The Mecklenburg North Carolina Stockholders Agreement is a legally binding contract between Unilab Corp., Also Investment Associates VI, LLP, KEEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors. This agreement outlines the rights, obligations, and responsibilities of each party as stockholders in Mecklenburg, North Carolina. The agreement establishes the terms under which the stockholders will exercise their rights as owners of the company, including voting rights, dividend distributions, and the transfer of shares. It also addresses the governance and management of the company, specifying the composition and powers of the board of directors, the appointment of officers, and the decision-making process for major corporate matters. These stockholders' agreement ensures that each party's interests are protected and that there is a clear framework for decision-making and dispute resolution. It establishes guidelines for the sale, transfer, or issuance of shares, as well as restrictions on the transferability of shares to outside parties. The agreement also includes clauses related to confidentiality, non-compete agreements, and non-disclosure, ensuring that sensitive information remains confidential and that the parties cannot engage in activities that could harm the company or each other. There may be different types of Mecklenburg North Carolina Stockholders Agreements between these specific parties, depending on their individual roles, ownership percentages, and investment arrangements. These agreements could include variations such as: 1. Preferred Stockholders Agreement: If any of the parties hold preferred stock, this agreement may outline additional rights and preferences granted to them, such as priority in liquidation or dividends. 2. Voting Agreement: In the case where any party has significant voting power, a separate voting agreement may be drafted to establish voting commitments, proxy arrangements, or voting thresholds for certain decisions. 3. Investor Rights Agreement: This type of agreement may exist if there are specific investor rights that need to be protected, such as rights to information, participation in future financing rounds, or registration rights for the sale of shares. It is important for all parties involved to carefully review and negotiate the specific terms and conditions of the Mecklenburg North Carolina Stockholders Agreement to ensure a fair and mutually beneficial arrangement that aligns with their respective investment goals and interests.

Mecklenburg North Carolina Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors

Description

How to fill out Mecklenburg North Carolina Stockholders Agreement Between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, And Rollover Investors?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Mecklenburg Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Mecklenburg Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors from the My Forms tab.

For new users, it's necessary to make several more steps to get the Mecklenburg Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors:

