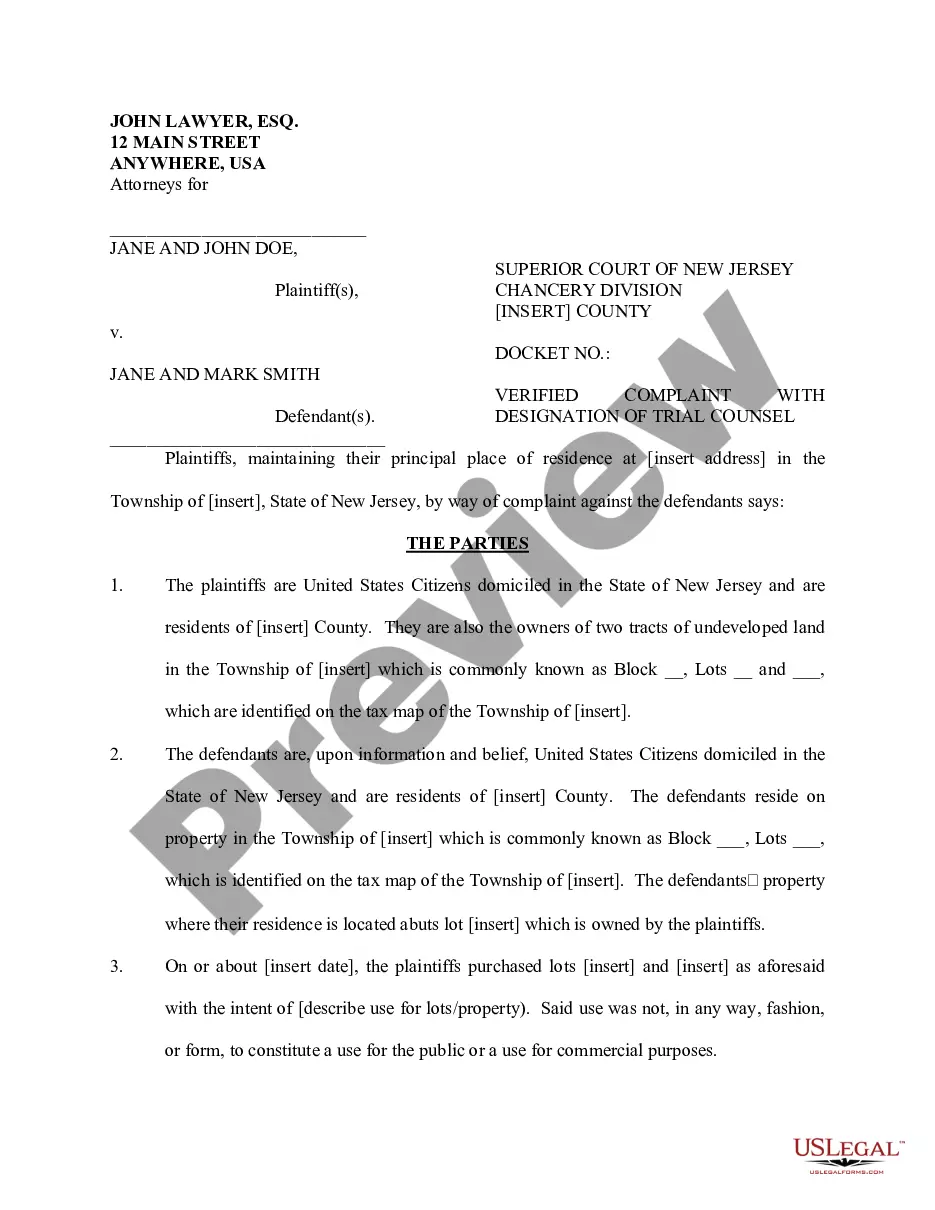

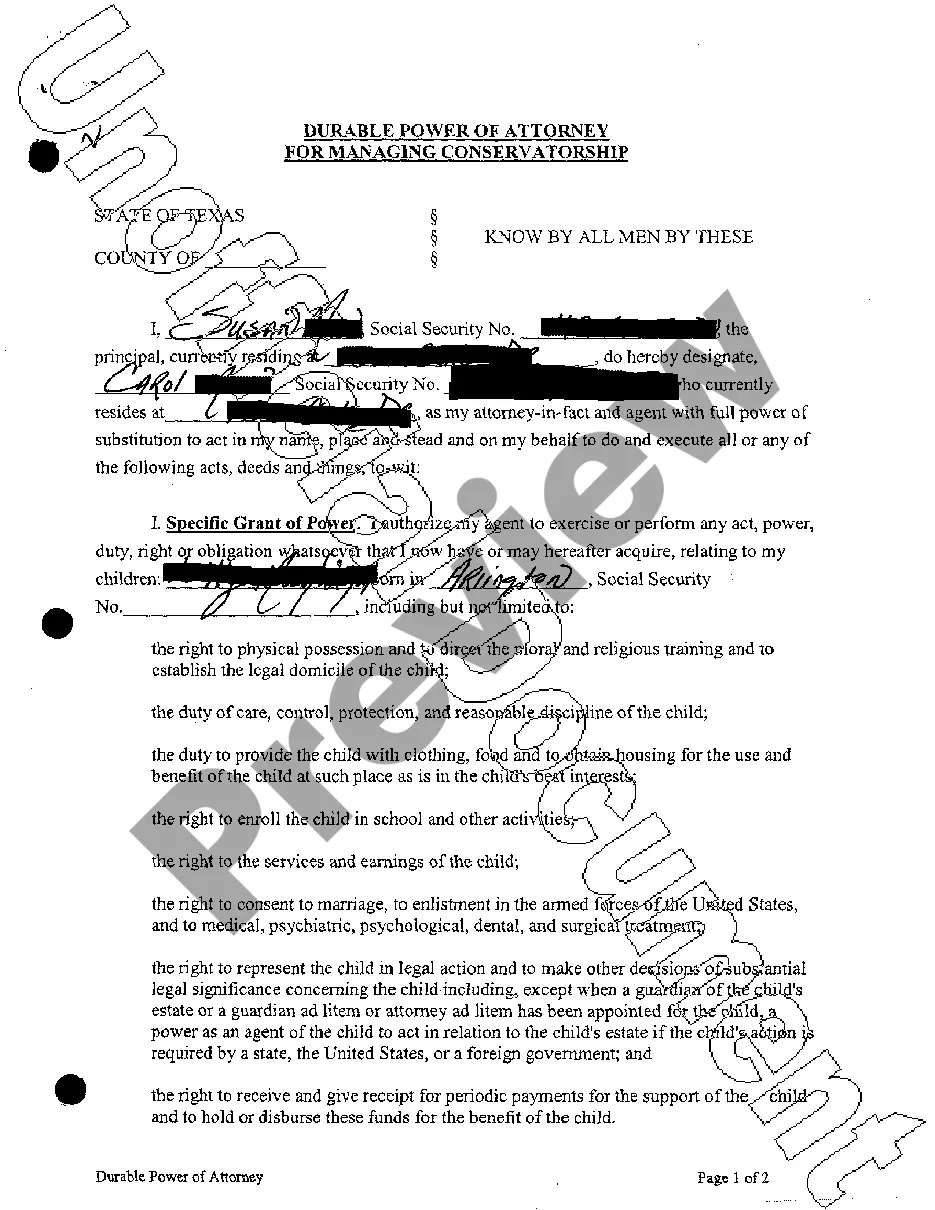

A San Diego California Registration Rights Agreement is a legally binding contract that outlines the rights and obligations of Visible Genetics, Inc. (the company) and the purchasers of common shares of the company. This agreement ensures that the shareholders have certain rights related to the registration of their shares with the Securities and Exchange Commission (SEC) and the company's compliance with applicable securities laws. The Registration Rights Agreement is crucial for shareholders as it ensures that they have the opportunity to sell their shares in the public market, as well as provides them with the necessary information and access to the registration process. It is designed to protect the interests of both parties involved. Key provisions in a typical San Diego California Registration Rights Agreement may include: 1. Demand Registration: This provision grants the shareholders the right to request the company to register their shares with the SEC. The company is obligated to fulfill this request within a specified timeframe and bear the associated costs. 2. Piggyback Registration: Shareholders may have the right to include their shares in any registration statement filed by the company, allowing them to sell their shares alongside the company or other selling shareholders. 3. S-3 Registration: This provision grants eligible shareholders the right to demand registration of their shares on Form S-3, simplifying the registration process and reducing associated costs. 4. Expenses: The agreement may specify how the registration expenses, such as legal and accounting fees, will be shared between the company and the shareholders. 5. Lock-Up Periods: It is common for the Registration Rights Agreement to include lock-up provisions, restricting shareholders from selling their registered shares for a specified period after the registration statement becomes effective. Different types of San Diego California Registration Rights Agreements between Visible Genetics, Inc. and the purchasers of common shares may include variations in the aforementioned provisions, depending on the specific circumstances and negotiations between the parties involved. In conclusion, a San Diego California Registration Rights Agreement is a crucial document for Visible Genetics, Inc. and its shareholders, as it outlines the rights and obligations related to the registration and sale of shares. It ensures transparency, compliance, and protection for both the company and its shareholders.

