Los Angeles California Pooling and Servicing Agreement refers to a legal contract between Green point Credit, LLC and Bank One, National Association regarding the pooling and servicing of mortgage loans in the Los Angeles area. This agreement outlines the terms and conditions governing the management, administration, and disposition of these mortgage loans. Keywords: Los Angeles California, Pooling and Servicing Agreement, Green point Credit, LLC, Bank One, National Association, mortgage loans, management, administration, disposition. There are various types of Los Angeles California Pooling and Servicing Agreements between Green point Credit, LLC and Bank One, National Association, depending on the specific characteristics and terms of the mortgage loans being pooled. These different types may include: 1. Conventional Loan Pooling and Servicing Agreement: This agreement governs the pooling and servicing of conventional mortgage loans in the Los Angeles area. These loans typically follow standard underwriting guidelines and are not insured or guaranteed by government agencies. 2. FHA Loan Pooling and Servicing Agreement: This type of agreement pertains to the pooling and servicing of mortgages insured by the Federal Housing Administration (FHA). These loans provide additional protection to the lenders in case of borrower default. 3. VA Loan Pooling and Servicing Agreement: This agreement applies to the pooling and servicing of mortgage loans guaranteed by the Department of Veterans Affairs (VA). These loans are available to eligible veterans and provide more favorable terms and conditions. 4. Jumbo Loan Pooling and Servicing Agreement: This type of agreement refers to the pooling and servicing of high-value mortgage loans that exceed the conforming loan limit set by government-sponsored enterprises like Fannie Mae and Freddie Mac. Jumbo loans cater to homebuyers in expensive real estate markets like Los Angeles. 5. Adjustable-Rate Mortgage (ARM) Pooling and Servicing Agreement: This agreement governs the pooling and servicing of mortgage loans with an adjustable interest rate structure. The interest rates on these loans can fluctuate over time based on an index, potentially impacting the borrowers' monthly mortgage payments. 6. Fixed-Rate Mortgage Pooling and Servicing Agreement: This agreement applies to the pooling and servicing of mortgage loans with a fixed interest rate throughout the loan term. The interest rate and monthly payments remain constant, providing stability for borrowers. These various types of Los Angeles California Pooling and Servicing Agreements cater to different types of mortgage loans and allow Green point Credit, LLC and Bank One, National Association to efficiently manage and administer the mortgage-backed securities backed by these loans. Through these agreements, the parties ensure compliance with applicable laws, adherence to investor guidelines, and the proper handling of borrower payments, delinquencies, and foreclosures.

Los Angeles California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

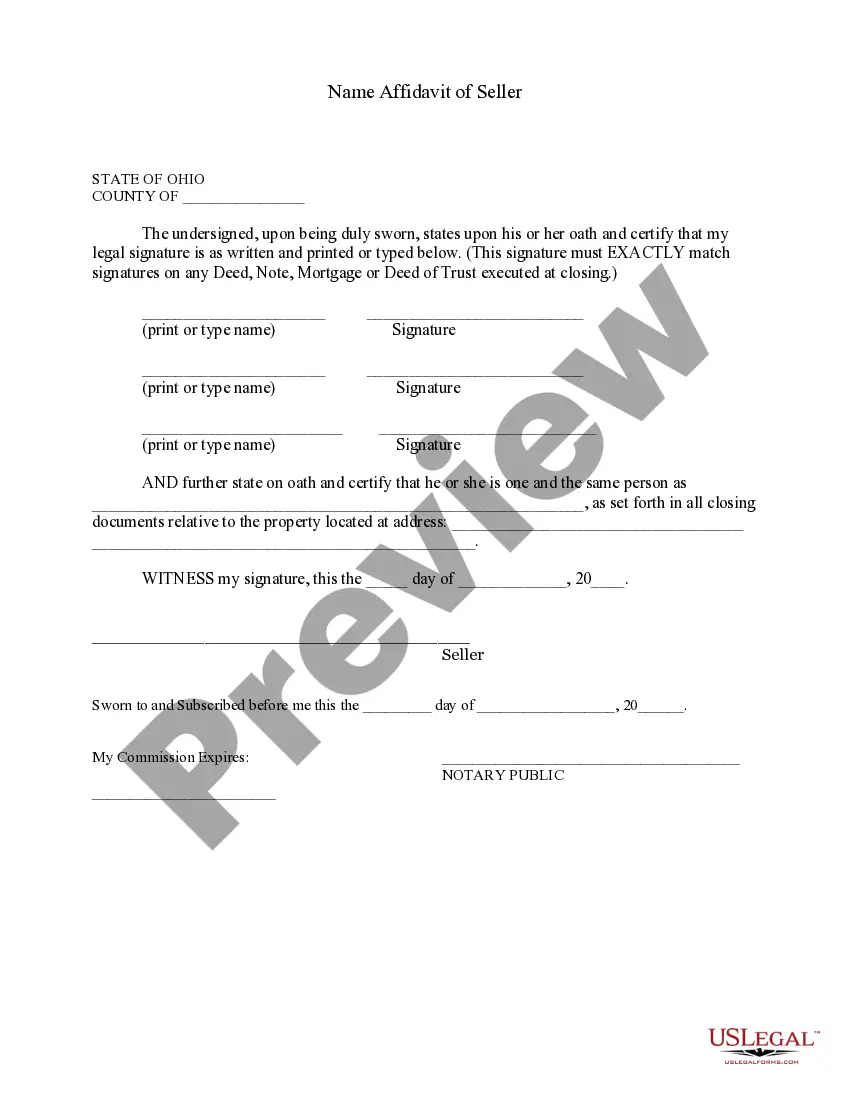

Description

How to fill out Los Angeles California Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

Drafting paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Los Angeles Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Los Angeles Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Los Angeles Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!