Hennepin County, Minnesota is located in the state of Minnesota and is known for being the most populous county in the state. It is home to numerous cities and townships, including the city of Minneapolis, which is the county seat. The LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. Subsequent Transfer Agreement is a legal document that outlines the terms and conditions surrounding the purchase and sale of mortgage loans between these two entities. This agreement ensures that the transfer of these loans is properly executed and adheres to all applicable laws and regulations. The purpose of the Subsequent Transfer Agreement is to provide a framework for the smooth and efficient transfer of mortgage loans from LCC Mortgage Investors, Inc. to Bankers Trust of CA, N.A. It covers important details such as the terms of the transfer, the pricing and payment arrangements, the responsibilities of each party, and any necessary documentation. It is important to note that there may be different types of Hennepin Minnesota Subsequent Transfer Agreements between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding the consummation for the purchase and sale of mortgage loans. These different types may vary based on factors such as the specific terms and conditions, the type of mortgage loans being transferred, or any additional provisions that may be included. Some potential variations or specific types of Hennepin Minnesota Subsequent Transfer Agreements could include: 1. Fixed-Rate Mortgage Loan Agreement: This type of agreement may be used when transferring fixed-rate mortgage loans between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. It would outline the specific terms related to the interest rate, repayment schedule, and other details relevant to fixed-rate mortgage loans. 2. Adjustable-Rate Mortgage Loan Agreement: This type of agreement may be used when transferring adjustable-rate mortgage loans between the two entities. It would specify the terms related to interest rate adjustments, index rates, and any caps or limitations that may apply. 3. Government-Insured Mortgage Loan Agreement: This type of agreement may be used specifically for mortgage loans insured or guaranteed by government entities such as the Federal Housing Administration (FHA) or the Veterans Administration (VA). It would include provisions related to the unique requirements and regulations associated with government-insured loans. These are just a few examples of potential types of Hennepin Minnesota Subsequent Transfer Agreements that could exist between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. The specific terms and conditions of each agreement would depend on the nature of the mortgage loans being transferred and the intentions of the parties involved.

Hennepin Minnesota Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

How to fill out Hennepin Minnesota Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

