Title: Understanding Contra Costa California Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association Introduction: Contra Costa County, located in California, is the setting for a notable pooling and servicing agreement between Green point Credit, LLC (Green point) and Bank One, National Association (Bank One). This agreement aims to streamline the management and distribution of mortgage loans in the region. In this article, we will explore the details of the Contra Costa California Pooling and Servicing Agreement, highlighting its key aspects and potential variations. 1. Background: The Contra Costa California Pooling and Servicing Agreement establishes the framework for the pooling of mortgage loans primarily within Contra Costa County. It is an arrangement formed between Green point Credit, LLC, a leading mortgage lender, and Bank One, National Association, a trusted financial institution. The agreement ensures efficient management and servicing of mortgage loans throughout their lifecycle. 2. Primary Objectives: The agreement serves multiple purposes, including: — Loan Pooling: The pooling aspect allows the aggregation of multiple mortgage loans into a collective investment vehicle, boosting liquidity and creating potential investment opportunities. — Loan Servicing: The agreement outlines the responsibilities and obligations of Green point and Bank One in servicing the mortgage loans. This includes collecting payments, managing escrow accounts, and processing disbursements to investors. 3. Key Elements: A. Mortgage Loan Criteria: The agreement specifies the types of mortgage loans that can be included in the pool, such as residential or commercial, conforming or non-conforming, adjustable-rate or fixed-rate, etc. B. Pooling Criteria: The pooling requirements include aspects like loan size, creditworthiness, occupancy status, geographic location, loan-to-value ratio, and other relevant factors. C. Service Responsibilities: The agreement outlines the duties of Green point and Bank One as mortgage loan services, including customer support, loan modifications, escrow administration, and foreclosure procedures. D. Payment Distribution: The agreement establishes the mechanisms through which funds collected from mortgage borrowers are distributed to investors and other stakeholders, ensuring transparency and compliance with relevant regulations. E. Reporting and Disclosure: Both parties commit to providing regular reports to each other, sharing information on loan performance, delinquencies, defaults, and other essential metrics. 4. Potential Variations: While the detailed terms of the pooling and servicing agreement between Green point Credit, LLC and Bank One, National Association may not be publicly available, it is plausible that certain variations exist. Some potential types of Contra Costa California Pooling and Servicing Agreements could include: — Residential Mortgage Loans: Specifying agreements related explicitly to residential mortgage loan pools within Contra Costa County. — Commercial Mortgage Loans: Focusing on pooling and servicing agreements for commercial properties, like office buildings, retail spaces, or industrial facilities. — Adjustable vs. Fixed Rate Mortgages: Highlighting agreements that deal specifically with pools composed of either adjustable-rate or fixed-rate mortgages. — Conforming vs. Non-Conforming Loans: Addressing agreements pertaining to pools consisting solely of conforming loans, conforming jumbo loans, or non-conforming (jumbo) loans. Conclusion: The Contra Costa California Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association provides a structured framework for managing mortgage loans in Contra Costa County. The agreement enhances liquidity, ensures efficient servicing, and establishes clear guidelines for both parties involved. Understanding the elements and potential variations of this agreement is crucial for stakeholders within the mortgage industry.

Contra Costa California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

How to fill out Contra Costa California Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Contra Costa Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the latest version of the Contra Costa Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association:

