Maricopa Arizona Subsidiary Assumption Agreement Overview In Maricopa, Arizona, a Subsidiary Assumption Agreement is a legal document that outlines the assumption of debt or obligations by a subsidiary company within a larger corporate structure. This agreement is often utilized when a parent company wishes to transfer certain financial responsibilities to its subsidiary. Key Elements of a Maricopa Arizona Subsidiary Assumption Agreement 1. Parties involved: The agreement will identify the parent company, referred to as the "Transferor," and the subsidiary company, referred to as the "Transferee." 2. Assumed obligations: This agreement specifies the exact obligations or debts that the subsidiary company will assume. These may include loans, leases, or contractual liabilities. 3. Terms and conditions: The agreement will outline the terms and conditions under which the subsidiary company assumes the obligations. It may entail the repayment schedule, interest rates, collaterals, and any penalties or default provisions. 4. Release of the transferor: An essential aspect of the agreement is the release of the transferor from the obligations assumed by the subsidiary company. This section clarifies that the parent company will no longer be responsible for the specific liabilities transferred. Different Types of Maricopa Arizona Subsidiary Assumption Agreements 1. Debt Assumption Agreement: This type of agreement is used when a subsidiary company assumes the outstanding debts of the parent company. It allows the parent company to alleviate its financial burden by transferring specific liabilities to the subsidiary. 2. Lease Assumption Agreement: When a parent company holds various leases for properties or equipment, a subsidiary can assume these lease obligations through a lease assumption agreement. This allows the parent company to transfer lease payments and obligations to its subsidiary. 3. Contractual Assumption Agreement: In certain cases, a parent company may want to transfer contractual obligations, such as service agreements, supply contracts, or customer warranties, to a subsidiary. A contractual assumption agreement facilitates this transfer, ensuring the subsidiary takes on these responsibilities. It is crucial for all parties involved in a Maricopa Arizona Subsidiary Assumption Agreement to consult legal professionals to ensure compliance with applicable state laws and to protect their respective rights and interests.

Maricopa Arizona Subsidiary Assumption Agreement

Description

How to fill out Maricopa Arizona Subsidiary Assumption Agreement?

