Wayne Michigan Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMB His a legal document that outlines the terms and conditions for the transfer of shares to one or more qualified subsidiaries. This agreement ensures a smooth and transparent transfer of ownership within the telecommunications' industry. In this particular agreement, Deutsche Telecom AG, a leading global telecommunications company, agrees to transfer a certain number of shares to NAB Nordamerika Beteiligungs Holding GmbH, a subsidiary of NAB Bank, for the purpose of expanding their presence in the North American market. The agreement emphasizes the importance of complying with all applicable laws and regulations, as well as maintaining confidentiality throughout the transfer process. Some key elements covered in the agreement include: 1. Parties Involved: The agreement clearly identifies Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMB Has the two parties involved in the transfer process. It also lists their respective roles and responsibilities throughout the agreement. 2. Share Transfer Details: The agreement specifies the number of shares to be transferred from Deutsche Telecom AG to NAB Nordamerika Beteiligungs Holding GmbH. It also outlines the payment terms and any conditions attached to the transfer. 3. Qualified Subsidiaries: The agreement may include provisions allowing NAB Nordamerika Beteiligungs Holding GmbH to transfer the received shares to one or more qualified subsidiaries. These subsidiaries are expected to meet certain criteria, such as financial stability and compliance with relevant laws and regulations. 4. Due Diligence: The agreement emphasizes the importance of conducting thorough due diligence before finalizing the share transfer. This includes assessing the financial health and legal standing of the qualified subsidiaries, as well as any potential risks associated with the transfer. 5. Governance and Reporting: The agreement may outline the governance and reporting requirements for both parties involved. This may include regular reporting on the performance and financial status of the transferred shares and qualified subsidiaries, as well as mechanisms for dispute resolution. It is important to note that while this description provides a general overview of the Wayne Michigan Transfer Agreement, there may be different types or versions of this agreement that exist. These variations can include specific clauses and terms tailored to the unique circumstances and goals of Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GmbH.

Wayne Michigan Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries

Description

How to fill out Wayne Michigan Transfer Agreement Between Deutsche Telecom AG And NAB Nordamerika Beteiligungs Holding GMBH Regarding Transfer Of Shares To One Or More Qualified Subsidiaries?