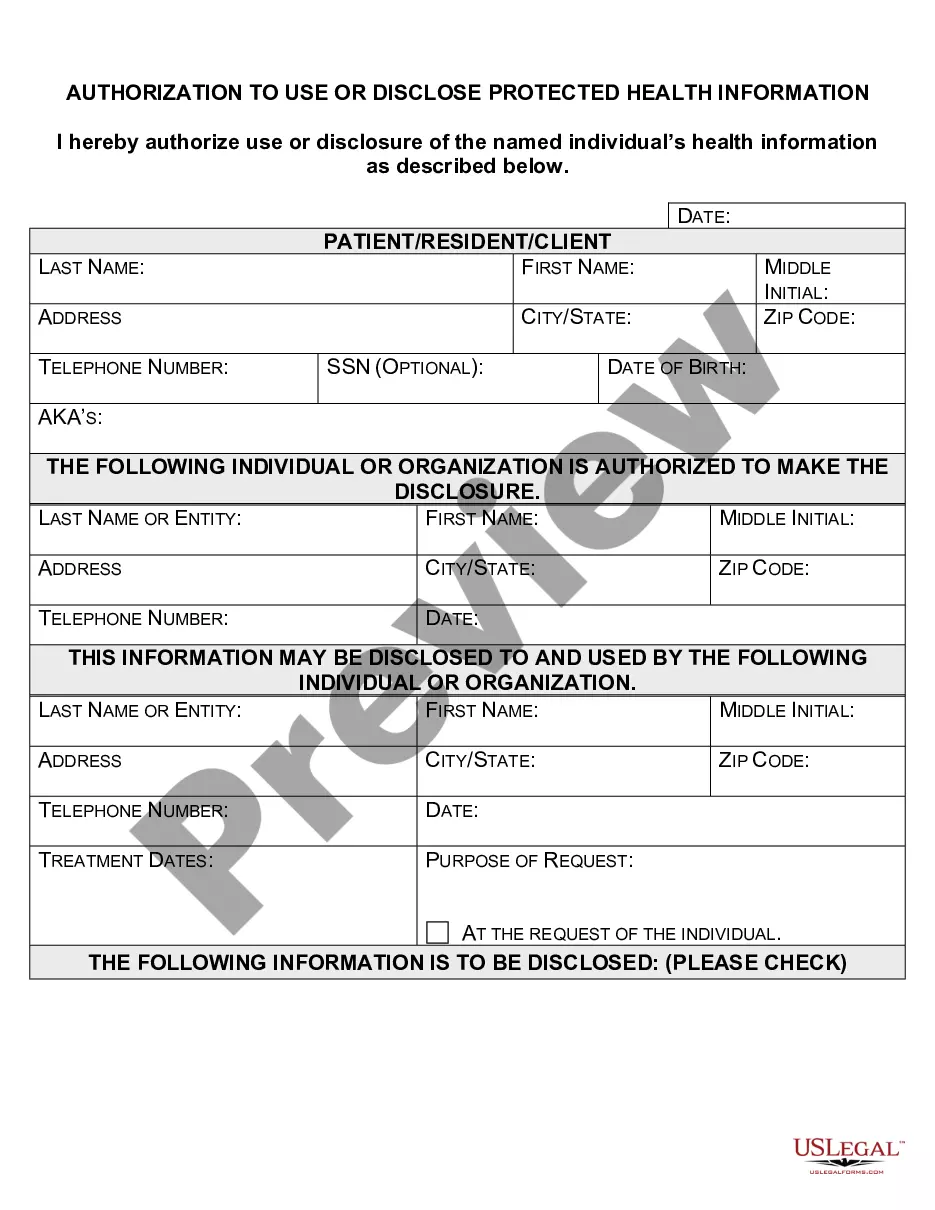

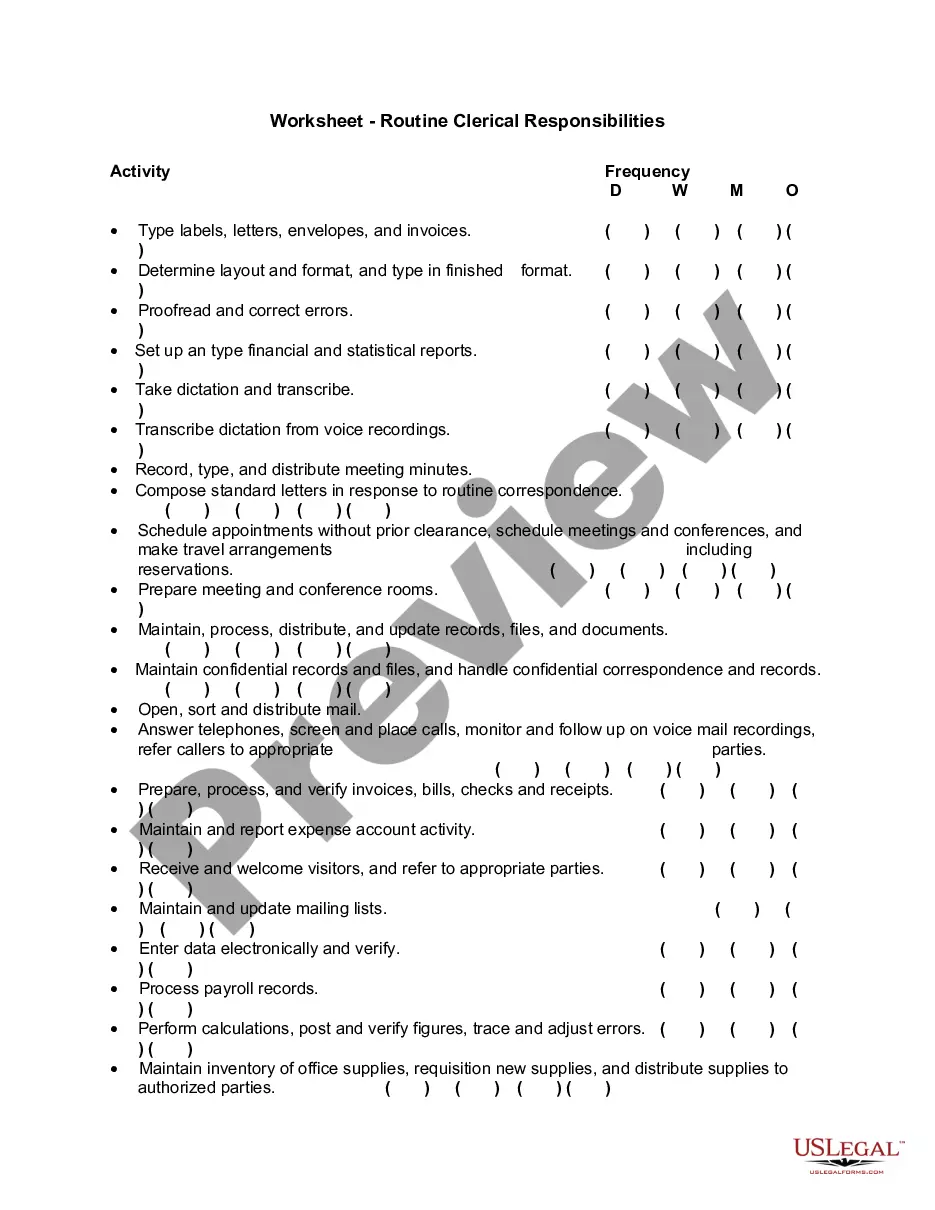

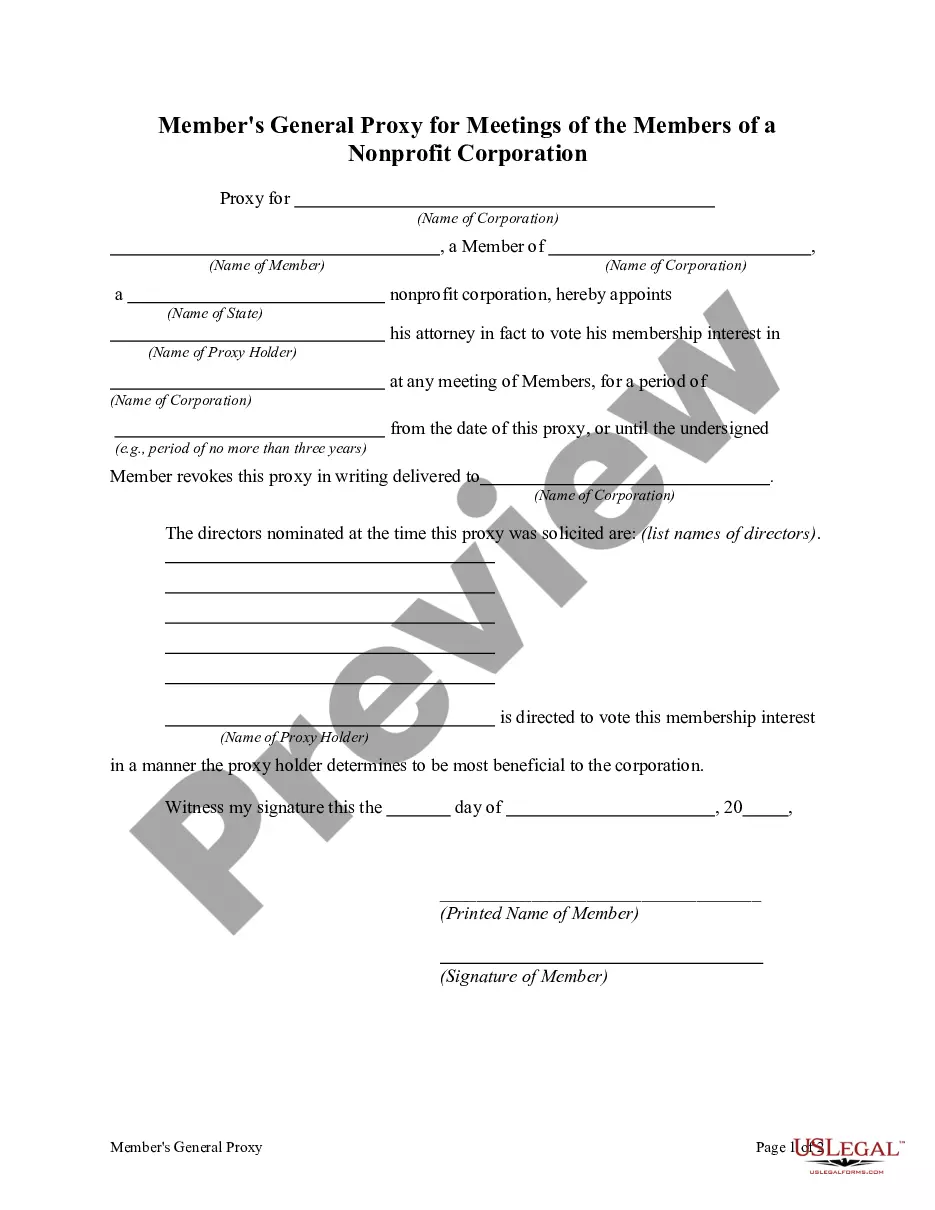

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Contra Costa Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!