Philadelphia, Pennsylvania Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp: A Comprehensive Overview The Philadelphia, Pennsylvania Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp represents a crucial financial arrangement that encompasses multiple entities involved in lending, borrowing, and financial management. This detailed description aims to provide comprehensive information about this agreement, highlighting its significance, key players, and possible variations. The Philadelphia, Pennsylvania Credit Agreement serves as a legally binding contract that outlines the terms, conditions, and obligations between Unilab Corp (as the borrower) and the Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp (as the lenders). This agreement determines the credit facilities that the lenders extend to Unilab Corp, ensuring access to necessary funds for operational, investment, or corporate purposes. This Credit Agreement includes various essential components, such as the loan amount, interest rates, repayment terms, collateral (if applicable), borrower's covenants, financial reporting requirements, and default provisions. These provisions ensure a fair and transparent financial relationship between the parties involved while mitigating potential risks and ensuring the timely repayment of loans. The parties involved in this Credit Agreement play distinct roles: 1. Unilab Corp: Unilab Corp is the borrower, typically representing a corporation or business entity seeking financial assistance. They are responsible for complying with the terms stated in the agreement, making timely interest payments, and repaying the principal amount borrowed. 2. Various Lending Institutions: These institutions are financial entities, such as banks, credit unions, or other lenders, that collectively provide the necessary credit facilities to Unilab Corp. The number and selection of these institutions may vary based on the specific agreement. 3. Bankers Trust Co: Bankers Trust Co is one of the lending institutions involved in the Credit Agreement. Its role is to contribute to the credit facilities and collaborate with other lenders in assessing and managing the financial risks associated with the agreement. 4. Merrill Lynch Capital Corp: Similar to Bankers Trust Co, Merrill Lynch Capital Corp is another lending institution involved in the agreement. Its participation in the Credit Agreement emphasizes the diversified sources of funding and expertise required to provide comprehensive financial solutions to Unilab Corp. Different types of Philadelphia, Pennsylvania Credit Agreements between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp may include: 1. Revolving Credit Agreement: This type of agreement provides Unilab Corp with access to a predetermined line of credit, allowing them to borrow, repay, and re-borrow funds within the agreed limit. This arrangement offers flexibility and short-term financing options for managing working capital needs or funding specific projects. 2. Term Loan Agreement: In contrast to the revolving credit agreement, a term loan agreement provides Unilab Corp with a specific amount of funds to be repaid over a predetermined period. This type of agreement suits long-term investment or expansion projects, with fixed repayment schedules and interest rates. 3. Syndicated Credit Agreement: A syndicated credit agreement involves multiple lenders, such as the Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp, collectively providing a larger credit facility to Unilab Corp. The lenders form a syndicate to minimize individual risks and offer increased borrowing capacity. The Philadelphia, Pennsylvania Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp plays a pivotal role in enabling businesses like Unilab Corp to thrive by ensuring access to necessary funds for growth, innovation, and operational stability. Through an understanding of the agreement's crucial components and potential variations, the parties involved can establish mutually beneficial financial arrangements that foster security, reliability, and business success.

Philadelphia Pennsylvania Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

How to fill out Philadelphia Pennsylvania Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Philadelphia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any tasks associated with document completion simple.

Here's how to locate and download Philadelphia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp.

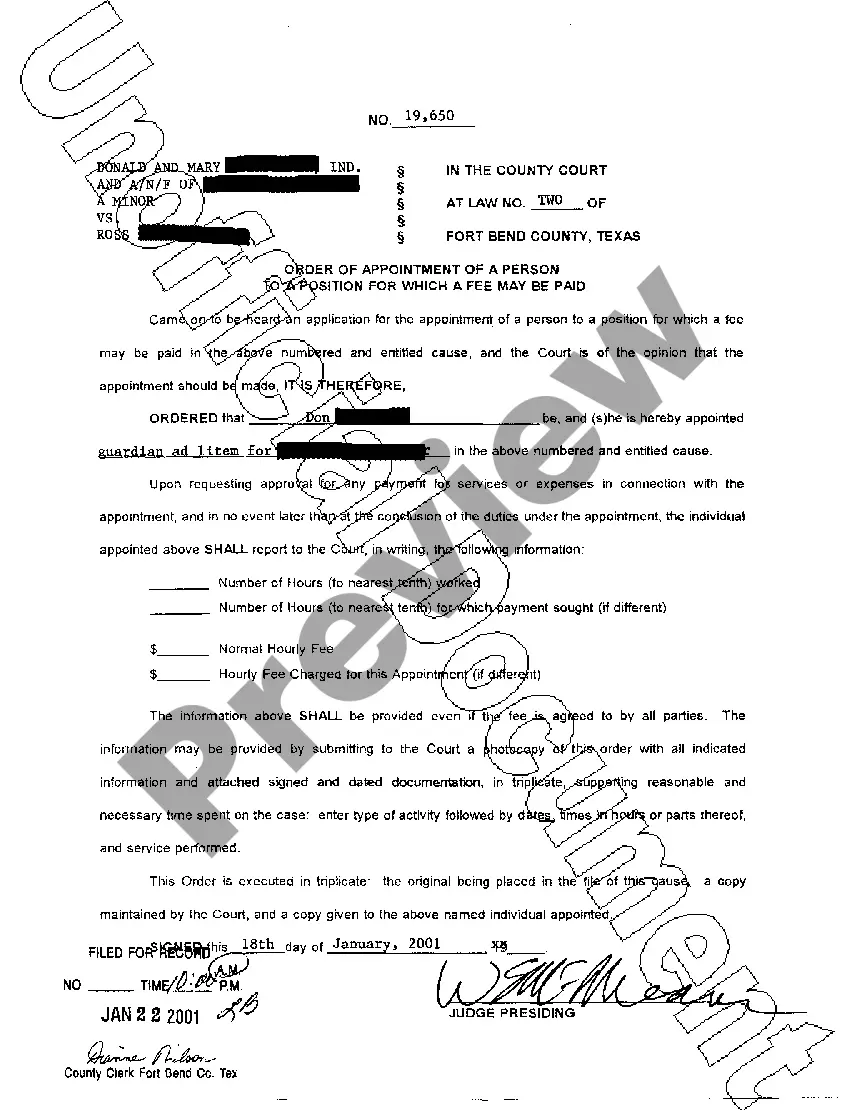

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and buy Philadelphia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Philadelphia Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to deal with an exceptionally complicated situation, we recommend using the services of a lawyer to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!