Nassau New York Pooling and Servicing Agreement (PSA) is a legal contract that outlines the terms and conditions of the pooling and servicing of mortgage loans between Green point Credit, LLC and Bank One, National Association. This agreement governs the process of bundling individual mortgage loans into a mortgage-backed security (MBS) and the ongoing servicing of these loans. Under the Nassau New York PSA, Green point Credit, LLC acts as the originating lender, responsible for originating and underwriting the mortgage loans. Bank One, National Association, serves as the trustee of the mortgage pool and oversees the administration and disbursement of funds to investors. The agreement specifies various key provisions, including the types of loans eligible for inclusion in the mortgage pool, the criteria for loan servicing, responsibilities of each party, and the allocation of principal and interest payments among the investors. It also outlines the procedures for the distribution of cash flows, handling delinquent loans, and managing foreclosure proceedings. Additionally, the Nassau New York PSA may include provisions regarding the representations and warranties made by Green point Credit, LLC regarding the individual mortgage loans, provisions for loan repurchases or substitute loans in case of defaults, and procedures for the termination or amendment of the agreement. The different types of Nassau New York Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association may include specific variations tailored for different mortgage loan programs or investment objectives. For example, there could be agreements specifically designed for prime mortgage loans, subprime mortgage loans, jumbo loans, or adjustable-rate mortgage loans. Each agreement may have unique provisions and requirements based on the characteristics of the underlying mortgage loans and the preferences of the investors. In conclusion, the Nassau New York Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association establishes the framework for pooling mortgage loans into mortgage-backed securities and governs their ongoing administration. This agreement serves to protect the interests of all parties involved and ensure the proper servicing and distribution of cash flows from the mortgage loans.

Nassau New York Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

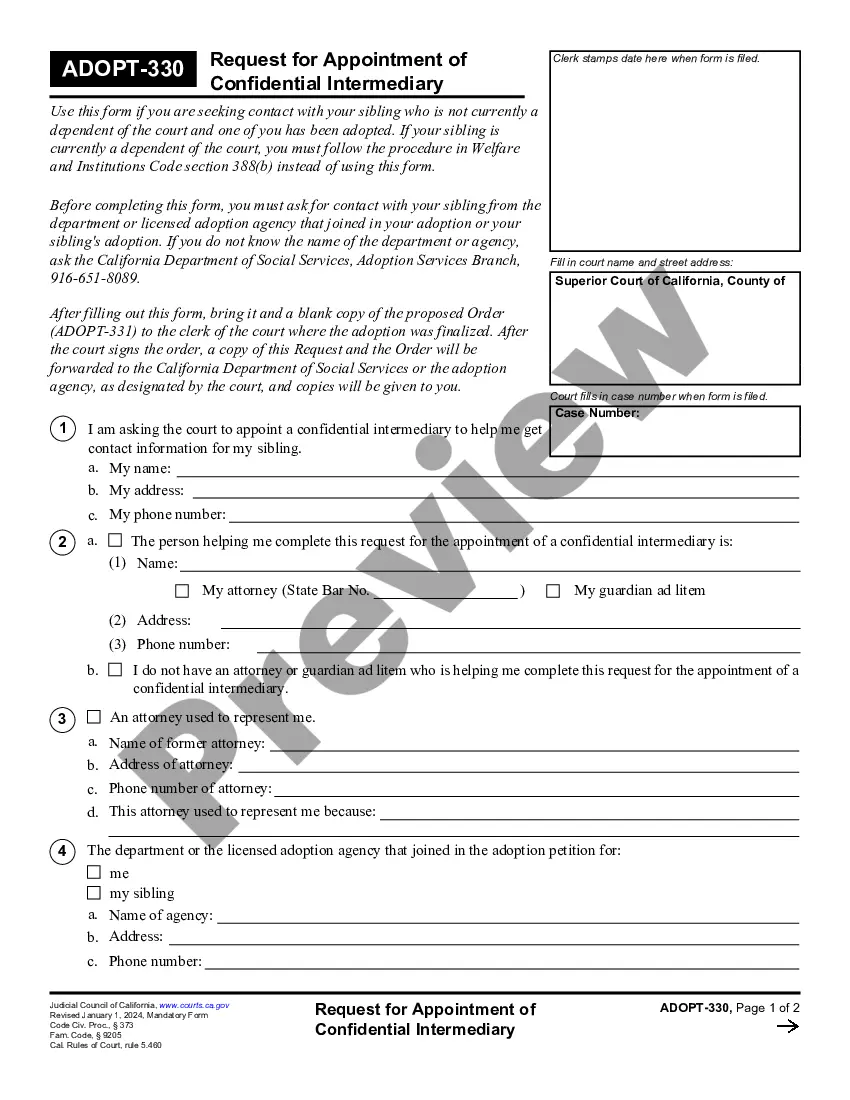

How to fill out Nassau New York Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

