The Wake North Carolina Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association is a legal contract that outlines the terms and conditions for pooling and servicing mortgage loans. This agreement governs the relationship between Green point Credit, LLC (the originator and seller of the loans) and Bank One, National Association (the trustee and service of the loans) in relation to the mortgage-backed securities. The pooling aspect of the agreement involves the bundling of multiple individual mortgage loans into a single investment product, known as a mortgage-backed security (MBS). By pooling together various loans, this agreement allows for the creation of a diverse investment portfolio. The investors who purchase these Mass can benefit from the interest and principal payments made by the borrowers. The servicing component of the agreement refers to the ongoing management and administration of the mortgage loans. Bank One, National Association, as the service, handles tasks such as collecting payments, maintaining escrow accounts, and handling any delinquencies or defaults. They ensure that the terms of the mortgage loans are followed and act as an intermediary between the borrower and the investors. It is important to note that there may be different types of Wake North Carolina Pooling and Servicing Agreements between Green point Credit, LLC and Bank One, National Association. These variations can stem from factors such as the type of mortgage loans being pooled, the term and structure of the Mass, or specific conditions agreed upon by the parties involved. Some examples of different types of agreements may include: 1. Residential Mortgage Pooling and Servicing Agreement: This type of agreement may be focused on residential mortgage loans, such as single-family homes or condominiums. 2. Commercial Mortgage Pooling and Servicing Agreement: This variation could pertain to commercial real estate loans, including those for office buildings, retail spaces, or industrial properties. 3. Adjustable-Rate Mortgage (ARM) Pooling and Servicing Agreement: In this case, the agreement might be specific to ARM loans, where the interest rate can fluctuate over time based on a predetermined index. 4. Non-Performing Loan Pooling and Servicing Agreement: This type of agreement could involve distressed mortgage loans that are not performing well, requiring specialized management and loss mitigation strategies. Each of these different types of agreements may have their own unique provisions and requirements, tailored to the specific nature of the mortgage loans being pooled and serviced. In conclusion, the Wake North Carolina Pooling and Servicing Agreement between Green point Credit, LLC and Bank One, National Association is a comprehensive legal contract that outlines how mortgage loans are pooled and managed in the form of mortgage-backed securities. Depending on the specific circumstances, different variations of this agreement exist, each addressing different types of mortgage loans and associated terms.

Wake North Carolina Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

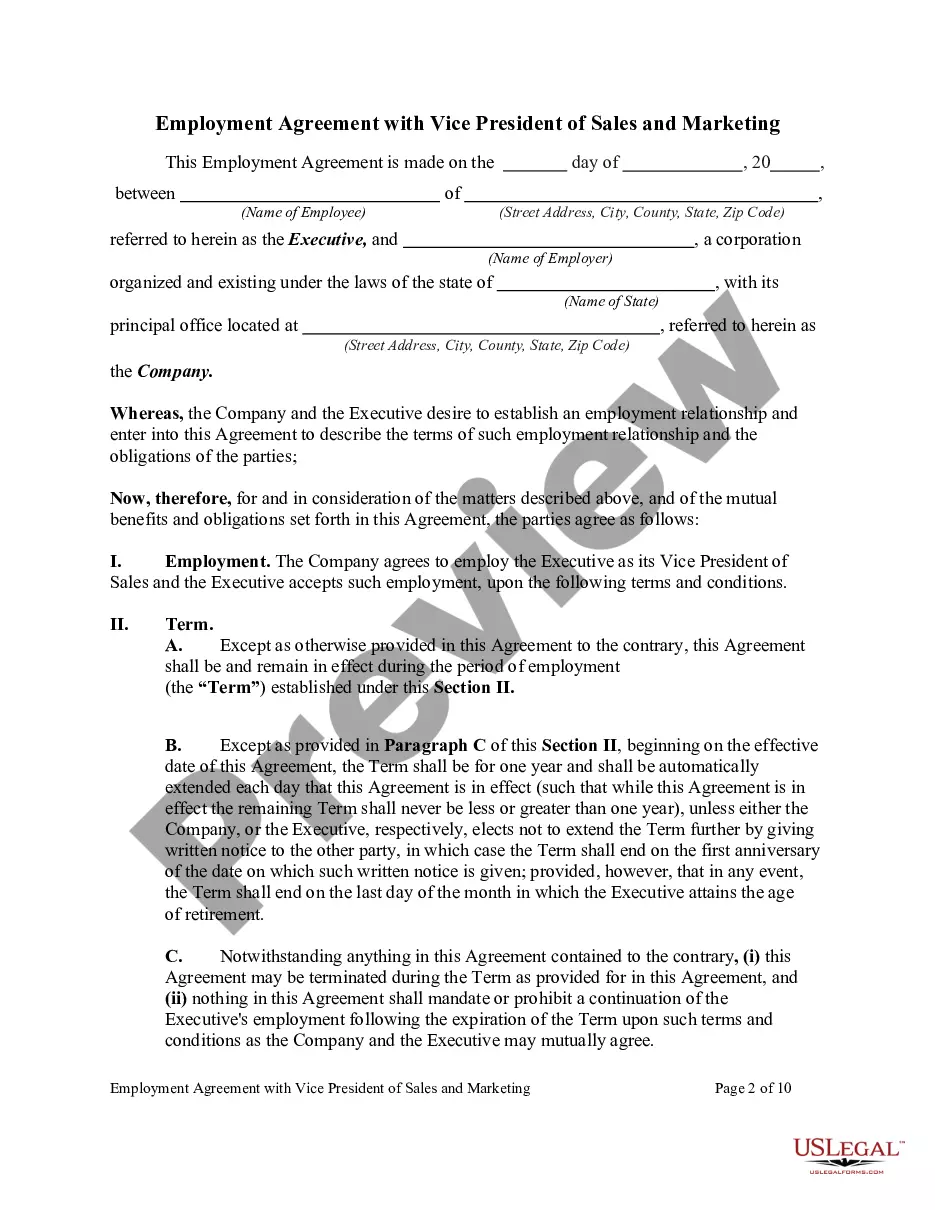

How to fill out Wake North Carolina Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wake Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the recent version of the Wake Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wake Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Wake Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!