The Wake North Carolina Natural Gas Inventory Forward Sale Contract is a financial agreement made between a buyer and a seller in the natural gas industry. It involves the sale of natural gas inventory at a future date and is primarily used to manage price risks associated with natural gas supply. In this contract, the seller agrees to deliver a specified quantity of natural gas from their inventory to the buyer at a predetermined price. The delivery can be made on a specific date in the future or within a specified timeframe. The buyer, on the other hand, agrees to purchase the natural gas at the agreed-upon price and take delivery of it within the specified terms. There are two primary types of Wake North Carolina Natural Gas Inventory Forward Sale Contracts: 1. Fixed-Price Forward Contract: This type of contract fixes the price at which the natural gas will be bought or sold. It provides certainty to both parties involved, as they can lock in a predetermined price for future transactions. This type of contract is commonly used by buyers and sellers who want to hedge against potential price fluctuations or secure their natural gas supply at a known cost. 2. Index-Based Forward Contract: In this contract, the price of the natural gas is linked to an index, such as the commodity exchange price. The parties involved agree on a formula or a pricing mechanism that determines the final price based on the index value at the time of delivery. This type of contract allows for some flexibility in pricing and can be beneficial when there is uncertainty about future price movements. Overall, the Wake North Carolina Natural Gas Inventory Forward Sale Contract provides a mechanism for participants in the natural gas market to mitigate price risks and ensure a smooth supply of natural gas. It offers both buyers and sellers the opportunity to secure their positions in the market and manage their exposure to price volatility effectively.

Wake North Carolina Natural Gas Inventory Forward Sale Contract

Description

How to fill out Wake North Carolina Natural Gas Inventory Forward Sale Contract?

Creating documents, like Wake Natural Gas Inventory Forward Sale Contract, to take care of your legal affairs is a difficult and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for a variety of cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Wake Natural Gas Inventory Forward Sale Contract form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Wake Natural Gas Inventory Forward Sale Contract:

- Ensure that your form is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Wake Natural Gas Inventory Forward Sale Contract isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our website and download the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Natural gas futures contract specifications Exchange, Product Name, Product CodeNew York Mercantile Exchange (NYMEX), Henry Hub Natural Gas Futures, NGContract Size10,000 mmBtuMinimum Tick Size and Value0.001, worth $10.00 per contract.2 more rows

Each futures contract specifies is the quantity of the product delivered for a single contract, also known as contract size. For example: 5,000 bushels of corn, 1,000 barrels of crude oil or Treasury bonds with a face value of $100,000 are all contract sizes as defined in the futures contract specification.

A natural gas end-user (consumer) can hedge their exposure by purchasing natural gas futures contracts. On the other hand, a natural gas producer can hedge their exposure by selling natural gas futures contracts.

The price of gasoline is made up of four factors: taxes, distribution and marketing, the cost of refining, and crude oil prices. Of these four factors, the price of crude oil accounts for nearly 70% of the price you pay at the pump, so when they fluctuate (as they often do), we see the effects.

Natural gas futures contract specifications Exchange, Product Name, Product CodeNew York Mercantile Exchange (NYMEX), Henry Hub Natural Gas Futures, NGContract Size10,000 mmBtuMinimum Tick Size and Value0.001, worth $10.00 per contract.2 more rows

For natural gas futures, it is $0.01 per million BTUs. Daily Price Limit (not applicable in electronic markets): $3 per million BTUs; contracts may expand by $3 in either direction if they are traded, bid, or offered.

Traders can trade natural gas futures directly on futures markets or through funds like ETFs that trade on stock exchanges.

LNG contract prices are typically expressed as a slope, or percentage, of Brent prices. For example, a 12% slope of the current front-month Brent price of $84.74 a barrel would translate to LNG price of roughly$10.17 per mmBtu, though the contracts may not be that straightforward on pricing.

What is Basis? Basis is the price differential between the NYMEX (the general benchmark) and the local cost of gas (the specific location). It is often mistaken with transport, but transport is only one of multiple factors that can play into basis pricing.

