Nassau New York Subsidiary Assumption Agreement is a legal document often used in corporate transactions and acquisitions. This agreement outlines the terms and conditions under which a subsidiary company agrees to assume certain responsibilities and liabilities from its parent company. It serves as a safeguard, ensuring a smooth transition and protection for both parties involved. The Nassau New York Subsidiary Assumption Agreement specifies various key details, including the specific assets, debts, contracts, and obligations that the subsidiary will take on from the parent company. It also outlines any limitations or exclusions, ensuring a clear understanding of the scope of the assumption. There are several types of Nassau New York Subsidiary Assumption Agreements, each serving a different purpose. Some common variations include: 1. Asset Assumption Agreement: This type of agreement pertains to the transfer of specific assets, such as real estate, intellectual property, contracts, and inventory, from the parent company to the subsidiary. It ensures the subsidiary assumes ownership, control, and any associated liabilities. 2. Debt Assumption Agreement: In situations where a parent company holds existing debts or loans, a subsidiary may assume these obligations through a debt assumption agreement. This agreement specifies the repayment terms and conditions, clarifying the subsidiary's responsibility. 3. Contract Assumption Agreement: When a parent company has ongoing contracts with third parties, the subsidiary may assume these agreements through a contract assumption agreement. This legal document allows the subsidiary to step into the shoes of the parent company, assuming all rights and obligations stipulated in the contracts. 4. Liability Assumption Agreement: A liability assumption agreement primarily focuses on transferring specific liabilities from the parent company to the subsidiary. This ensures that the subsidiary assumes responsibility for any legal claims, pending litigation, or other financial obligations associated with the transferred assets or operations. It is crucial to consult legal experts to draft and customize the Nassau New York Subsidiary Assumption Agreement to suit the specific needs of the transaction. These agreements play a vital role in protecting the interests of both the parent company and the subsidiary, ensuring a seamless and legally compliant transfer of assets, debts, contracts, and liabilities.

Nassau New York Subsidiary Assumption Agreement

Description

How to fill out Nassau New York Subsidiary Assumption Agreement?

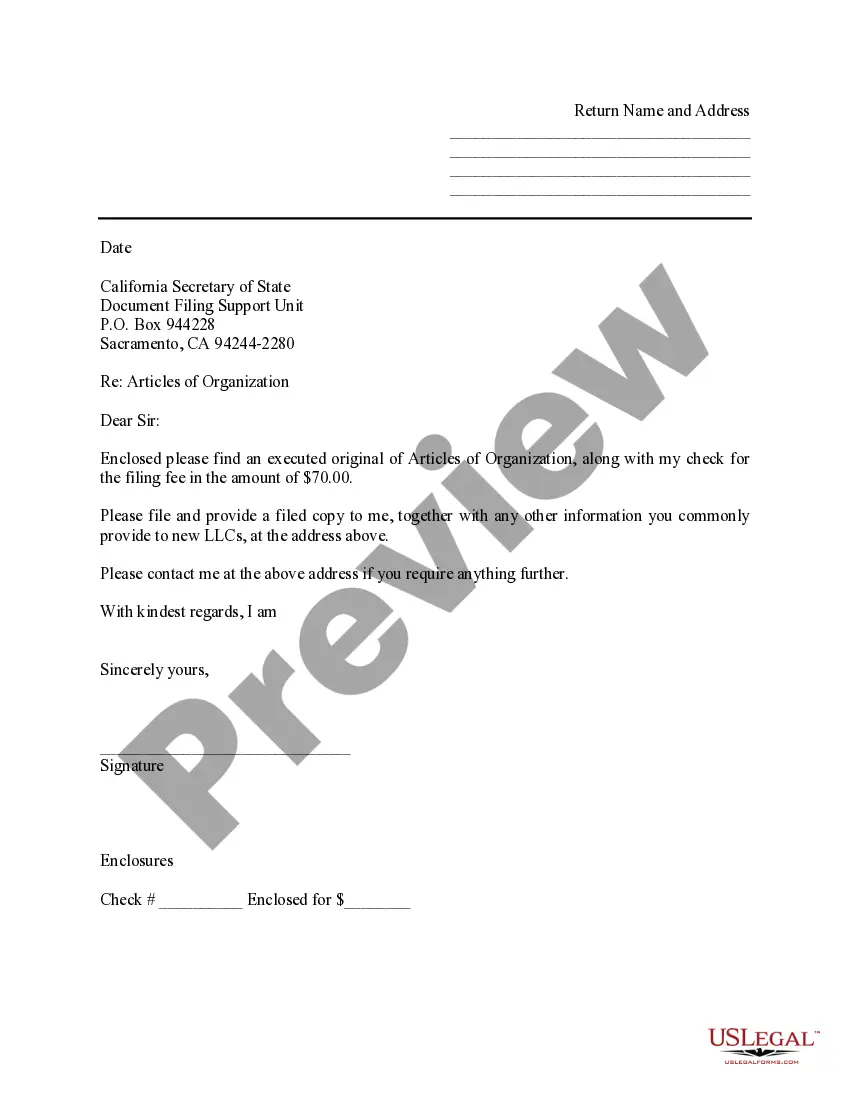

Draftwing forms, like Nassau Subsidiary Assumption Agreement, to manage your legal affairs is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for a variety of cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Nassau Subsidiary Assumption Agreement form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Nassau Subsidiary Assumption Agreement:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Nassau Subsidiary Assumption Agreement isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!