satisfaction.

Harris Texas Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

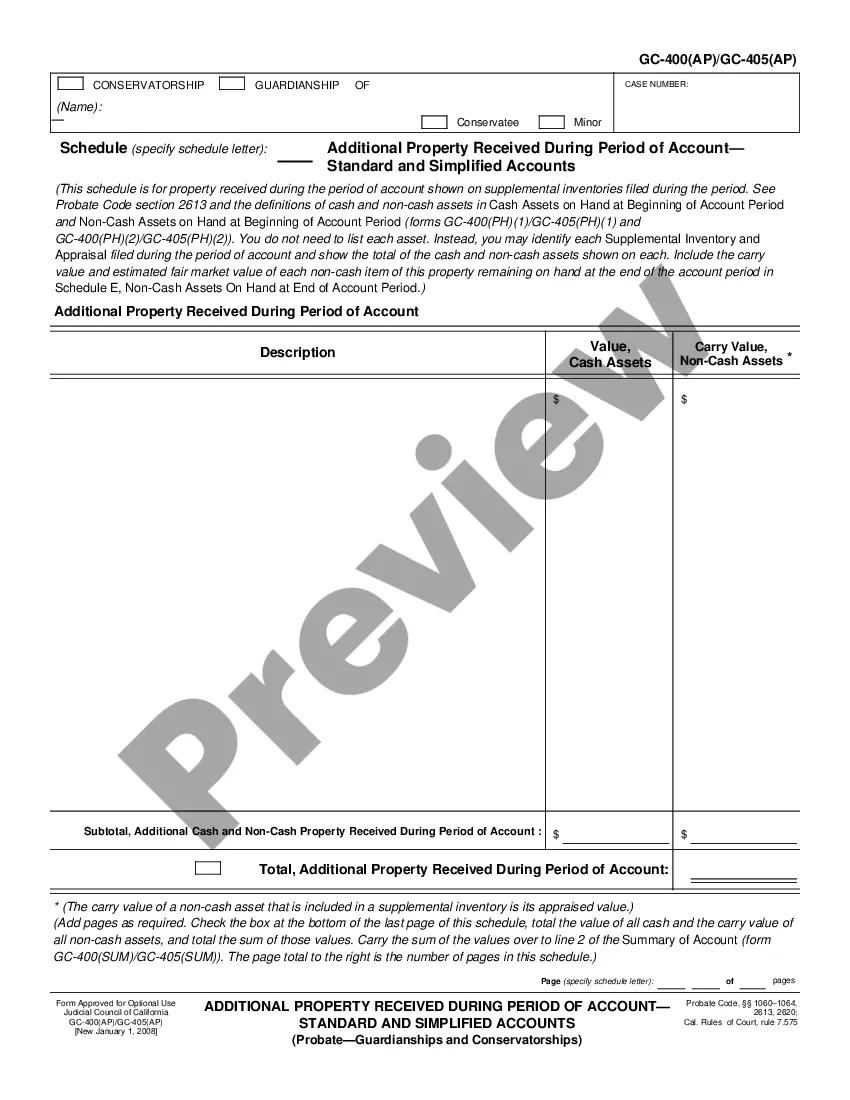

Description

How to fill out Harris Texas Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

Do you need to quickly create a legally-binding Harris Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. or maybe any other document to handle your personal or business matters? You can select one of the two options: hire a legal advisor to write a legal document for you or draft it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Harris Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Harris Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Harris Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!