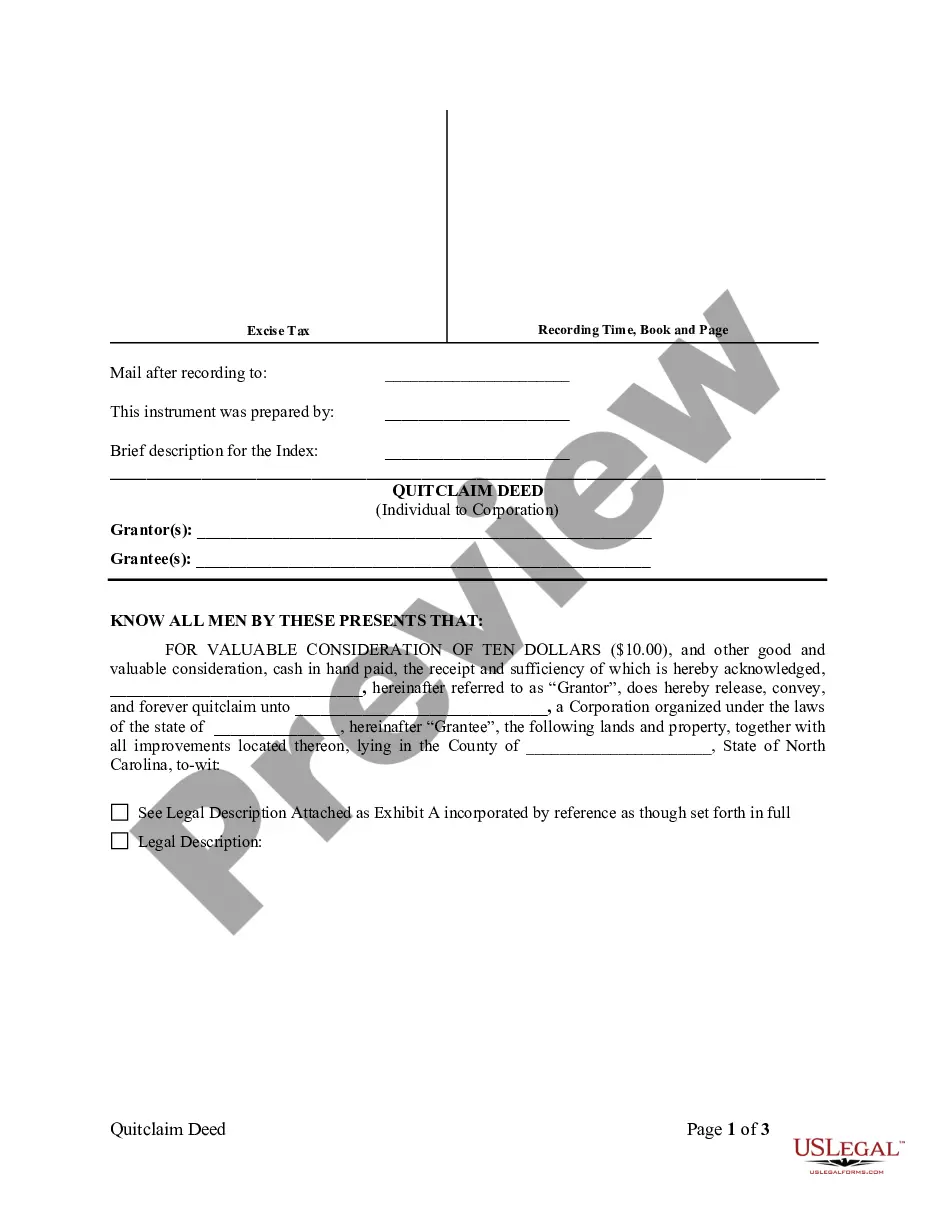

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Wayne Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Wayne Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Wayne Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries:

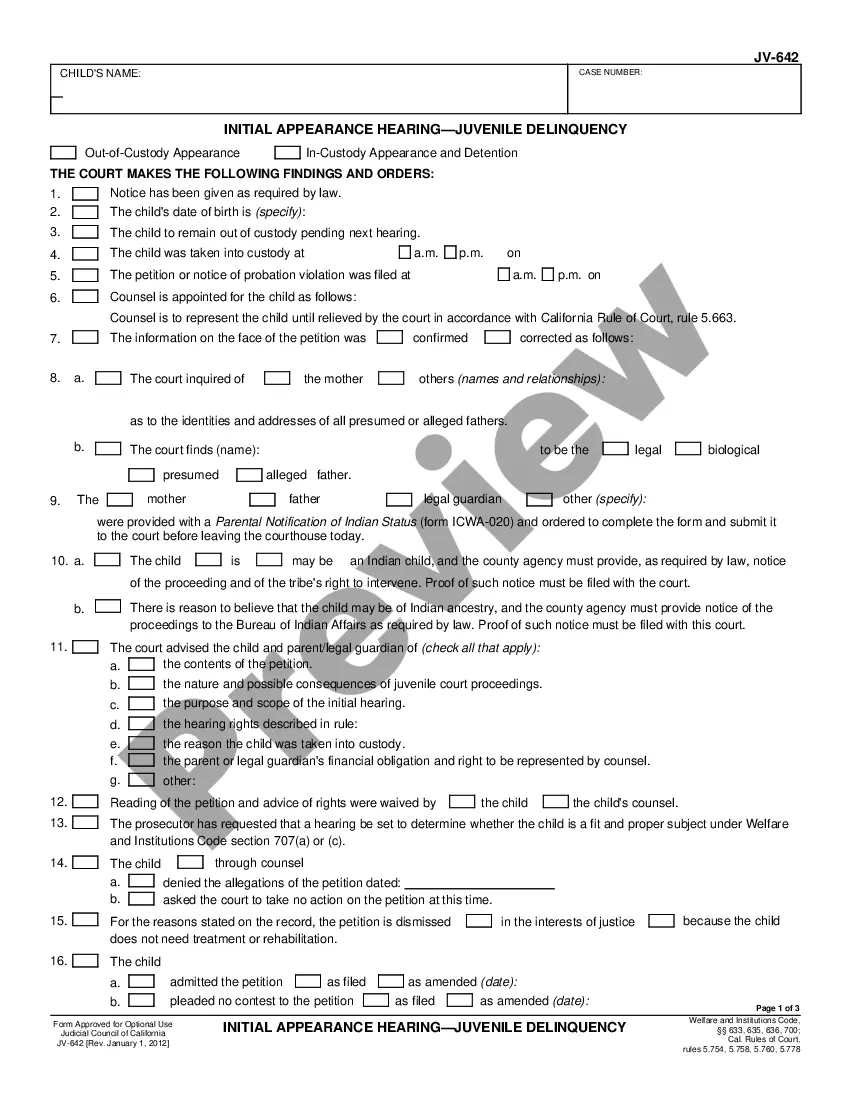

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wayne Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!