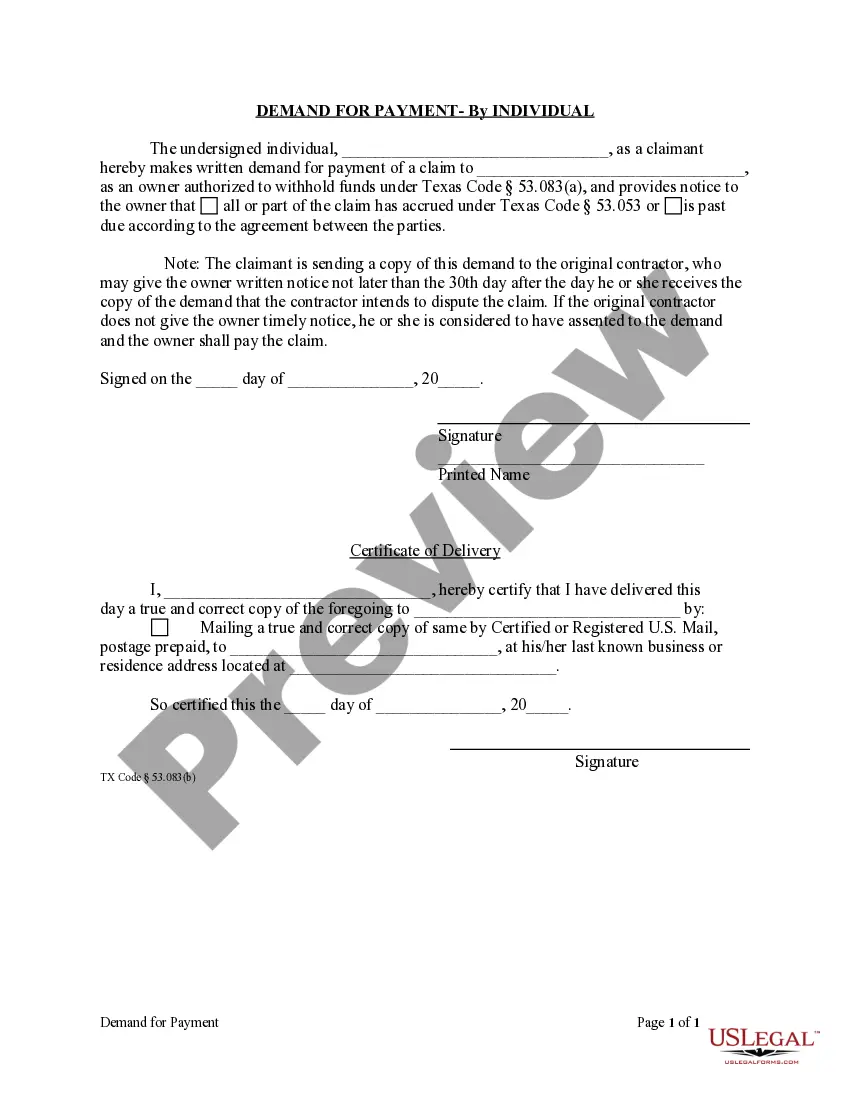

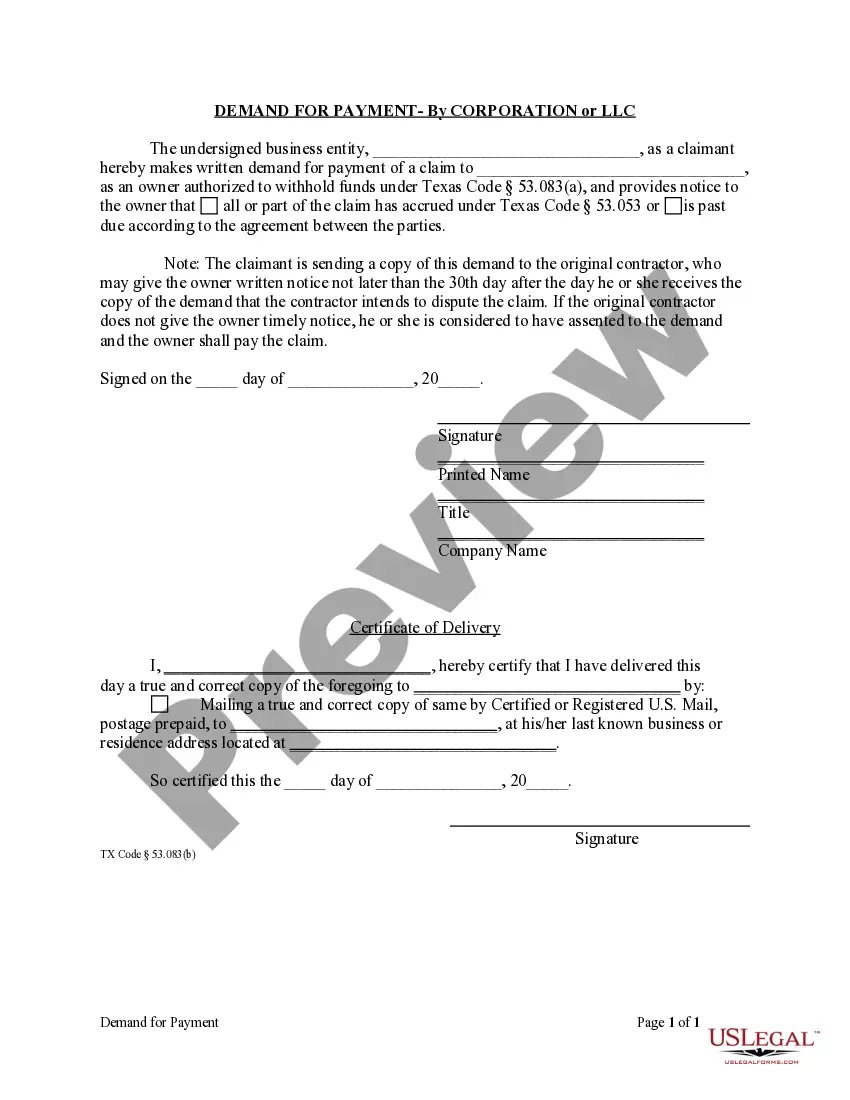

If you need to find a trustworthy legal form supplier to obtain the Maricopa Subsidiary Assumption Agreement, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to locate and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Maricopa Subsidiary Assumption Agreement, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Maricopa Subsidiary Assumption Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Maricopa Subsidiary Assumption Agreement - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

The Senior Property Valuation Protection Option (Senior Freeze) is available to residential homeowners, 65 years of age or older, who meet specific guidelines based on income, ownership, and residency (Arizona Constitution, Article 9, Section 18.)

Annual property tax statements are issued on a calendar year basis and are printed and mailed in September of that year. The September statement has two payment stubs thereby avoiding the waste of taxpayers money on a second billing.

The Public Records Office is open 8 a.m. to 5 p.m. Monday through Friday except state holidays and is on the first floor at 1616 W. Adams St., Phoenix, AZ 85007. The telephone number is 602-542-4631.

However, certain changes, such as new constructions or additions, parcel splits or consolidations, or changes to a property's use trigger a reassessment of the LPV.

Pay online using an E-check or you may make an E-check payment by calling FIS Customer service Toll Free at 866-757-3948. If remitting funds from a Business Account, please provide your financial institution with our third party processor's Merchant ID information to ensure a successful payment.

The Maricopa County Recorder's Office is capable of receiving and recording documents, plat and survey maps...

A title search in Arizona must be done by going to the recorder in the county in which the property is located. Some counties have parcel information online, while others require you to physically go to the office. Step 1 ? Go to This Website and locate the county in which the property is located.

Maricopa County Public Records Maricopa Assessor. (602) 506-3406. Go to Data Online. Maricopa Recorder. (602) 506-3535. Go to Data Online. Maricopa Treasurer. (602) 506-8511. Go to Data Online. Maricopa Mapping / GIS. Go to Data Online. Maricopa NETR Mapping and GIS.

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

Most Arizona county recorder offices or county assessors offices do have an online database property search. This source makes obtaining the Property Legal Description very easy. If you are online, merely go to the appropriate web address URL and run a search.