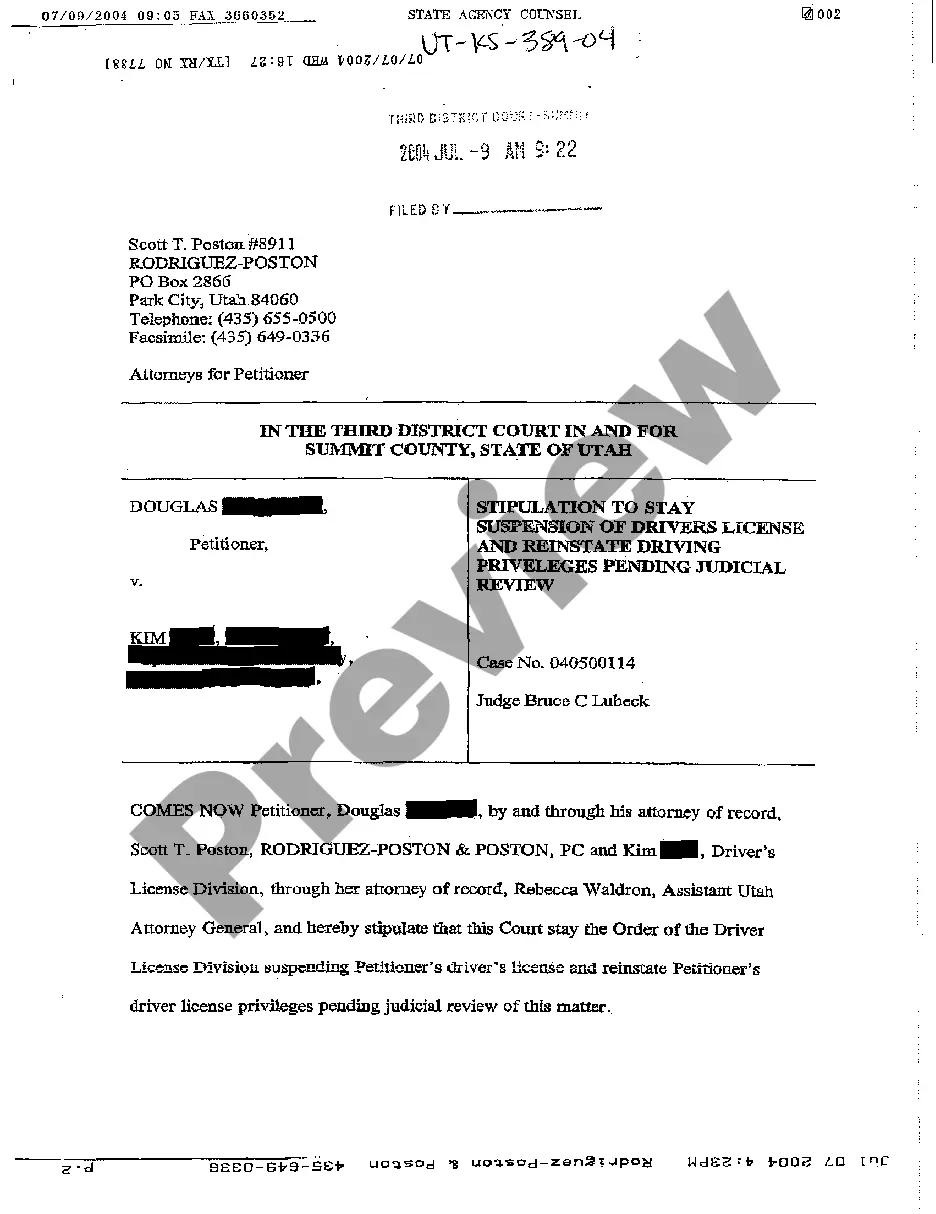

San Diego California Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company

Description

How to fill out San Diego California Registration Rights Agreement Between Visible Genetics, Inc. And The Purchasers Of Common Shares Of The Company?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like San Diego Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the San Diego Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

