The Harris Texas Stockholders Agreement is a crucial document that governs the relationship between Unilab Corp., Also Investment Associates VI, LLP, KEEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors. This agreement outlines the rights, obligations, and responsibilities of each party, ensuring a mutually beneficial partnership and protection for their respective investments. These are some key points covered in the Harris Texas Stockholders Agreement: 1. Ownership and Voting Rights: The agreement clearly defines the respective ownership stakes of each party and outlines the voting power associated with their shares. It may specify that certain decisions require the approval of a certain percentage of shareholders or a super majority. 2. Board Representation: The agreement may address the composition of the company's board of directors, including the number of directors and the appointment process. It may also determine the rights and responsibilities of each shareholder in board meetings and decision-making processes. 3. Transfer Restrictions: This section aims to protect the interests and stability of the company by imposing restrictions on the transfer of shares. It may include provisions such as rights of first refusal, tag-along rights, or drag-along rights, ensuring that shareholders have the opportunity to participate in any sale or transfer of shares. 4. Preemptive Rights: The agreement may provide preemptive rights to existing shareholders, allowing them to maintain their proportional ownership in the event of a new issuance of shares. This ensures that shareholders have the opportunity to invest further and maintain their influence on the company. 5. Confidentiality and Non-Disclosure: The Harris Texas Stockholders Agreement typically includes provisions ensuring the confidentiality of sensitive company information. This helps protect the company's trade secrets, customer data, and business strategies from being disclosed to competitors or the public. 6. Dispute Resolution: In the event of disputes or disagreements, the agreement may specify the procedures for resolving conflicts, including mediation, arbitration, or litigation. This section aims to provide a clear framework for dispute resolution, minimizing potential disruptions or legal complications. It is essential to note that there can be multiple types of Harris Texas Stockholders Agreements and variations in their terms depending on specific circumstances. These may include different terms for the transfer of shares, changes in corporate control, additional protective provisions, or customized clauses based on the parties' negotiation and requirements. Overall, the Harris Texas Stockholders Agreement is a comprehensive legal document that protects the interests of Unilab Corp., Also Investment Associates VI, LLP, KEEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors. It ensures transparency, stability, and fairness in the corporate governance and operations of the company.

Harris Texas Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors

Description

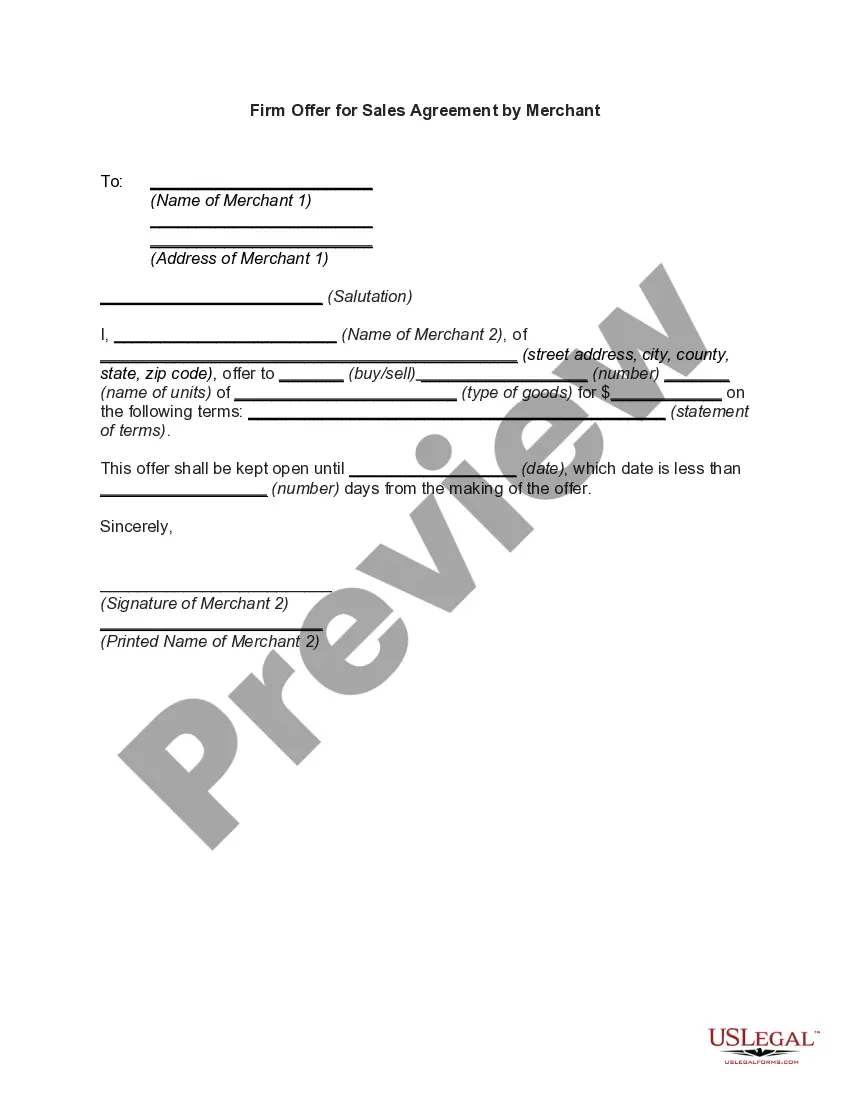

How to fill out Harris Texas Stockholders Agreement Between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, And Rollover Investors?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Harris Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Harris Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Harris Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a few clicks!