A Sacramento California Pooling and Servicing Agreement is a legal document that outlines the terms and conditions under which mortgage loans are packaged and sold by a company to a trustee, who then includes them in a trust fund. This agreement is commonly used in the mortgage-backed securities industry to transfer the ownership of mortgage loans from the originating lender to a trustee who represents the investors. The Pooling and Servicing Agreement (PSA) serves as the governing document for the securitization process and includes provisions related to loan eligibility, payment terms, servicing responsibilities, and reporting requirements. It specifies the rules and regulations that the trustee and the company must adhere to throughout the life cycle of the mortgage loans. In the case of Sacramento California Pooling and Servicing Agreement, some specific types of agreements can be named: 1. Residential Mortgage-Backed Securities (RMBS) Agreement: This agreement focuses on residential mortgage loans, where individual home loans are pooled together, securitized, and sold to investors as mortgage-backed securities. 2. Commercial Mortgage-Backed Securities (CMOS) Agreement: This type of agreement involves pooling and securitizing commercial mortgage loans, typically secured by income-generating properties such as office buildings, retail centers, or hotels. 3. Collateralized Loan Obligation (CIO) Agreement: CIO agreements facilitate the pooling and securitization of corporate loans originated by various lenders. These agreements are commonly used in the corporate lending market. 4. Asset-Backed Securities (ABS) Agreement: ABS agreements cover a wide range of assets such as auto loans, student loans, credit card receivables, or lease payments. In this scenario, the company packages the mortgage loans as part of a larger pool of assets to be securitized. It's important to note that the specific terms and conditions of these agreements may vary based on the company, type of loan, and investor requirements. The PSA ensures that the transfer of mortgage loans is handled according to regulatory guidelines, safeguarding the interests of all parties involved.

Sacramento California Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Sacramento California Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

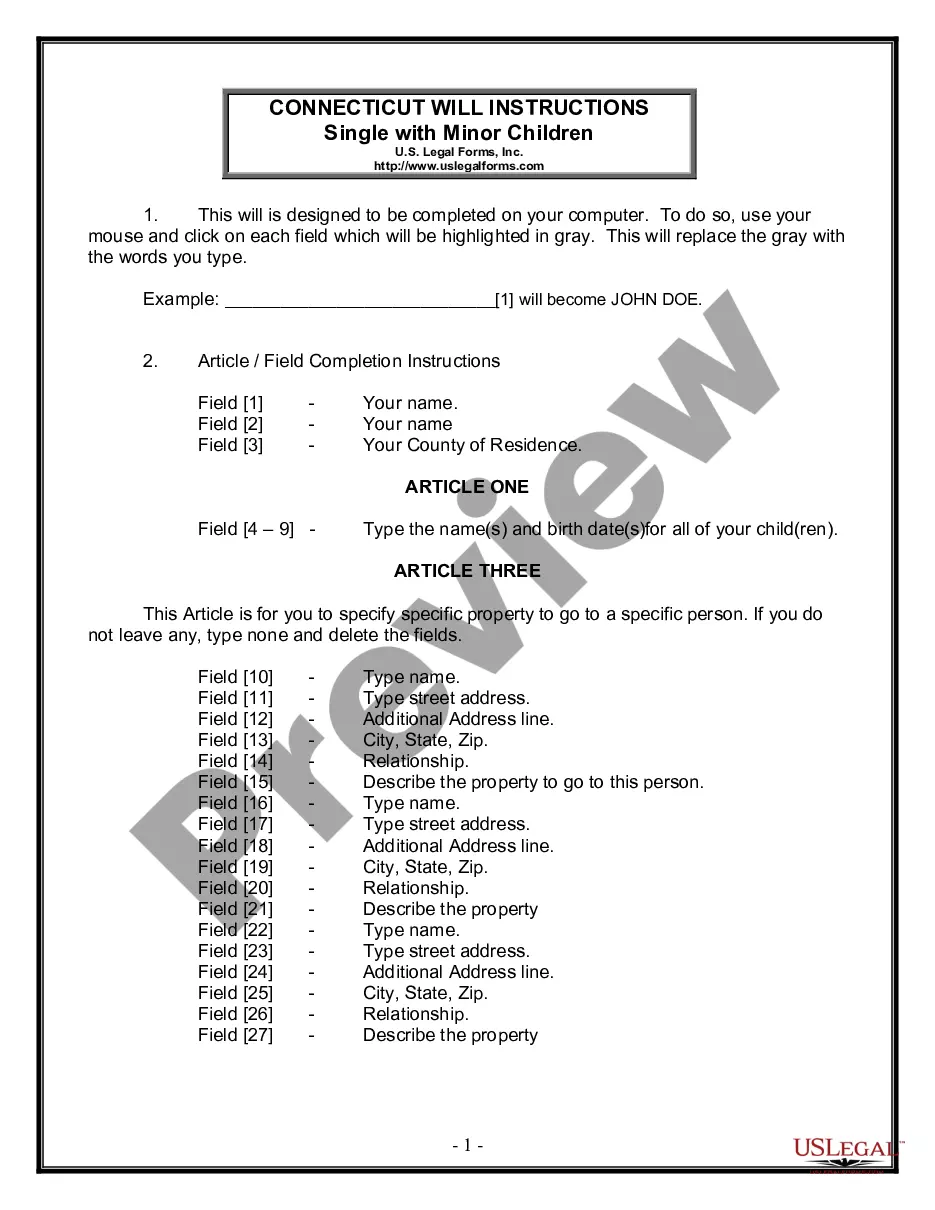

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Sacramento Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks related to paperwork execution simple.

Here's how to locate and download Sacramento Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and buy Sacramento Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Sacramento Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you have to deal with an extremely challenging case, we recommend using the services of an attorney to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!

Form popularity

FAQ

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

Services agreements are arrangements (usually informal) between two or more parties and are sometimes enforceable at law. Contracts are a formal arrangement between two or more party that, by its terms and elements, are always enforceable at law.

A Service Agreement is a contract used between a service provider and a client (or customer) that outlines the exchange of services for compensation.

How to Get a Copy of the Pooling and Servicing Agreement. If the securitization is public, the PSA will be filed with the Securities and Exchange Commission (SEC), and you can usually find a copy on EDGAR (Electronic Data Gathering, Analysis, and Retrieval) at .

The Pooling and Servicing Agreement is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Service agreements help make sure the participant and provider have the same expectations of what supports will be delivered and how they will be delivered. Making a service agreement is a negotiation between the participant and the provider.

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves. These are the simplest form of mortgage-backed security.

A loan servicing agreement is a written contract between a lender and a loan servicer that gives the loan servicer the authority to manage most aspects of a particular loan.