The Tarrant Texas Call Agreement is a legal agreement established between Also and Company, LP, Unilab Corporation, and Bankers Trust Company. This agreement outlines the terms and conditions regarding the purchase and sale of certain securities. The purpose of the Tarrant Texas Call Agreement is to provide a framework for parties involved to execute a call option, a financial instrument granting one party (the buyer) the right, but not the obligation, to purchase a specified amount of securities from the other party (the seller), at a predetermined price (the strike price), within a specified period (the expiration date). This agreement ensures that Also and Company, LP, Unilab Corporation, and Bankers Trust Company adhere to the terms set forth, maintaining transparency and legal compliance in their transactions. It serves as a critical document for regulating the rights and obligations of the involved parties. Various types of Tarrant Texas Call Agreements that could be in place between these entities include: 1. Standard Call Agreement: This is a regular call agreement, where the buyer has the right to purchase securities from the seller at a predetermined price within a specified expiration date. 2. American Call Agreement: This type of call agreement allows the buyer to exercise their call option at any time before the expiration date, providing greater flexibility. 3. European Call Agreement: Unlike the American call agreement, this type only allows the buyer to exercise their call option on the expiration date itself. 4. Naked Call Agreement: In this agreement, the seller does not own the underlying securities but believes that the market will not rise significantly, potentially resulting in a profit for the seller if the buyer fails to exercise their call option. 5. Covered Call Agreement: The seller in a covered call agreement already owns the underlying securities, providing protection against potential losses if the buyer exercises their call option. These various types of Tarrant Texas Call Agreements cater to different investment strategies, risk appetites, and market conditions. It is important for the involved parties to specify the type of agreement being executed to ensure all parties are aware of their rights and obligations in the transaction.

Tarrant Texas Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company

Description

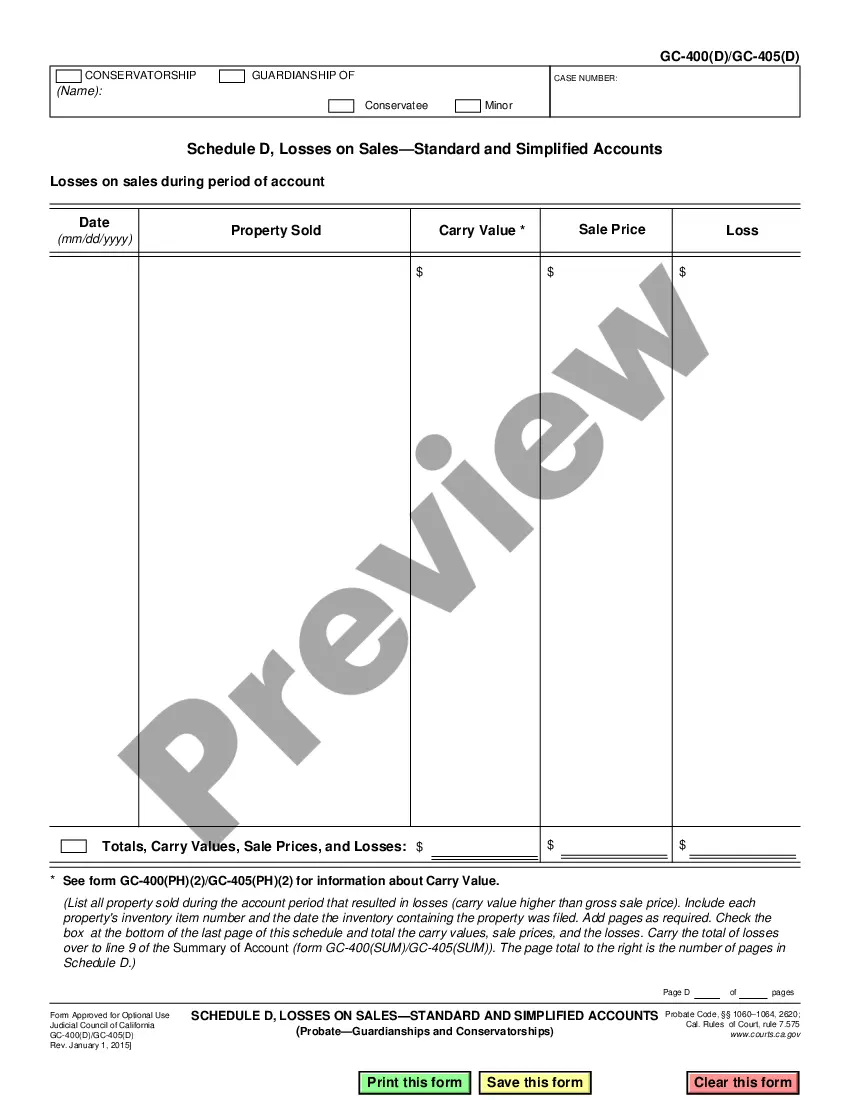

How to fill out Tarrant Texas Call Agreement Between Kelso And Company, LP, Unilab Corporation And Bankers Trust Company?

Draftwing paperwork, like Tarrant Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company, to take care of your legal matters is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for various scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Tarrant Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Tarrant Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company:

- Ensure that your template is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Tarrant Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!