Santa Clara California Granter Trust Agreement is a legally binding document between Cumberland Mountain Ranchers, James J. Shaffer, et al., that establishes a trust relationship where Cumberland Mountain Ranchers acts as the granter, transferring assets to the trust for the benefit of James J. Shaffer and other designated beneficiaries. The agreement lays out the terms and conditions under which the trust operates, including its purpose, duration, and administration. It provides a detailed description of the assets contributed to the trust, such as real estate, stocks, bonds, or other investments. The Santa Clara California Granter Trust Agreement may include specific provisions regarding income distribution, tax implications, and investment decisions. It ensures that the granter retains certain control over the trust property while providing potential tax advantages, asset protection, and estate planning benefits. Different types of Santa Clara California Granter Trust Agreement between Cumberland Mountain Ranchers, James J. Shaffer, et al., may include: 1. Revocable Trust Agreement: This type of trust agreement allows the granter to modify or terminate the trust during their lifetime. It offers flexibility and allows for changes if circumstances warrant. 2. Irrevocable Trust Agreement: As the name suggests, this type of trust agreement cannot be modified or terminated once established, except under certain circumstances. It provides increased asset protection and potential tax benefits. 3. Testamentary Trust Agreement: This agreement is established through a will and only takes effect after the granter's death. It allows the granter to specify how assets will be managed and distributed for the benefit of the beneficiaries. 4. Living Trust Agreement: This type of agreement takes effect during the granter's lifetime, allowing them to place assets into the trust and retain control until their death or incapacity. It offers potential probate avoidance and privacy benefits. 5. Special Needs Trust Agreement: This agreement caters to the specific needs of a beneficiary with disabilities, ensuring that they can receive assets without affecting their eligibility for government assistance programs. 6. Charitable Trust Agreement: This type of agreement is designed to benefit charitable organizations, allowing the granter to make charitable contributions while potentially minimizing tax obligations. In summary, the Santa Clara California Granter Trust Agreement between Cumberland Mountain Ranchers, James J. Shaffer, et al., establishes a legal arrangement for the transfer of assets and management of trust property. The different types of trust agreements mentioned can cater to various objectives, providing guidelines for administration, taxation, and asset distribution.

Santa Clara California Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al.

Description

How to fill out Santa Clara California Grantor Trust Agreement Between Cumberland Mountain Bancshares, James J. Shoffner, Et Al.?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Santa Clara Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Santa Clara Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Santa Clara Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al.:

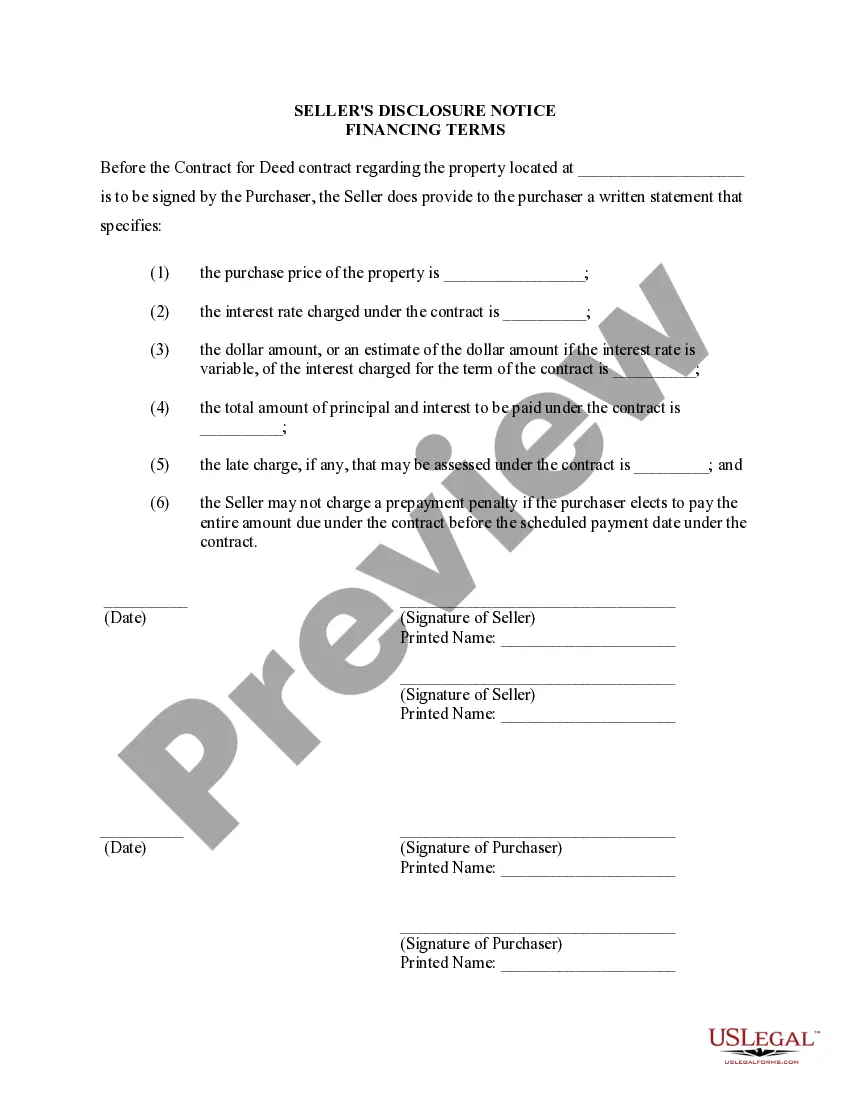

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!

Form popularity

Interesting Questions

More info

Download in .pdf format. PDFs for public use may be downloaded free of charge, provided that the documents are not sold, leased, or rented and that no alterations are made to them.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.