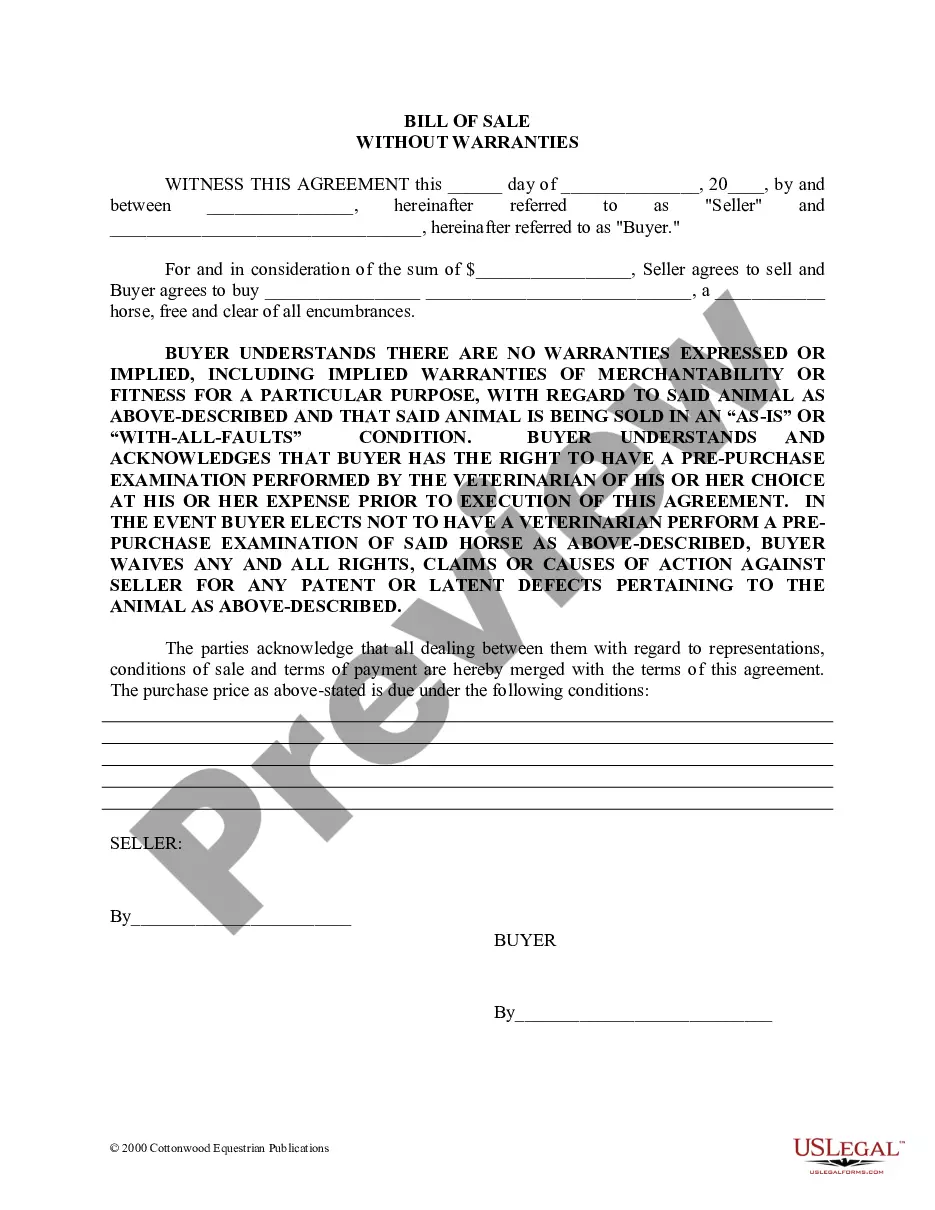

There are two fundamental ways to price natural gas: (1) fixed price or (2) index priced. If you have a fixed price, then the contract should specify a price in million British thermal units (MMBtu) also referred to as Dekath- erms (DTH) or Therms.