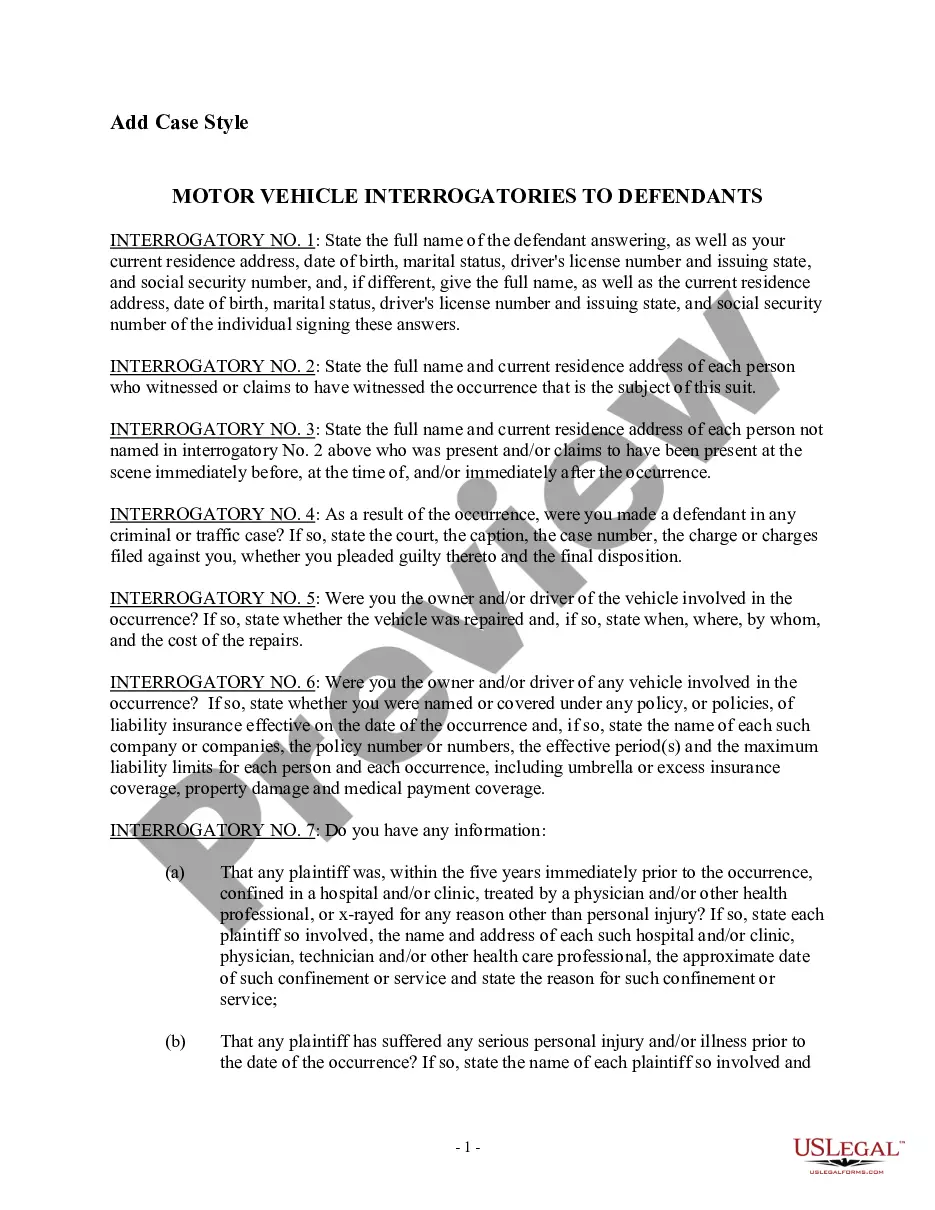

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Stock registration is the process of registering a company's stock for sale to the public. In the United States, this requires the filing of registration documents with the Securities and Exchange Commission (SEC), which can be an expensive and lengthy process.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

Piggybacking is defined as the post-award use of a contractual document/process that allows an entity that was not contemplated in the original procurement to purchase the same supplies/equipment through that original document/process.

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

As the name implies, demand registration rights are rights that warrant investors to force the company's hand into registering shares of common stock, thus allowing them to sell them to the public. This means that the business in question must become a publicly traded entity if it isn't one already.

(Finance: Investment) Piggyback investing is a situation in which a broker repeats a trade on his own behalf immediately after trading for an investor, because he thinks the investor may have inside information.

Piggyback registration rights, where the investor is entitled to register its securities when either the company or another investor initiates the registration. Holders of piggyback rights are allowed to include their securities in a registration initiated by the company or another investor.