Orange California Natural Gas Inventory Forward Sale Contract is a financial agreement between two parties for the sale and purchase of natural gas inventory in Orange, California at a future date, at a predetermined price. The contract acts as a hedge against price fluctuations and is commonly used by natural gas producers, suppliers, and distributors to manage their risk exposure. The Orange California Natural Gas Inventory Forward Sale Contract allows participants to lock in a favorable price for the future delivery of natural gas, mitigating the volatility and uncertainty associated with the commodity market. This type of contract is typically settled in cash or physical delivery, depending on the terms negotiated between the buyer and the seller. There may be various types of Orange California Natural Gas Inventory Forward Sale Contracts, each tailored to the specific needs of the parties involved. Some variations of these contracts include: 1. Fixed-Price Forward Contract: Under this type of contract, the buyer and seller agree on a fixed price for the natural gas inventory to be delivered in the future. This provides stability and allows both parties to plan their operations accordingly. 2. Index-Based Forward Contract: In this type of contract, the price of the natural gas inventory is tied to a specific index, such as the Henry Hub Futures contract or the California Gas Index. The contract's price will adjust based on changes in the underlying index, offering some flexibility to both parties. 3. Swing Contract: The swing contract allows the buyer and seller to adjust the quantity of natural gas to be delivered within agreed-upon ranges, providing flexibility in the face of uncertain demand or supply conditions. 4. Heat-Rate Forward Contract: This variation of the Orange California Natural Gas Inventory Forward Sale Contract takes into account the energy content of the natural gas, using the heat rate as a basis for pricing. It allows participants to trade based on the energy value rather than the volume of natural gas. These different types of Orange California Natural Gas Inventory Forward Sale Contracts offer market participants a range of options to manage their risk exposure and ensure smooth operations within the natural gas industry. By utilizing these contracts, parties can benefit from price stability, mitigate potential losses, and optimize their inventory management strategies.

Orange California Natural Gas Inventory Forward Sale Contract

Description

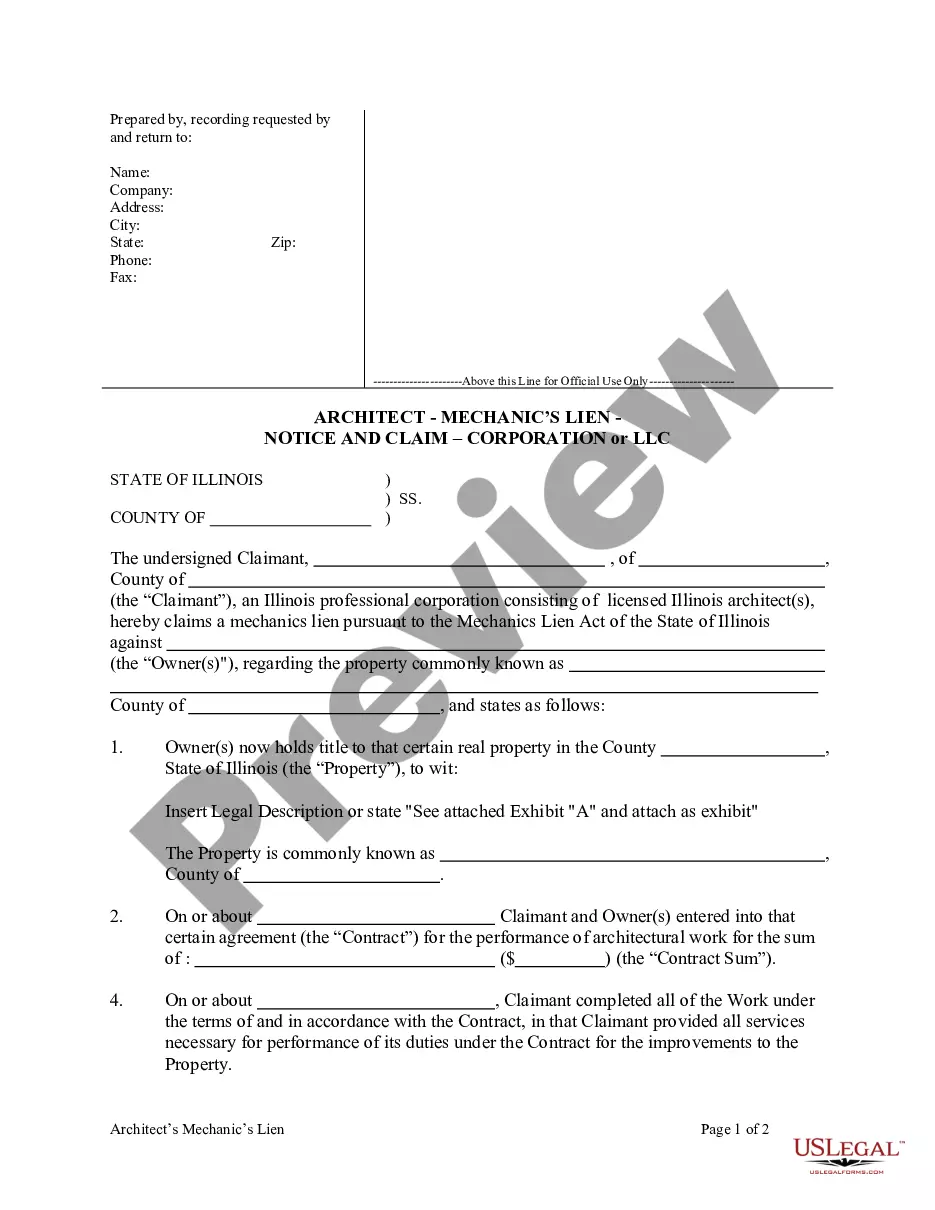

How to fill out Orange California Natural Gas Inventory Forward Sale Contract?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Orange Natural Gas Inventory Forward Sale Contract, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Therefore, if you need the current version of the Orange Natural Gas Inventory Forward Sale Contract, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Natural Gas Inventory Forward Sale Contract:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Orange Natural Gas Inventory Forward Sale Contract and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!