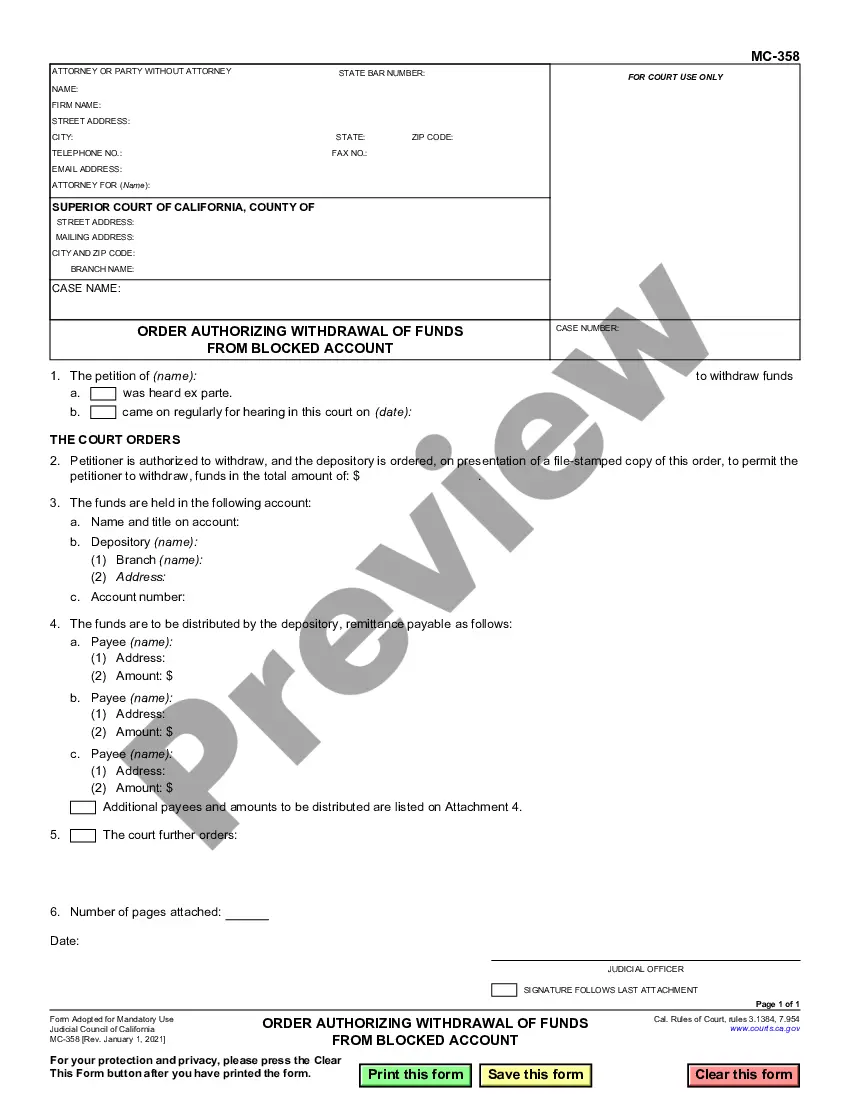

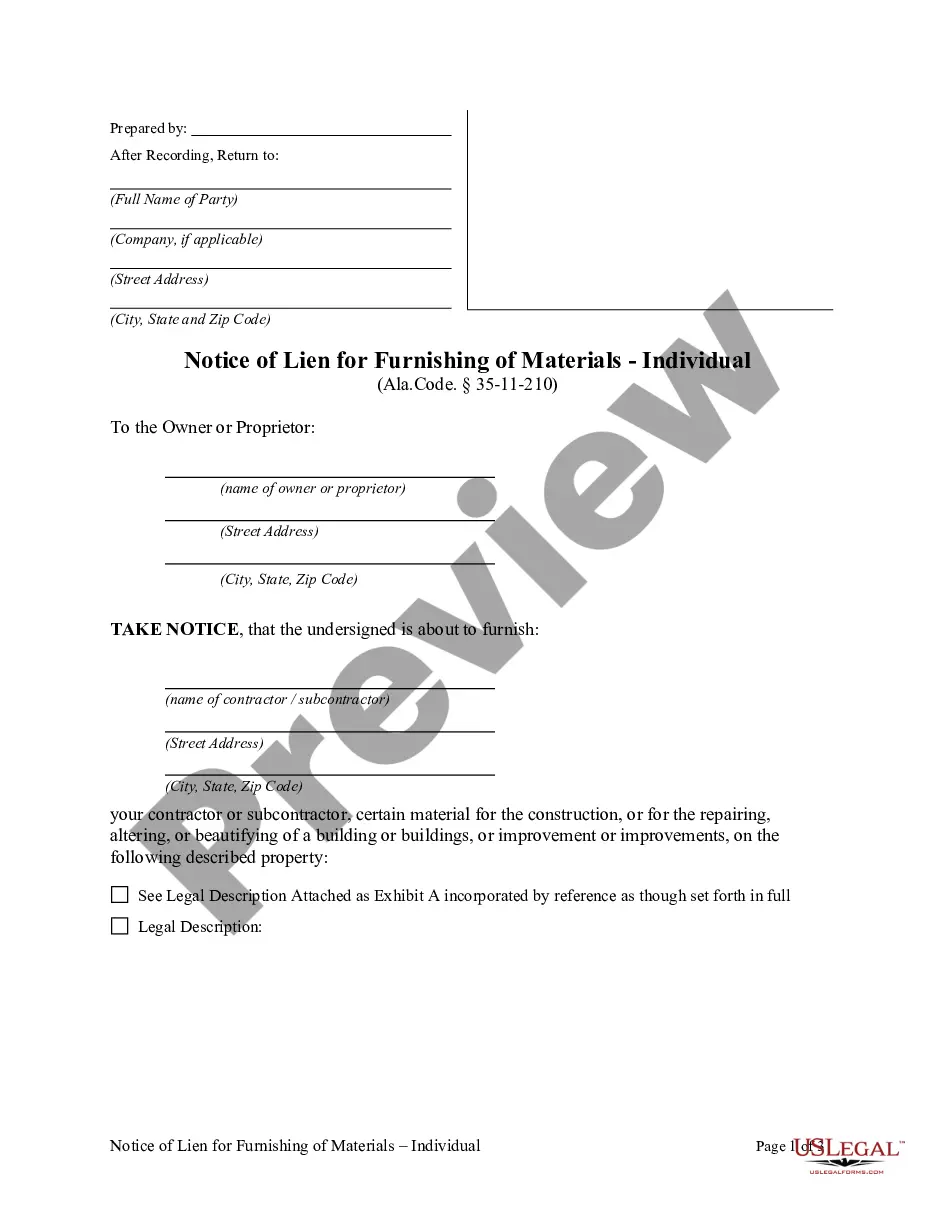

