A Collin Texas Natural Gas Inventory Forward Sale Contract is a specific type of agreement made between a seller and a buyer for the forward sale of natural gas inventory in the Collin County area of Texas. This contract represents a legally binding commitment to deliver a predetermined amount of natural gas at a future date, thereby allowing both parties to manage their risks associated with price fluctuations and availability of natural gas. Key provisions of a Collin Texas Natural Gas Inventory Forward Sale Contract include the quantity and quality specifications of the natural gas, the delivery period, pricing terms, and any additional terms and conditions agreed upon by the parties involved. The contract provides clarity and certainty by establishing the obligations and rights of both the seller and the buyer. There are different types of Collin Texas Natural Gas Inventory Forward Sale Contracts that can be categorized based on their duration, pricing mechanisms, and physical settlement. Some common types include fixed price contracts, index price contracts, and swing contracts. 1. Fixed Price Contract: In a fixed price contract, the buyer and seller agree on a predetermined fixed price for the natural gas for the entire duration of the contract. This type of contract provides price stability for both parties, protecting them from market fluctuations. It is particularly popular for long-term agreements. 2. Index Price Contract: An index price contract links the price of natural gas to a specified index, such as the Henry Hub Natural Gas Index. The contract price is determined based on the index value at a specified date or a predetermined time frame before the delivery period. This type of contract allows for some flexibility in pricing while still providing a degree of predictability. 3. Swing Contract: A swing contract provides the buyer with the option to vary the quantity of natural gas to be delivered within certain predetermined parameters. This contract type allows the buyer to adjust their delivery amounts based on demand fluctuations, providing flexibility in managing inventory levels. Collin Texas Natural Gas Inventory Forward Sale Contracts are commonly used by natural gas producers, pipeline companies, utilities, and industrial users. These contracts play a crucial role in ensuring the predictable supply and pricing of natural gas in the region, enabling all parties involved to efficiently plan their natural gas requirements and mitigate potential risks.

Collin Texas Natural Gas Inventory Forward Sale Contract

Description

How to fill out Collin Texas Natural Gas Inventory Forward Sale Contract?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Collin Natural Gas Inventory Forward Sale Contract without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Collin Natural Gas Inventory Forward Sale Contract on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Collin Natural Gas Inventory Forward Sale Contract:

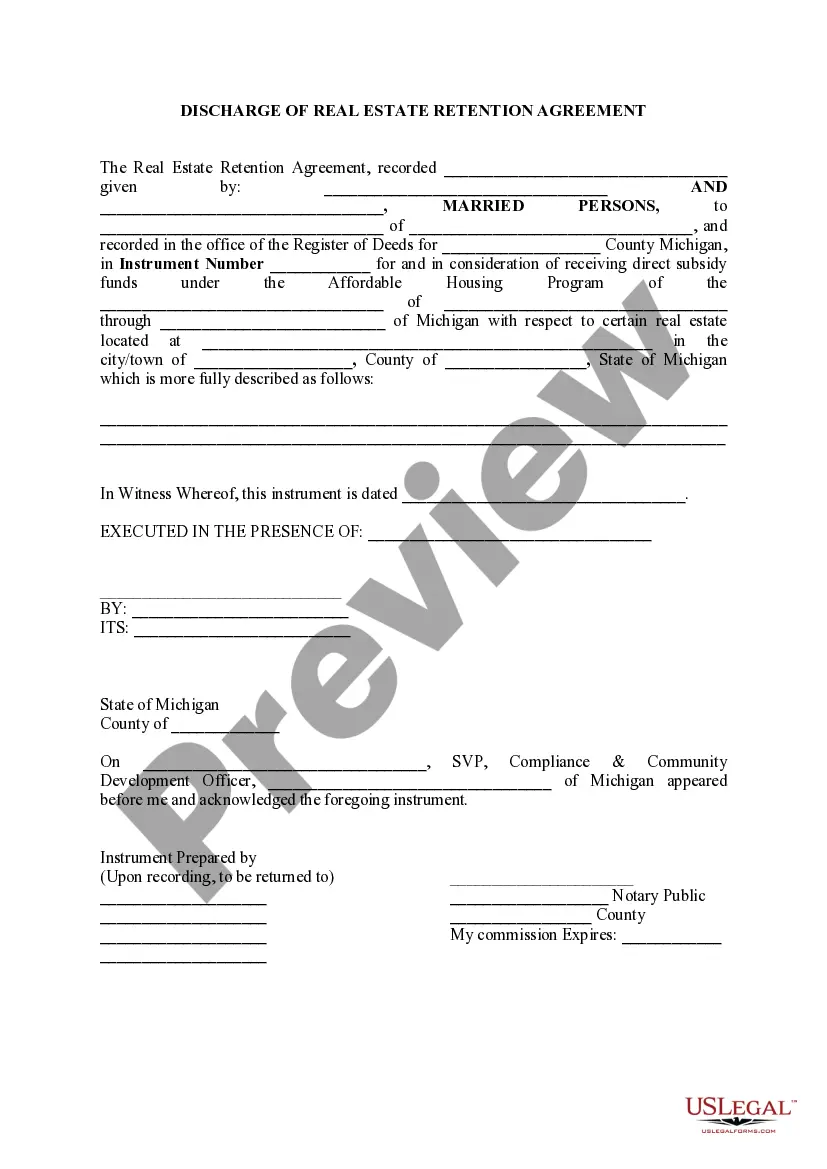

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

Natural gas futures contract specifications Exchange, Product Name, Product CodeNew York Mercantile Exchange (NYMEX), Henry Hub Natural Gas Futures, NGContract Size10,000 mmBtuMinimum Tick Size and Value0.001, worth $10.00 per contract.2 more rows

The most common way that traders take a position on natural gas is with a futures contract, such as the Henry Hub natural gas futures contract on the CME. With a futures contract, traders agree to the delivery of a certain amount of natural gas at a set date in the future for an agreed-upon price.

A forward contract allows you to buy or sell an asset on a specified future date. To account for one, start by crediting the Asset Obligation for the current value of the good on the liability side of the equation. Then, on the asset side, debit the Asset Receivable for the forward rate, or future value of the good.

There are two fundamental ways to price natural gas: (1) fixed price or (2) index priced. If you have a fixed price, then the contract should specify a price in million British thermal units (MMBtu) also referred to as Dekath- erms (DTH) or Therms.

Each futures contract specifies is the quantity of the product delivered for a single contract, also known as contract size. For example: 5,000 bushels of corn, 1,000 barrels of crude oil or Treasury bonds with a face value of $100,000 are all contract sizes as defined in the futures contract specification.

0.001, worth $10.00 per contract. Natural gas futures are traded electronically on the Globex® trading platform from p.m. U.S. ET until p.m. U.S. ET, Sunday through Friday. Primary natural gas futures contracts trade every calendar month, from January through December.

What Are Natural Gas Futures? A natural gas future - like all commodities - is a contract obligating the buyer to purchase a specific quantity of natural gas at a future date and price. Delivery dates are set around the 15th day of the following month.

A futures contract for natural gas can be traded on the NYMEX, Intercontinental Exchange ( ICE ), or Multi Commodity Exchange (MCX). The NYMEX is the commodity benchmark in the United States while the ICE and MCX are based out of the U.K. and India, respectively.

The most common way that traders take a position on natural gas is with a futures contract, such as the Henry Hub natural gas futures contract on the CME. With a futures contract, traders agree to the delivery of a certain amount of natural gas at a set date in the future for an agreed-upon price.