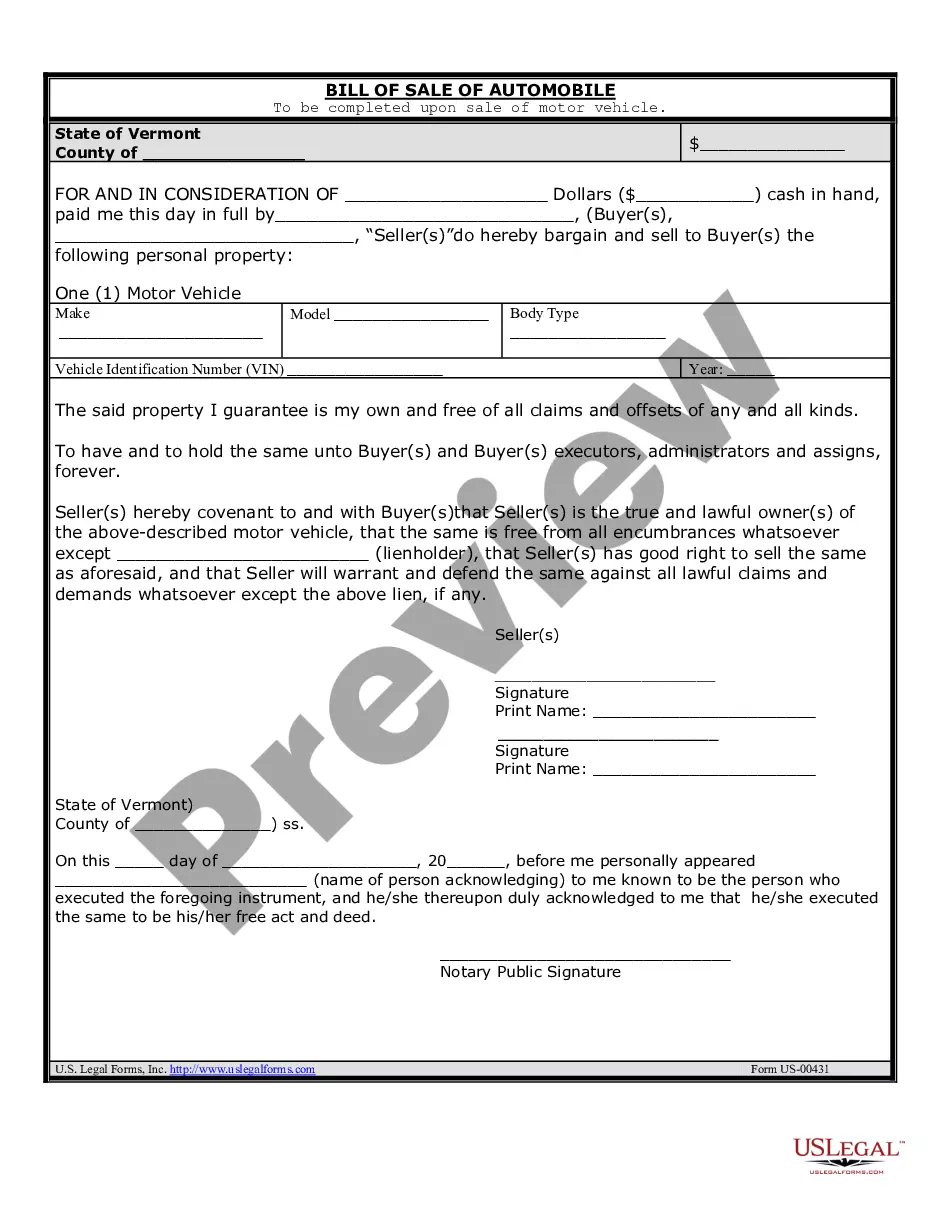

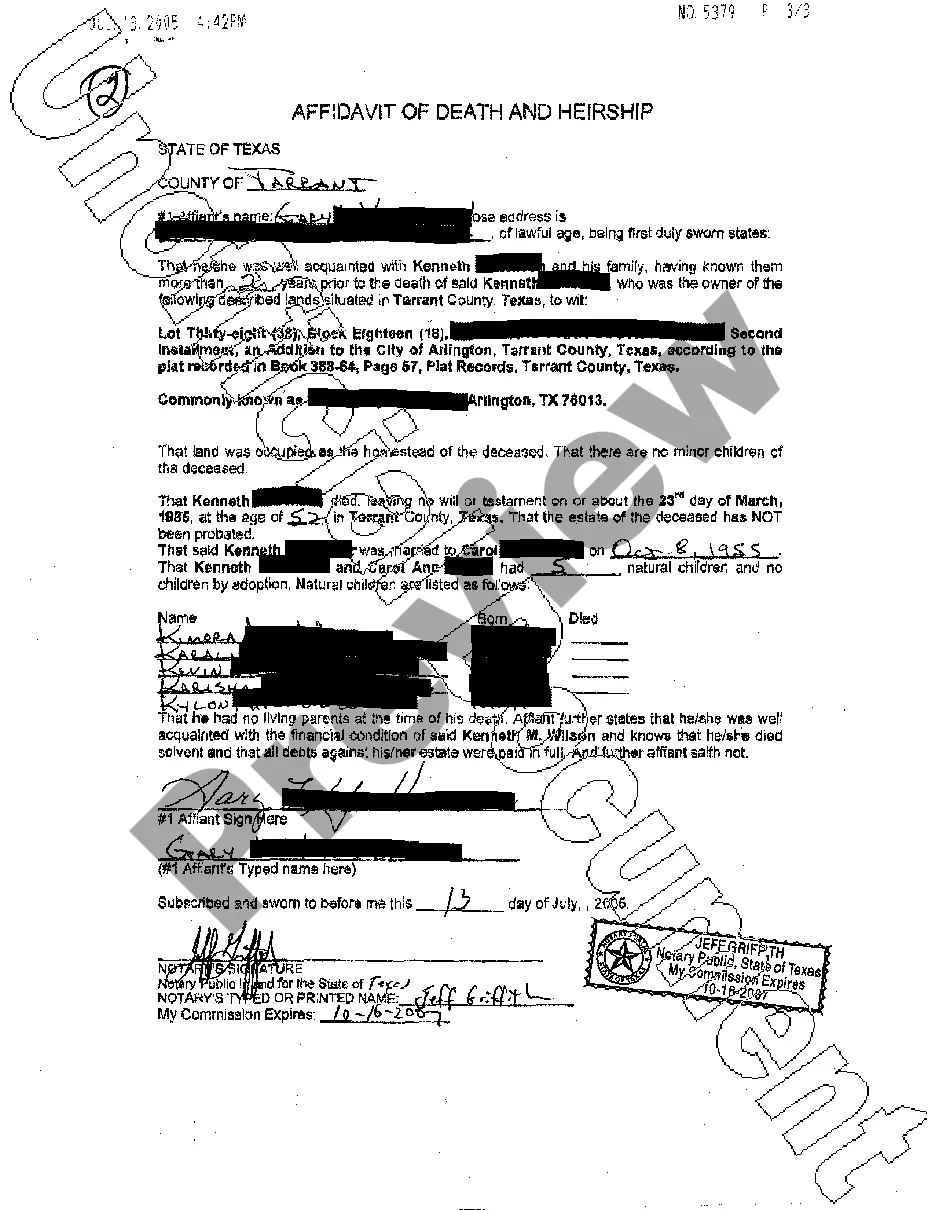

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Hennepin Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Hennepin Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!