The Suffolk New York Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMB His a legal document outlining the transfer of shares from one company to one or more qualified subsidiaries. This agreement facilitates the transfer of ownership and enables the parent company, Deutsche Telecom AG, to distribute its shares among its subsidiaries in a structured and controlled manner. This type of transfer agreement is commonly used in corporate transactions, particularly when a parent company seeks to streamline its operations by consolidating its ownership structure. By transferring shares to qualified subsidiaries, Deutsche Telecom AG can optimize its management and corporate structure, allowing each subsidiary to operate independently while still being under the parent company's supervision. The Suffolk New York Transfer Agreement ensures that the transfer of shares adheres to legal requirements and provides guidelines for the transfer process. The agreement typically includes provisions related to share valuation, transfer pricing, shareholder rights, regulatory compliance, and other relevant matters. Additionally, it may specify the timeframe within which the transfer should occur and any necessary approvals or permissions needed from relevant regulatory authorities. It is important to note that there may be variations of the Suffolk New York Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GmbH regarding the transfer of shares to qualified subsidiaries. These variations could arise due to differences in the structure or nature of the subsidiaries involved, the specific assets or shares being transferred, or other unique circumstances that may impact the transfer process. Overall, the Suffolk New York Transfer Agreement serves as a crucial legal framework that governs the transfer of shares from Deutsche Telecom AG to one or more qualified subsidiaries. By adhering to this agreement, both parties can ensure a smooth and legally compliant transfer of ownership, enabling effective corporate restructuring and optimizing the overall operations of the parent company and its subsidiaries.

Suffolk New York Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries

Description

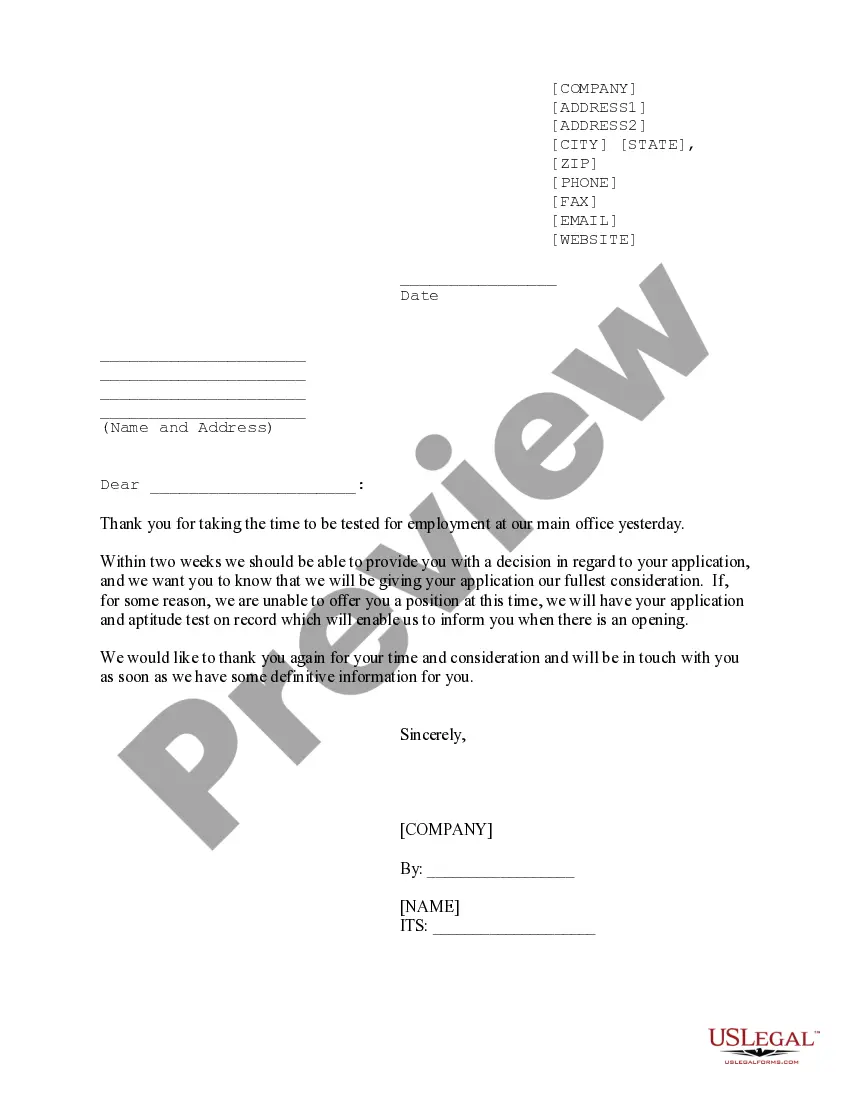

How to fill out Suffolk New York Transfer Agreement Between Deutsche Telecom AG And NAB Nordamerika Beteiligungs Holding GMBH Regarding Transfer Of Shares To One Or More Qualified Subsidiaries?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Suffolk Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Suffolk Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!