Allegheny Pennsylvania Pooling and Servicing Agreement is a legal document that outlines the terms and conditions for the sale of mortgage loans to the Trustee, with the purpose of including them in the Trust Fund. This agreement is primarily used in the mortgage industry to facilitate the transfer of loans and ensure compliance with relevant regulations. The Pooling and Servicing Agreement (PSA) serves as a contractual framework between the company, acting as the seller of the mortgage loans, and the Trustee, who is responsible for managing the loans within the Trust Fund. The PSA lays out the responsibilities, rights, and obligations of both parties involved in the transaction. The PSA details various aspects of the mortgage loan sale, including: 1. Loan Pool Composition: The agreement outlines the criteria for selecting and including mortgage loans in the Trust Fund. It may specify the types of loans eligible for inclusion, such as fixed-rate, adjustable-rate, or government-backed loans. The PSA may also include criteria related to loan size, geographic location, credit quality, or other relevant factors. 2. Loan Purchase Price: The agreement defines the purchase price for the mortgage loans being sold. It may specify how this price is determined, such as based on the outstanding principal balance, current interest rate, or other factors. 3. Representations and Warranties: The PSA includes representations and warranties made by the seller regarding the quality and characteristics of the mortgage loans being sold. These ensure that the loans meet specific standards, such as loan-to-value ratio, borrower creditworthiness, and compliance with regulations. 4. Servicing of Loans: The PSA may detail how the servicing of the mortgage loans will be handled, including the responsibilities of the service and any compensation arrangements. It may also outline provisions for the transfer of servicing rights to a third-party service, if applicable. 5. Cash Flows and Distributions: The agreement specifies how cash flows from the mortgage loans, such as borrower payments of principal and interest, will be allocated and distributed to investors holding interests in the Trust Fund. This includes the calculation of interest payments, reserve accounts, and any priority of payments. 6. Default and Remedies: The PSA outlines the procedures and processes to be followed in case of borrower default, foreclosure, or other loan-related issues. It may describe the rights and remedies available to the Trustee and investors in such situations. It is important to note that Allegheny Pennsylvania Pooling and Servicing Agreement can have variations and may include additional provisions or clauses specific to the parties involved and the nature of the mortgage loans being sold. Furthermore, it is advisable to consult legal professionals or refer to the specific agreement in question for comprehensive and accurate information.

Allegheny Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Allegheny Pennsylvania Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Allegheny Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Allegheny Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Allegheny Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company:

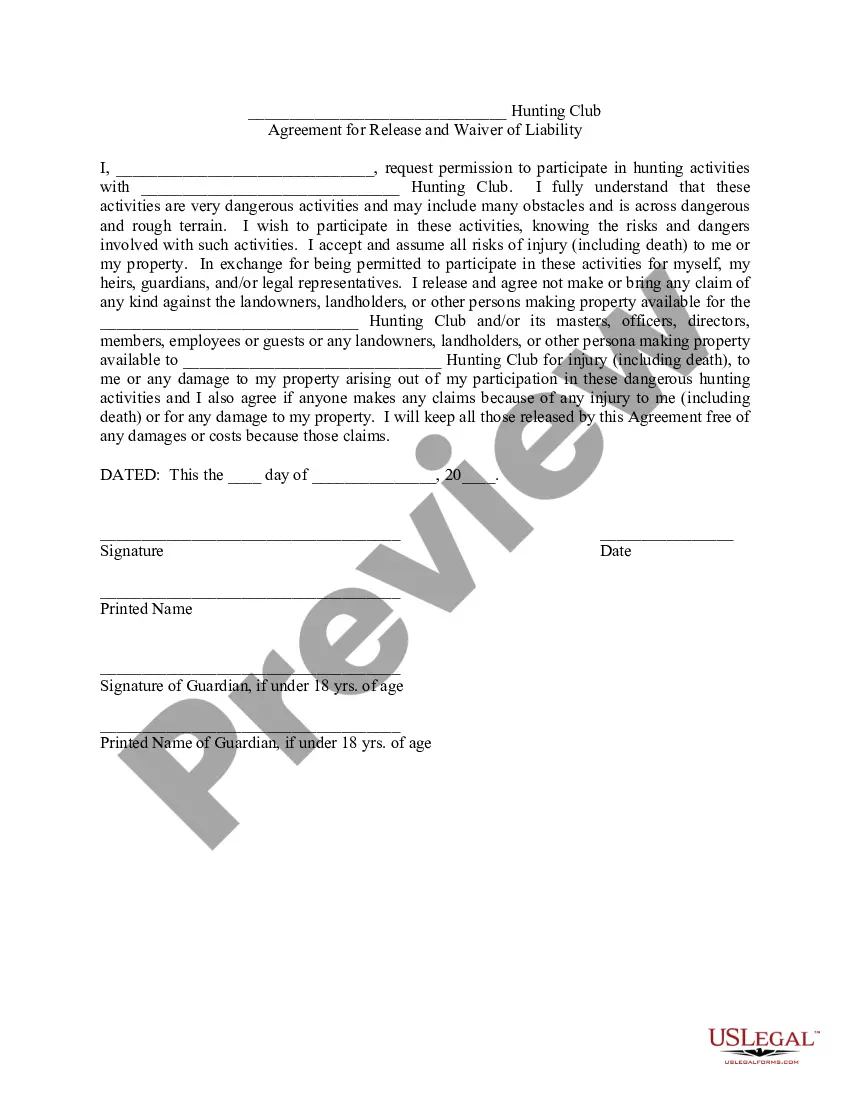

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!