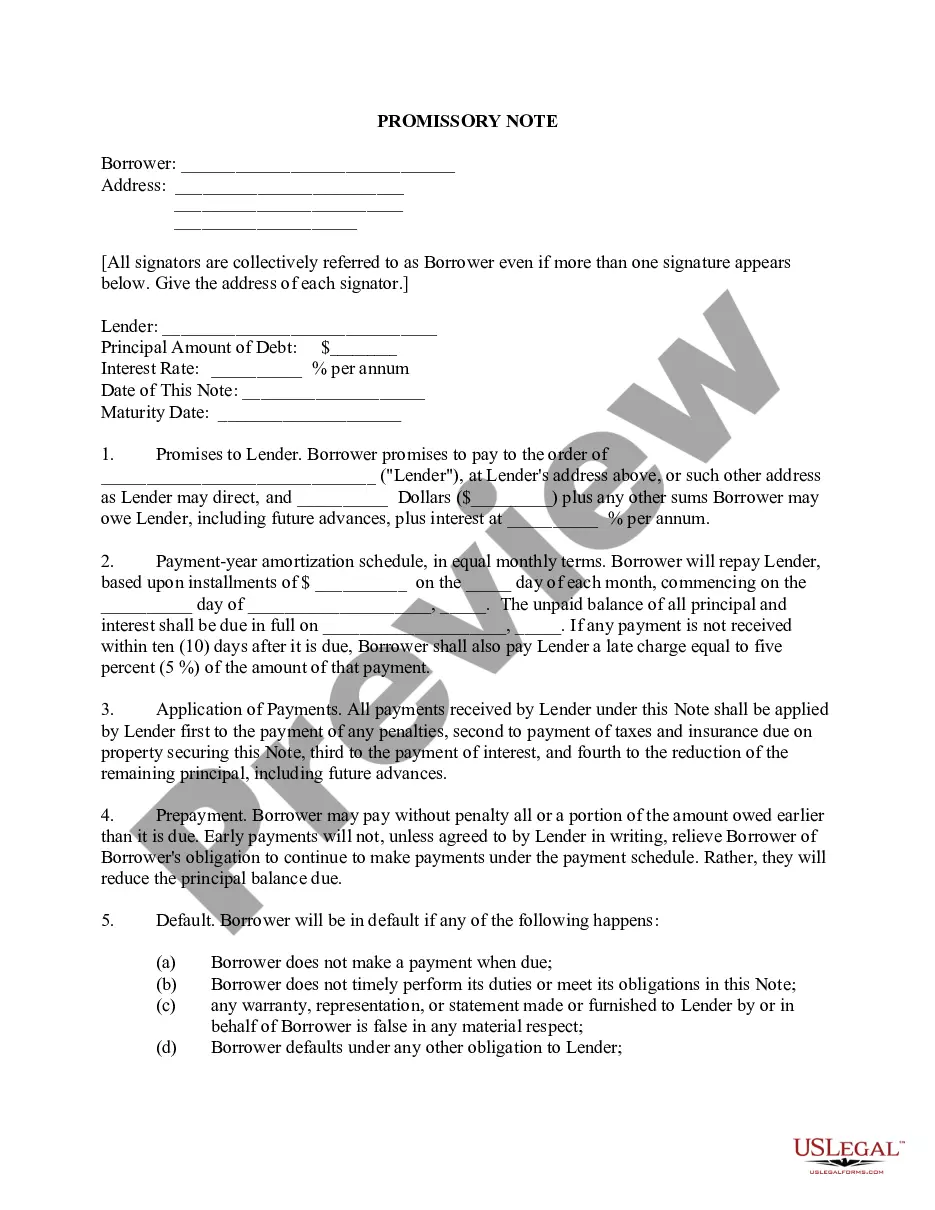

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.