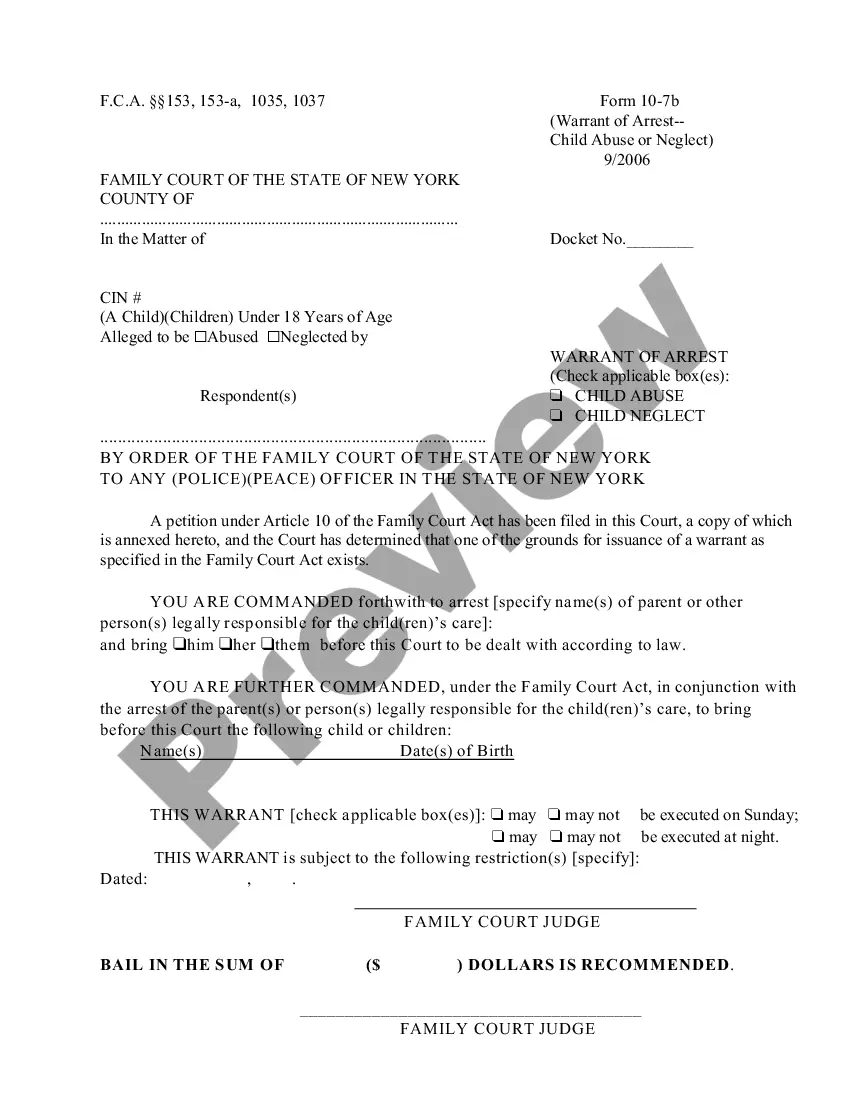

Description: The Fairfax Virginia Credit Agreement is a comprehensive financial agreement entered into by Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp. This agreement serves as a legally binding document that outlines the terms and conditions under which Unilab Corp can access credit facilities from the lending institutions and banks mentioned. The purpose of the Credit Agreement is to facilitate Unilab Corp's access to credit capital to support its ongoing operations, working capital requirements, expansion plans, and other financial needs. The agreement specifies the maximum amount of credit that Unilab Corp can borrow from each lender, the interest rates applicable, repayment terms, conditions for prepayments, and any collateral or security requirements. Furthermore, the Fairfax Virginia Credit Agreement contains key provisions related to financial covenants, which are essential to safeguard the interests of the lending institutions and banks. These covenants may include requirements for Unilab Corp to maintain a certain level of financial ratios, provide regular financial statements, and ensure compliance with applicable laws and regulations. It is worth noting that there can be different types of Fairfax Virginia Credit Agreements between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp, depending on specific circumstances and financing needs. Some common types of credit agreements include: 1. Revolving Credit Facility: This type of credit agreement provides Unilab Corp with a predetermined credit limit that can be accessed and repaid multiple times within a specified timeframe. It offers flexibility as the company can borrow and repay funds as needed, often with no fixed repayment schedule. 2. Term Loan Agreement: A term loan agreement provides Unilab Corp with a specific amount of credit that needs to be repaid over a predetermined period, typically through regular installment payments. The interest rates may be fixed or variable, and the repayment schedule is commonly set in advance. 3. Syndicated Credit Agreement: In some cases, Unilab Corp may require a significantly larger credit facility that can't be provided by a single lending institution. In such situations, a syndicated credit agreement may be established, involving multiple lenders who collectively provide the credit facility. Each lender's terms and conditions are included within the agreement. 4. Secured Credit Agreement: If the lenders require additional security for their loans, a secured credit agreement may be executed. This involves Unilab Corp pledging specific assets, such as real estate, equipment, or receivables, as collateral to secure the borrowed funds. In the event of default, lenders have the right to seize and sell the collateral to recover their losses. The Fairfax Virginia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp is a crucial financial instrument that enables Unilab Corp to meet its funding requirements while providing the lenders with the necessary safeguards.

Fairfax Virginia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

How to fill out Fairfax Virginia Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Fairfax Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Fairfax Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Fairfax Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Fairfax Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!