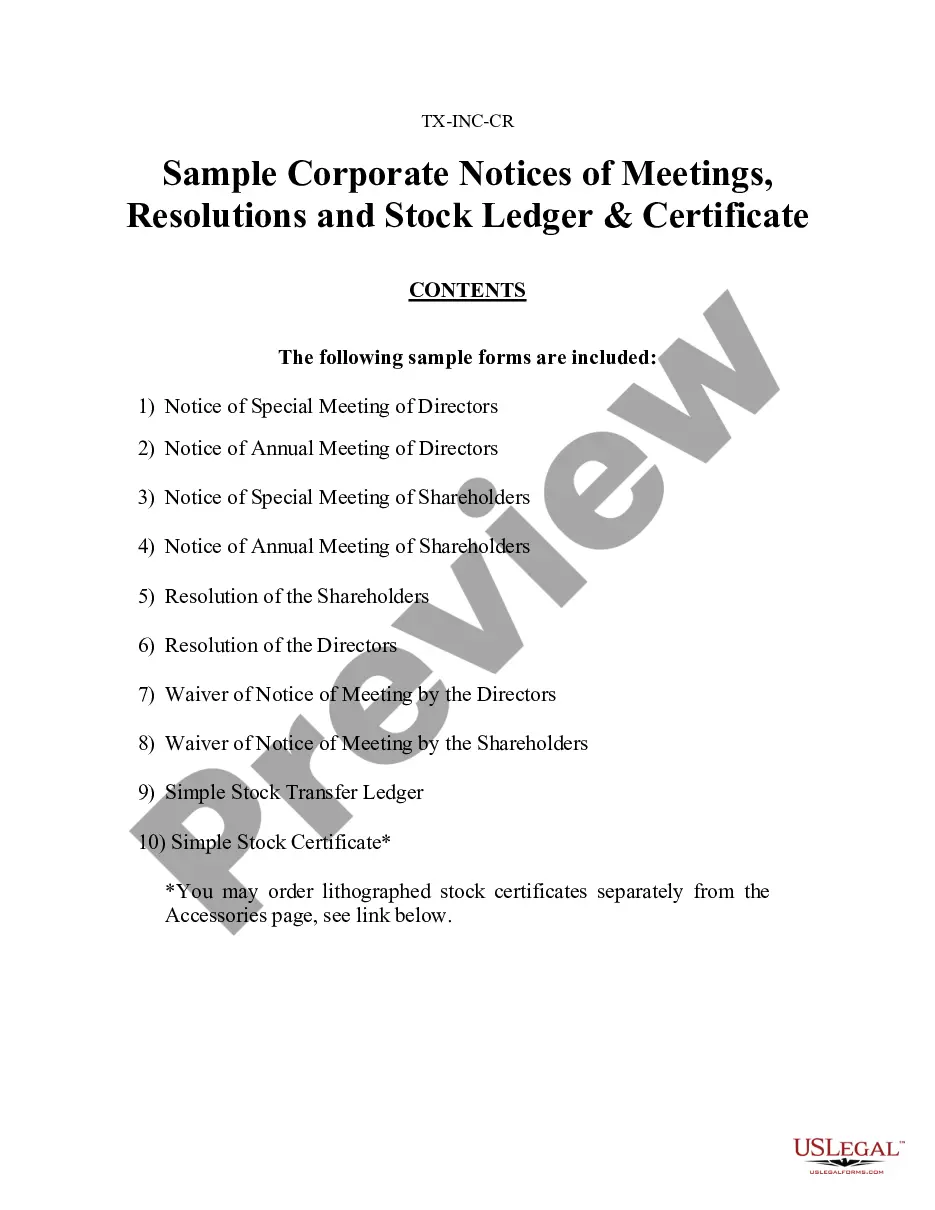

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Nassau Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any activities related to paperwork execution simple.

Here's how to purchase and download Nassau Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Check the similar document templates or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Nassau Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you have to deal with an extremely difficult situation, we recommend getting a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

Loan Pool means: (a) in the context of a Securitization, any pool or group of loans that are a part of such Securitization; (b) in the context of a Transfer, all loans which are sold, transferred or assigned to the same transferee; and (c) in the context of a Participation, all loans as to which participating interests

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

A loan servicing agreement is a written contract between a lender and a loan servicer that gives the loan servicer the authority to manage most aspects of a particular loan.

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

Loan servicing includes sending monthly payment statements, collecting monthly payments, maintaining records of payments and balances, collecting and paying taxes and insurance (and managing escrow funds), remitting funds to the note holder, and following up on any delinquencies.

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

North Fork Bancorp acquired GreenPoint Financial in October 2004 for $6.3 billion in stock.

Go to and click on Search for Company Filings under Filing & Forms (EDGAR). Under General-Purpose Searches, click on Companies & other filers. Then, in the Enter your search information box, type in Ameriquest next to Company name and click on the Find Companies button.